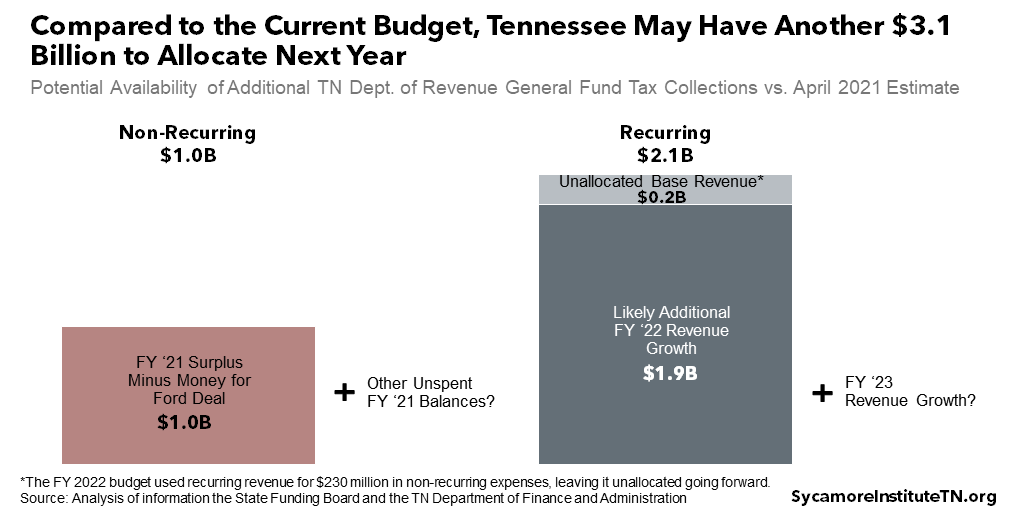

Governor Bill Lee and state lawmakers just used some of Tennessee’s largest ever budget surplus to fund a historically large incentive package for Ford Motor Company. Even after that deal, policymakers may still have at least $3 billion in unallocated funds to appropriate next year. This total includes a record-setting $2 billion for recurring items – and that’s before even speculating about routine revenue growth. For comparison, Tennessee’s total budget from state revenues this year was about $21 billion before the Ford deal passed.

Details on how the administration might spend this money will start to emerge in the governor’s budget hearings, which begin next week.

The $884 Million Ford Deal

Last week, lawmakers approved a total of $884 million in non-recurring spending for Ford and the Memphis Regional Megasite. (1) Since 2006, the state has invested millions of dollars trying to attract large employers to this site in rural Haywood and Fayette Counties. (2) On September 27, Gov. Lee announced plans for a new Ford manufacturing facility at the site – a deal involving nearly $900 million from the state and the promise of thousands of new jobs and billions in private investment. (3) The funding package lawmakers approved in last week’s special legislative session includes: (1) (4)

- $500 million to help offset Ford’s capital costs as it constructs its new facilities.

- $200 million for nearby interstate improvements.

- $138 million for water and sewer infrastructure at the site.

- $40 million for the construction of a new Tennessee College of Applied Technologies (TCAT) at the site to support workforce training.

- $6 million for various consulting and legal services and the creation of a Megasite Authority of West Tennessee administratively attached to the Department of General Services to manage certain activities related to the site. (5)

Where the Ford Money Came From

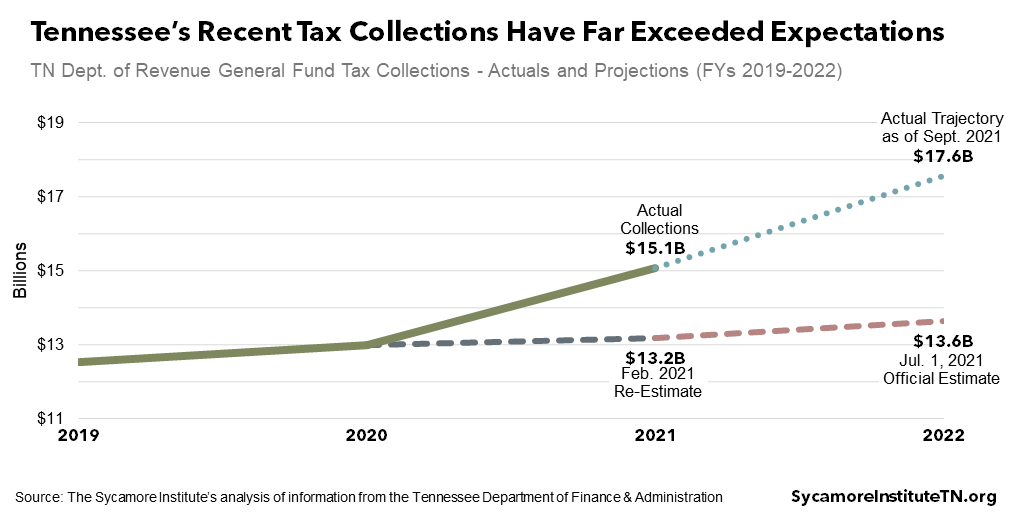

Funding for the Ford incentive and megasite investments came from Tennessee’s historically large budget surplus for the fiscal year that ended in June. (11) Tennessee’s tax collections were better than expected throughout the pandemic because of a strong consumer spending rebound aided by federal relief efforts and state changes to online sales tax collections. Even after a mid-year upward revision, the state ultimately collected nearly $2 billion more revenue in FY 2021 than projected (Figure 1). That surplus rolled over to the current fiscal year (FY 2022) as non-recurring funds available for one-time expenses – like the Ford deal, for example.

Figure 1

$3 Billion Still Available Next Year … and Maybe More

At Least $1 Billion Non-Recurring

Even after the Ford deal, policymakers will still have at least $1 billion in non-recurring dollars to allocate when the General Assembly meets next January (Figure 2). About $1.0 billion remains available from the FY 2021 surplus. Additional money may come from reversions – unspent program funds that reverted to the General Fund when the last fiscal year ended. End-of-year program reversions are common and typically total about $150-200 million per year. Reversions could be higher this time, however, if state agencies used federal pandemic relief for expenses they had initially planned to cover with state funds.

Figure 2

At Least $2 Billion Recurring

The governor and state lawmakers may also have at least $2 billion in recurring revenues to put toward longer-term initiatives (Figure 2). The State Funding Board will meet in November and/or December to re-estimate current-year revenues. At the very least, that revision is likely to reflect the base revenue growth that created the recent $1.9 billion FY 2021 surplus (Figure 1). Another $230 million of the recurring base budget was not allocated beyond the current fiscal year due to worries that strong pandemic-era consumer spending would not last. Finally, FY 2022 revenue collections for the first two months are already about $646 million (or 24%) above the official budget forecast – including $529 million in the General Fund.

On top of all that, routine revenue growth could potentially generate even more recurring dollars. When the State Funding Board meets later this year, it will also recommend a range of revenue predictions to guide the FY 2023 budget process. That exercise seems likely to project additional revenue growth based on the trajectory of collections over the past 15 months (Figure 1). Given the high degree of uncertainty, however, we excluded it from our calculations.

Routine cost increases will take up some of the new recurring money. For example, over $600 million of the governor’s FY 2022 budget recommendation covered recurring inflation- and population growth-related increases for K-12 and higher education, TennCare, and personnel-related expenses.

Limitations

This analysis focuses on the availability of revenues collected by the Tennessee Department of Revenue and allocated to the General Fund based on publicly available documents. It does not reflect other items that have yet to be determined or announced in detail, such as:

- Potential effects of other FY 2021 year-end transactions (e.g. transfers between funds, other General Fund revenue sources, additional agency reversions of unspent appropriations to the General Fund, etc.). For example, recent state testimony suggested the end-of-year surplus of General Fund taxes may have been as large as $2.1 billion after final accounting. (11)

- The FY 2023 recurring costs associated with the Ford project special session legislation. (11)

- A recent federal audit of the TennCare program recommended that the federal Medicaid program recoup nearly $770 million from Tennessee, which could have state budget implications. (12)

- The budget typically includes some cost reductions that free up revenues for other purposes. The governor’s internal FY 2023 budget instructions, for example, requested that agencies identify cost reduction options totaling 1% of their discretionary base.(13) Some of these options may make their way into the Governor Lee’s budget recommendation in February.

References

Click to Open/Close

- Tennessee General Assembly. SB 8002 – As Amended By Senate Amendment 1 and House Amendment 2. [Online] October 2021. https://wapp.capitol.tn.gov/apps/BillInfo/Default.aspx?BillNumber=SB8002.

- Tennessee Department of General Services. Memphis Regional Megasite Site Assessment Study. [Online] June 2021. https://www.tn.gov/content/dam/tn/governorsoffice-documents/governorlee-documents/MRM-AssessmentStudy-Final.pdf

- Tennessee Department of Economic & Community Development. Memphis Regional Megsite Lands $5.6 Billion Investment from Ford Motor Company and SK Innovations. [Online] September 27, 2021. https://tnecd.com/news/memphis-regional-megasite-lands-5-6-billion-investment-from-ford-motor-company-and-sk-innovation

- State of Tennessee. Special Session on Historic Megasite Investment Comes to a Close. [Online] October 20, 2021. https://www.tn.gov/governor/news/2021/10/20/special-session-on-historic-megasite-investment-comes-to-a-close.html

- Tennessee General Assembly. SB 8001 — As Amended by Senate Amendment 2 and House Amendment 4. [Online] October 2021. https://wapp.capitol.tn.gov/apps/BillInfo/Default.aspx?BillNumber=SB8001

- State of Tennessee. Comparison Statement of State Revenues. FY 2021 and FY 2022 Tennessee State Budgets. [Online] Available via https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive.html

- Tennessee Department of Finance & Administration. July Revenues. [Online] August 13, 2021. https://www.tn.gov/finance/news/2021/8/13/july-revenues.html

- —. Statement of Adjustments to Tax Estimates, Department of Revenue Taxes 2019-2020 Through 2021-2022. FY 2021-2022 Budget Overview. [Online] February 4, 2021. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/22AdReq15i.pdf

- —. 2021-2022 Monthly Distribution of Estimated State Tax Revenue Official Budgeted Estimates. [Online] July 2021. https://www.tn.gov/content/dam/tn/finance/budget/documents/revenues/2021-2022MonthlyRevenueEstimates(WebVersion).pdf

- —. September Revenues. [Online] October 13, 2021. https://www.tn.gov/finance/news/2021/10/13/september-revenues.html

- Senate Finance, Ways, & Means Committee. Testimony of TN Budget Director David Thurman (beginning ~25:00, ~50:00). Tennessee General Assembly. [Online] October 19, 2021. Video available at https://tnga.granicus.com/MediaPlayer.php?view_id=614&clip_id=25516

- U.S. Department of Health & Human Services Office of Inspector General. Tennessee Medicaid Claimed Hundreds of Millions of Federal Funds for Certified Public Expenditures That Were Not in Compliance With Federal Requirements. [Online] October 19, 2021. https://oig.hhs.gov/oas/reports/region4/41904070.asp

- Tennessee Department of Finance & Administration. Fiscal Year 2022-2023 Budget Instructions. [Online] August 13, 2021. https://www.tn.gov/content/dam/tn/finance/budget/documents/budgetinstructions/08.13.2021%20-%20FY23%20Budget%20Instructions%20Memo%20-%20Final.pdf