This week, Governor Lee and the General Assembly approved a preliminary budget for FY 2021 —significantly revising the original budget plan the governor proposed in February. The approved budget includes changes to both FY 2020 and FY 2021.

The General Assembly paused this year’s session until June 1 due to the COVID-19 pandemic. Before doing so, legislators set aside most other pending legislation to complete the FY 2021 budget, which takes effect July 1, 2020. Of all the bills the legislature considers each year, the budget is the only one they are constitutionally required to pass. When lawmakers return, they plan to take up other unfinished business. In addition, they could tweak the approved budget to reflect new information about the pandemic’s effect on state revenues and spending needs.

Members of the General Assembly have called this a “preliminary budget,” so we use the same terminology throughout our analysis. However, this budget has the force of law and will take effect unless lawmakers enact changes.

Key Takeaways

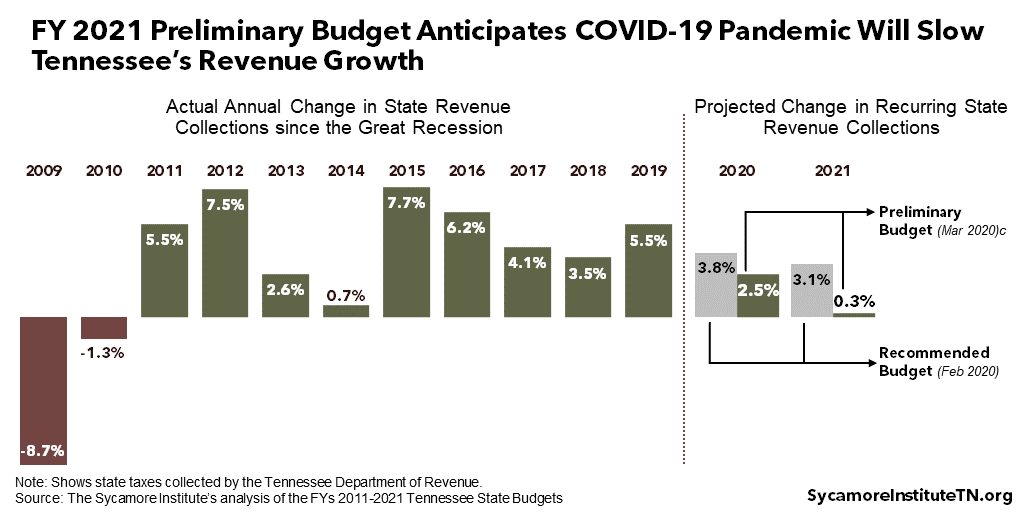

- Due to the COVID-19 pandemic, the preliminary budget projects slower tax revenue growth than previously estimated for FY 2020 and near-zero growth in FY 2021.

- State appropriations and reserve allocations for FY 2021 are $854 million (or 4.2%) below the original recommendation. Many initiatives were shelved to preserve or increase funding for COVID-19 response and higher costs from inflation, formulas, or client growth.

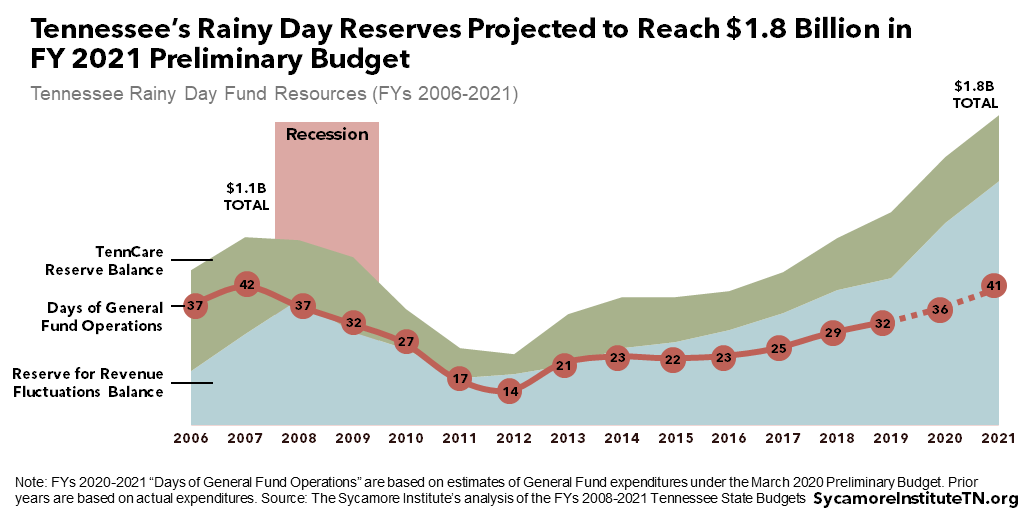

- The two main rainy day reserves combined would top $1.8 billion in FY 2021 and cover about 41 days of General Fund operations — one day less than in FY 2007 before the Great Recession.

Figure 1

Changes to Revenue Expectations

The preliminary budget projects slower tax revenue growth than previously estimated for FY 2020 and near-zero growth in FY 2021 to reflect the expected economic effects of the COVID-19 pandemic (Figure 1). Changes to recurring tax revenue estimates (compared to the February proposal) include:

- $399 million fewer dollars in FY 2021 by revising the 3.75% anticipated growth down to 2.5%

- $455 million fewer dollars in FY 2020 from:

- -$528 million by revising the 3.1% projected growth down to 0.25%.

- -$7 million in anticipated tobacco tax collections from recent federal changes increasing the legal smoking age from 18 to 21.

- +$40 million by forgoing the original budget proposal to cut the existing professional privilege tax.

- +$40 million from new legislation that would collect sales tax from online marketplace facilitators (e.g. e-Bay or Etsy) with sales of $500,000 or more in Tennessee.

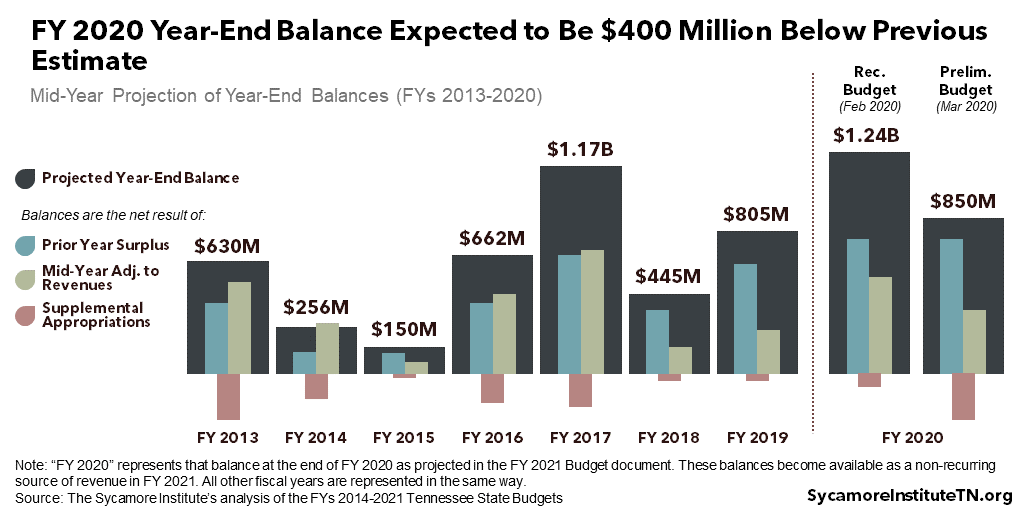

The preliminary budget also anticipates $392 million less in non-recurring revenue for FY 2021. The recommended budget projected a balance of $1.2 billion at the end of FY 2020, which becomes available as non-recurring revenue in FY 2021. The lower FY 2020 growth discussed above and the additional supplemental spending discussed below is now expected to reduce those balances to $850 million (Figure 2).

Figure 2

Changes to Spending and Reserves

In the preliminary budget, state appropriations and reserve allocations for FY 2021 are $854 million (or 4.2%) below the prior recommendation. Many initiatives were shelved to preserve or increase funding for COVID-19 response and higher costs from inflation, formulas, or client growth. This includes $789 million less in FY 2021 expenditures and $65 million less in one-time allocations to reserves and trust funds (which are typically excluded from state budget totals). Dubbed a “no-growth budget,” the total allocations and appropriations are about $177 million more (or 0.9%) than those in FY 2020.

FY 2021 Spending Not in the Prior Recommendation

The preliminary budget includes several new appropriations and reserve allocations related to expected COVID-19 needs to supplement recent executive actions.

- Rainy Day Fund: The deposit to the rainy day fund rose from $50 million to $250 million (see below).

- Local Support: Grants to county and city governments grew from $100 million in the February recommendation to $200 million. The purpose of these grants also expanded to include efforts related to COVID-19. Under the legislature’s changes, the state’s three metropolitan governments, which combine both city and county responsibilities into one entity, can only receive either a city or county allocation – not both. These include Nashville-Davidson Co., Hartsville-Trousdale Co., and Lynchburg-Moore Co.

- Emergency Fund: Policymakers added $75 million for a new health and safety emergency fund to “increase capacity, containment efforts, disease surveillance and tracking, mitigation efforts at schools and institutions of higher education, and education and prevention programs.”

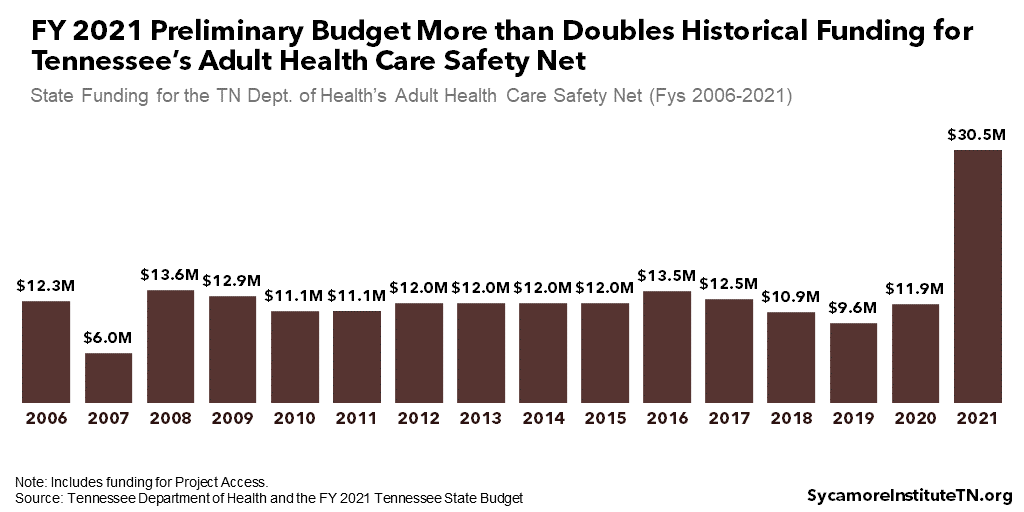

- Health Care Safety Net: The planned $6.5 million increase for the state’s primary care safety net for uninsured adults rose to $19 million, bringing total funding to $30.5 million in FY 2021 (Figure 3)

Figure 3

FY 2021 Spending Retained from the Original Budget Recommendation

Most of the increases retained in the preliminary budget reflect higher costs from inflation, formulas, or client growth. These include scaled-back state personnel-related costs, formula growth for K-12 and higher education, deferred maintenance of state buildings, and expected cost increases in TennCare, the Department of Children’s Services, and the Department of Correction.

A handful of initiatives in the governor’s original recommendation were retained in full.

- TennCare Support for Mothers: The preliminary budget funds TennCare’s proposals to extend post-partum coverage to 12 months ($7 million) and provide dental coverage to pregnant women ($2 million).

- Education Savings Accounts (ESAs): It also retains $42 million associated with ESAs. Much of this funding will go to school districts to backfill any loss in state BEP money a district might experience due to ESA-related drops in enrollment. See our February summary for a more complete description of how those funds work.

- Children’s Behavioral Health Safety Net: Lawmakers also kept an $8 million increase to create a new children’s behavioral health safety net.

Changes to FY 2021 Proposed Initiatives

In light of the latest revenue projections and new needs, the preliminary budget forgoes or scales back nearly all of the governor’s proposed increases. The most notable examples appear below.

- K-12 Mental Health Trust Fund: The preliminary budget eliminates the proposed $250 million deposit for a new trust fund to support behavioral health for children.

- Capital Improvements: It also drops $187 million proposed to improve state and higher education buildings.

- Teacher Pay: Proposed increases for teacher pay were scaled back. The budget includes a 2% boost (or +$59 million over FY 2020) to the state’s teacher pay allocation, down from a previously recommended 4% boost (or +$117 million over FY 2020).

- Addiction Treatment and Recovery: Proposals to expand substance abuse treatment and recovery for adults were eliminated. These included $6 million for the substance abuse safety net and $4 million to expand wraparound services for addiction recovery.

- School Choice: The budget forgoes a proposed $24 million increase for charter schools.

- Long-Term Services and Supports: A proposed expansion of TennCare long-term services and supports has been scaled back. The budget includes a $21 million increase over FY 2020 for the Employment and Community First (ECF) Choices program to reduce the waiting list by 1,000 slots. The prior recommendation was $36 million and a 2,400-slot reduction to the waiting list.

New FY 2021 Spending Reductions

The preliminary budget includes two new reductions not included in the February recommendation. They consist of a $20 million non-recurring reduction to the Department of Human Services and a $57 million recurring reduction in TennCare. For the latter, the state will no longer offset a federal health insurer fee paid by the private managed care organizations that cover TennCare enrollees.

Changes to the FY 2020 Budget

The preliminary budget also added $238 million in new FY 2020 supplemental spending to respond to the effects of the recent tornadoes and the COVID-19 pandemic. The increases relative to the February recommendation include:

- +$30 million for tornado disaster relief recovery.

- +$33 million to repair state buildings damaged in the tornadoes.

- +$75 million for the new health and safety emergency fund described above.

- + $100 million for the rainy day fund, on top of the $225 million deposit already approved for FY 2020 in 2019 (see below).

Figure 4

Increases for Rainy Day Reserves

The preliminary budget allocates a combined balance of $1.8 billion in the Reserve for Revenue Fluctuation and the TennCare Reserve by the end of FY 2021 (Figure 4). That amount is $300 million more than originally proposed in February. These funds represent Tennessee’s ability to respond to an economic downturn, and the significant boost reflects the anticipated economic effects of the COVID-19 pandemic.

There are many ways to measure how well a state’s rainy day reserves will withstand an economic downturn, but none of them are perfect. For example, nearly all assume very little change in how a state spends its dollars. In reality, states often face higher costs in some areas and cut back in others. During the Great Recession, the federal government also provided extra resources to states. Each metric, however, may provide some helpful estimation of the spending power of these reserves. Here are three of those ways.

Credit rating agencies often look at reserves as a percent of revenues. For example, at least one credit rating agency only gives its best rating when dedicated rainy day reserves exceed 8% of annual revenues. The FY 2021 Reserve for Revenue Fluctuation balance would represent about 9% of annual revenues. The two reserves combined would equal roughly 12% of revenues.

The private sector usually measures reserves in terms of the amount of time funds would cover expenses in the absence of any other revenues. It is a metric commonly used to understand financial security. The combined balance would cover about 41 days of state-funded General Fund operations at the FY 2021 levels approved in the preliminary budget (Figure 4). This is just one day (or 1%) less cushion than before the Great Recession that began in December 2007 — a considerable improvement over recent years. In reality, of course, state revenues would never completely disappear.

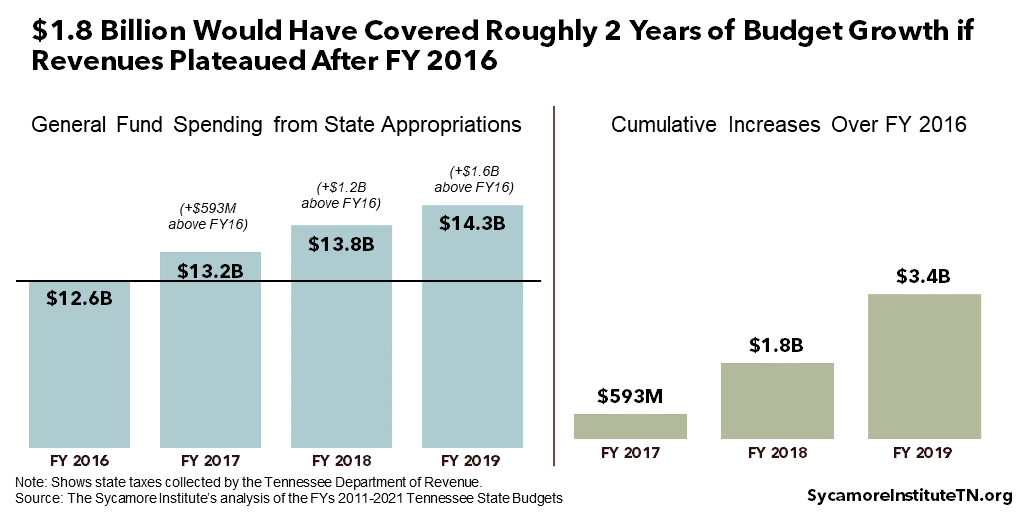

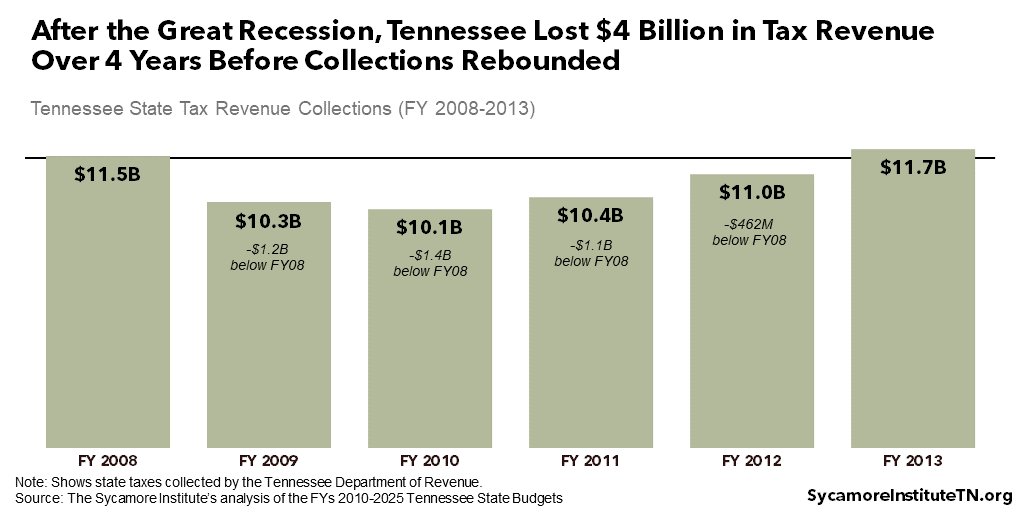

Policymakers have recently framed reserves in terms of how much normal budget growth they could cover. If revenues had stopped growing in FY 2016, for example, $1.8 billion would have covered cost increases above the FY 2016 level for two years — $593 million in FY 2017 and $1.2 billion in FY 2018 (Figure 5). The most recent recession, however, suggests revenues may be more likely to decline than plateau. State tax collections dropped nearly 12% between FY 2009 and FY 2011. Ultimately, the state lost $4 billion in tax revenue over four years before collections rebounded to their pre-recession levels (Figure 6).

Figure 5

Figure 6

References

Click to Open/Close

- State of Tennessee. Tennessee State Budgets for FYs 2006-2020. [Online] Available via https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive.html.

- —. Tennessee State for Budget for FY 2021. [Online] Available from https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive/fa-budget-publication-2020-2021.html.

- Tennessee Department of Finance and Administration. FY 2020-2021 Recommended Budget Overview. [Online] January 30, 2020. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/21AdReq17.pdf.

- —. FY 2021 Administration Budget Amendment Overview. [Online] March 17, 2020. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/21AdminAmendOverviewRevisedEstimates.pdf.

- Tennessee General Assembly. Amendment 2-0 to HB2821 (Administration Amendment). [Online] March 19, 2020. Available from http://wapp.capitol.tn.gov/apps/BillInfo/Default.aspx?BillNumber=HB2821.

- —. Amendment 1-0 to HB2821 (Recommended Budget). [Online] March 19, 2020. Available from http://wapp.capitol.tn.gov/apps/BillInfo/Default.aspx?BillNumber=HB2821.

- —. Amendment 3-0 to HB2821 (Legislative Changes). [Online] March 19, 2020. Available from http://wapp.capitol.tn.gov/apps/BillInfo/Default.aspx?BillNumber=HB2821.