Key Takeaways

- The statutory requirements for what the state must cover add up to about 66% of the total BEP calculation. Local school districts are responsible for the other 34%.

- Tennessee’s 95 counties contribute different amounts toward that 34% based on their fiscal capacity – an estimate of how much local revenue they can potentially generate.

- The way Tennessee calculates local fiscal capacity is a big reason our state has one of the most complex education funding formulas in the country.

- A funding formula that does not adequately cover the costs of educating Tennessee’s children puts districts with less fiscal capacity at the greatest disadvantage.

Tennessee’s state and local governments jointly fund K-12 education. How they share these costs is a key factor in the Basic Education Program (BEP), the state’s school funding formula.

It is not yet clear if Gov. Bill Lee’s efforts to replace the BEP with a student-based formula will address the state/local split. Most of the details released so far focus on how Tennessee calculates the total statewide cost of providing an adequate education to our students. The governor’s upcoming proposal may or may not change how the state shares those costs with and between individual school districts.

Either way, policymakers should understand how these aspects of the BEP work today. Due to the structure of the BEP formula, the amount of money each school district gets from the state is highly dependent on how Tennessee estimates what locals can afford to spend for themselves.

The BEP’s 3 Core Questions

The BEP formula answers three core questions that together determine how much money each school district receives from the state and how much locals must spend:

- Total Size of the Pie: What does it cost to provide an “adequate” education to every child in Tennessee?

- Total State/Local Split: How much of that total cost does the state cover, and how much do locals cover?

- District-Specific Split: How much does each specific district receive from the state?

This policy brief focuses on questions two and three. In it, we explain how the BEP determines what share of K-12 education funding local school districts must contribute – both individually and in aggregate. We also highlight the considerations and challenges facing policymakers as they look to overhaul the BEP. For our purposes, readers should assume the state has already decided question one about the total amount of funding required. As a companion to the full report, Figure 1 and Textbox 2 present much of the same information using visuals and a simplified example, respectively.

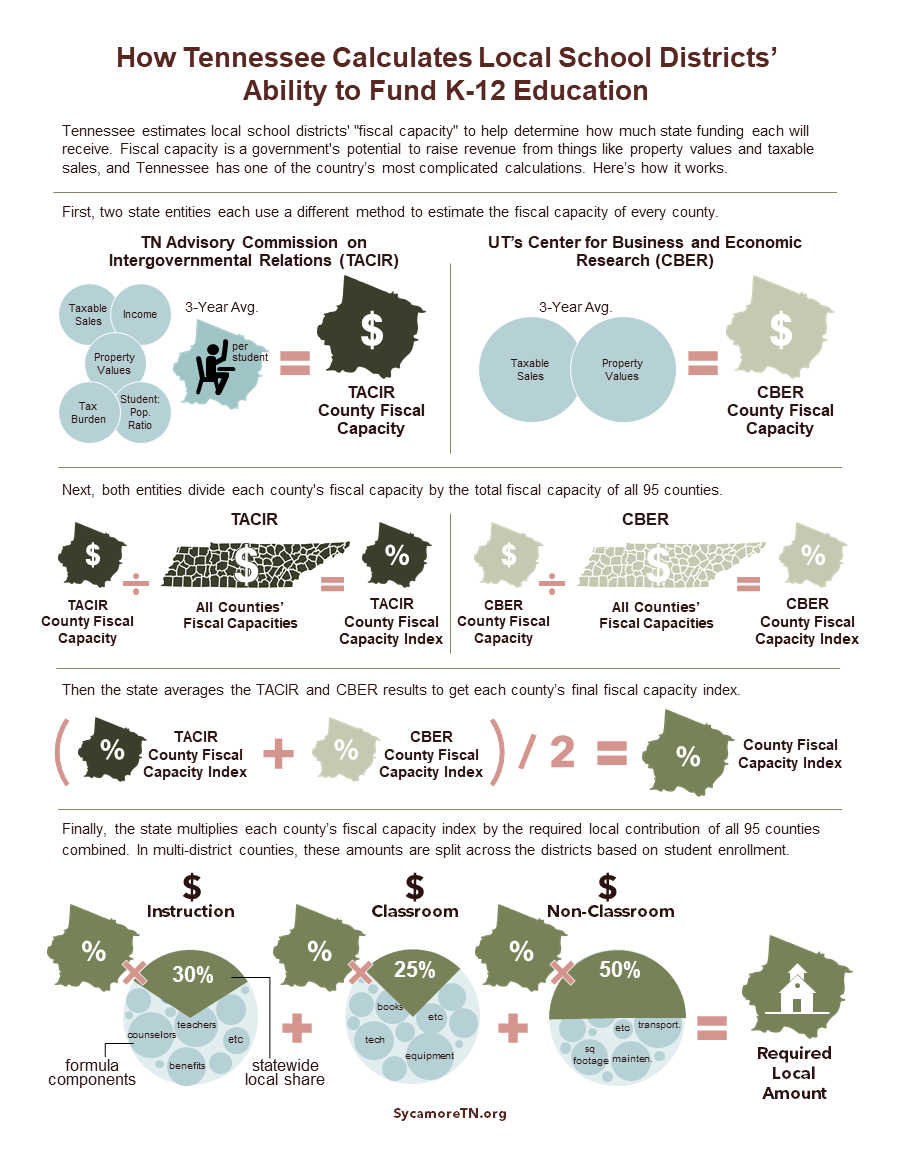

Figure 1

Challenges for Policymakers to Consider

Tennessee has one of the country’s most complicated methods of splitting the cost of K-12 education between the state and local governments. Later sections of this report explain the process in more detail. This section highlights some of the key factors that make our system so complex, along with comparisons to other states, trade-offs, and other important points to consider.

Multiple Models with a Large Number of Variables

Tennessee may be the only state that averages two calculations of local fiscal capacity – one of which uses a complex regression model based on a half dozen variables. This approach is hard for the average citizen to understand, especially when many other states use just a couple of variables like property values and income. On the other hand, Tennessee’s complex model may better capture the nuances of local fiscal capacity than simpler methods.

Prioritizing State or Local Stability

Tennessee’s aggregate state share of K-12 funding is set in law, while other states’ may vary from year to year based on local economic changes. Tennessee’s overall state/local split comes from an early 1990s analysis of: the BEP’s total cost, what the state could contribute, and local governments’ ability to cover the rest. We then apply a relative local fiscal capacity approach to determine how the state distributes its share across districts each year. Several other states, instead, use an absolute local fiscal capacity approach to determine state spending both in total and at the district level. This approach estimates what local districts can “afford” based on a required or assumed percentage of local resources, such as property taxes or sales taxes, to be set aside for education. (1) (2) (3)

Tennessee’s approach to local fiscal capacity provides stability for the state budget but may not be as responsive to swings in local economic conditions. Under Tennessee’s formula, the state share of education spending remains the same even if, for example, every district experiences a drop in local property values. One trade-off for local districts is the state’s share of spending is not responsive to widespread economic changes that may affect every district. Tennessee’s use of relative fiscal capacity combined with a fixed overall local share also means economic changes in one county can affect state funding for every district, even when those districts do not experience changes.

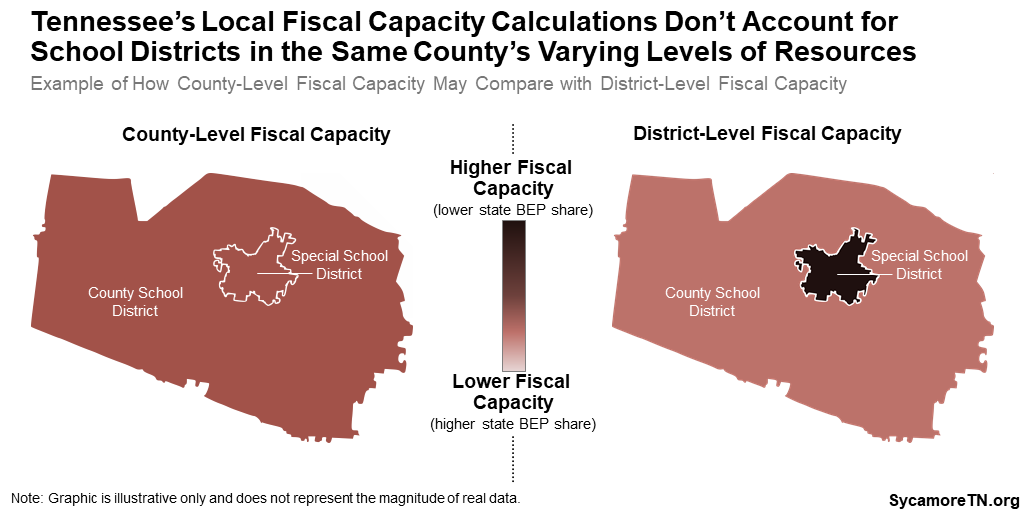

Counties vs. Districts

Tennessee calculates fiscal capacity at the county level, even when that county contains multiple school districts with different resources and student needs. (1) Under the current method, a city or special school district is assigned the same fiscal capacity as the entire county. If that district has more taxing potential than the other parts of its county, its assigned fiscal capacity will be artificially low and the rest of the county’s will be artificially high. As a result, the city or special school district gets more state funds and the remainder of the county less than if their fiscal capacities were calculated separately (Figure 2).

Figure 2

Winners and Losers

Any changes that policymakers implement may benefit some districts more than others. Changing how the state allocates K-12 education funding – including how we calculate fiscal capacity – may shift money between districts. Over the years, policymakers have rolled back prior reforms or held districts harmless to prevent or ameliorate these redistributive effects. In 2016, lawmakers halted the transition between two methods of calculating fiscal capacity – settling instead on a blend of both models. For similar reasons, lawmakers have set minimum funding levels to ensure no district receives less than it did in FY 2016. Actions like these reduce the negative financial impact on some districts but also undermine efforts to reduce funding inequities. Gov Lee’s proposal to increase recurring K-12 education funding by $750 million may help to avoid these tough choices. Nevertheless, policymakers should remain aware of the potential trade-offs.

Funding Adequacy and Fiscal Capacity

The issue of overall funding adequacy is ultimately a fiscal capacity question as well. Tennessee’s state and local governments both spend more on K-12 education than the BEP requires, but local school districts do so to a much greater degree. Districts with high fiscal capacity are better able to afford those additional costs than districts with low fiscal capacity. In other words, a funding formula that does not adequately cover the costs of educating Tennessee’s children puts districts with less fiscal capacity at the greatest disadvantage.

Textbox 1.

Note About Our Terminology and the Creation of the BEP

At times, this brief refers to the cost of an adequate or basic education. In context, these terms specifically mean the amounts generated by the BEP formula. They are based in the legal and conceptual reasons for the BEP’s creation, which we summarize below to help readers understand the origins of Tennessee’s current system. This wording does not refer to actual spending on education – nor is it a value judgment about the resources needed to sufficiently educate a child or children with different needs. Indeed, the current reform efforts stem from a widespread belief that the BEP does not reflect what it takes to adequately educate Tennessee children.

The BEP formula was created to ensure Tennessee met its obligations under our state constitution to support a system of free public schools (Article XI, Section 12) and to provide equal protection of the laws (Article XI, Section 8 and Article I, Section 8). (17) (10) To satisfy these requirements, the state needed two things: a way to determine the cost of giving each student an adequate education, and a plan to allocate funding between every school district. The BEP formula serves both functions. The rest of this report will focus on how Tennessee uses the BEP to meet its equal protection obligations.

How Tennessee Determines the State’s Overall Share of K-12 Funding

The statutory requirements for what the state must cover add up to about 66% of the total BEP calculation. Tennessee law specifies how much of the costs in the BEP’s four spending categories the state will cover – including 70% for the two instructional categories, 75% for classroom funding, and 50% for non-classroom funding (Figure 1). (4) In recent years, the total overall split has worked out to roughly 66%-34% state-local. (5) (6)

These ratios are a product of the state’s financial situation when it created the BEP in 1992. To generate the total cost of a basic education for Tennessee children, the BEP formula tallies 46 components within the four categories listed above based on student enrollment and automatic inflation adjustments. (7) (6) The state’s share of that total is based on what Tennessee could spend on public schools when the formula was created – with local governments responsible for the rest. State officials also ensured that districts got more than under the prior system and that local governments had sufficient revenues to cover their portion. (8) The resulting ratio of state/local funding was then codified in state law and remains in effect today with a few minor adjustments. (9)

How Tennessee Calculates Local Fiscal Capacity

To ensure every school district can provide a basic education no matter its resources, the state allocates its BEP dollars based on each district’s fiscal capacity. Due to differences in property values, incomes, the local economy, etc., some local governments can raise much more revenue per student than others. So, like most states, Tennessee looks at each county’s taxing potential to determine how much of the local school districts’ BEP costs it will pay.

Fiscal capacity is different than fiscal effort. Fiscal effort refers to the money counties actually raise to fund education and other local services. (5) Tennessee’s education funding formula does not consider local fiscal effort.

The Origins of BEP Equalization

Local fiscal capacity was at the heart of the BEP’s creation in 1992. The BEP formula settled a years-long lawsuit in which 77 rural school districts challenged the state’s prior education finance system. In that case, the state supreme court ruled that Tennessee’s constitution requires the state to provide equal education opportunities to all students, regardless of economic differences that exist across counties and districts. Under the state’s old funding structure, only about 2% of education funding went to smooth out these differences – far too little to achieve that goal. (10) The school districts argued and the court agreed that the state’s financing scheme violated the state constitution by inadequately supporting children in districts with fewer resources. (11)

The practice of adjusting state funding by local fiscal capacity is often called equalization. If the state gave every district the same per pupil amount, wealthier districts could end up with much more per pupil funding than poorer districts due to their higher local revenues. In theory, equalization helps school districts with different revenue-raising potential to spend roughly the same amount per pupil on education. In reality, definitions of “equal” or “equitable” often vary. For example, some believe that equitable finance requires more spending on higher need students (which is one argument for a student-based formula). However, local spending disparities driven by differences in local willingness – rather than ability – to pay are also widely accepted under “equitable” funding schemes. (2)

How the Calculation Works

To estimate local fiscal capacity, Tennessee takes the average of two models. The University of Tennessee’s Center for Business and Economic Research (CBER) evaluates property values and taxable sales, which reflect local governments’ largest revenue sources. The Tennessee Advisory Commission on Intergovernmental Relations (TACIR) model is much more complicated. On top of property and sales tax revenues, it also attempts to capture factors like household income, the number of students per county resident, and the ability to export some taxes (e.g. sales taxes from out-of-county shoppers). The TACIR model was used exclusively until 2008, when the state began transitioning to the simpler CBER model. This transition stalled in 2016 when policymakers chose to stick with an average of both models.(12)

The key number for each county is its share of the total fiscal capacity of all 95 counties. To get that number, TACIR and CBER run separate calculations. First, they estimate how much revenue each county could raise using the models outlined above. Next, they sum every county’s results and adjust for the number of students to find the combined fiscal capacity of all counties. They then divide each county’s fiscal capacity by the statewide total. This number – the fiscal capacity index – represents a county’s share of all counties’ potential revenue. Finally, the state averages the TACIR and CBER indices to determine the state/local funding split in each county.

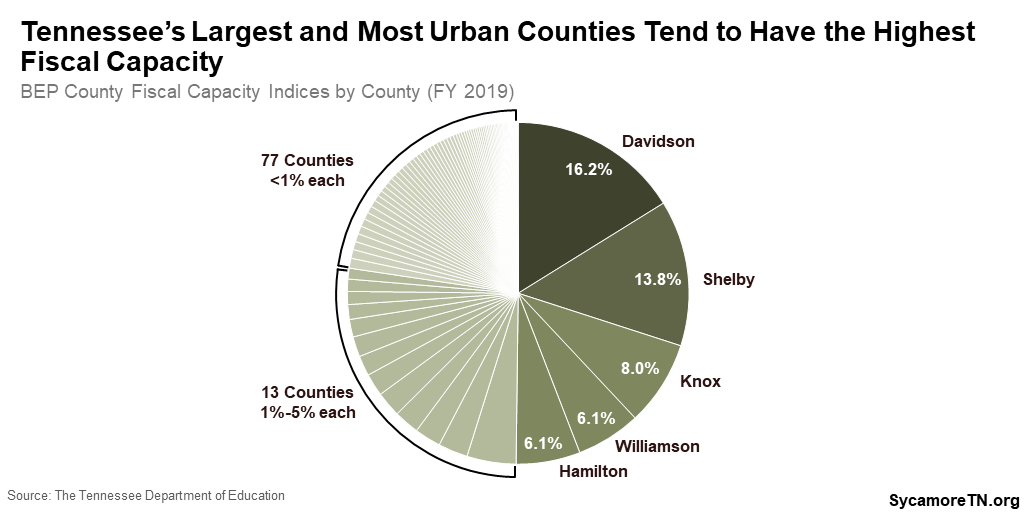

Generally, urban counties with higher incomes and more business activity have greater fiscal capacities than rural counties. Using the average of both models, for example, Davidson County had the highest fiscal capacity index at 16% and Hancock had the lowest at 0.03% (Figure 3). (13)

Figure 3

How Fiscal Capacity Determines State Funding for Each District

The amount of state funding each school district receives depends on the relative fiscal capacity of its county (Figure 1). For example, if a county has 10% of all 95 counties’ combined fiscal capacity – its fiscal capacity index – that county must contribute at least 10% of the total BEP costs required from all local governments (Textbox 2). Tennessee then subtracts each county’s required local contribution from its total BEP calculation to determine its state funding. (13) In multi-district counties, the overall county numbers are split across each district based on student enrollment.

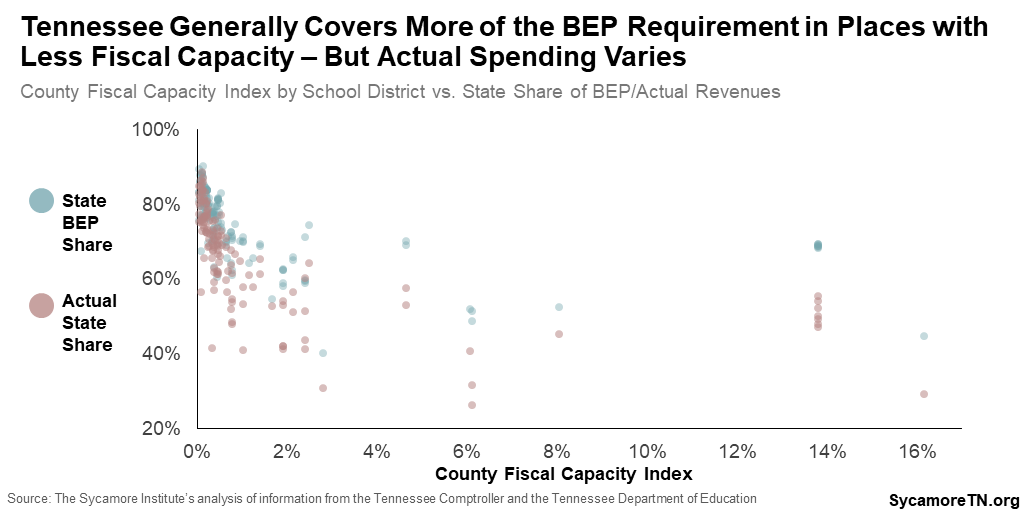

The state tends to cover more of the BEP calculation for areas with less fiscal capacity. While actual budgets vary according to school district size, every district with the same fiscal capacity index gets a similar share of its BEP-required funding from the state. (5) (13)

However, most districts spend more on K-12 education than the BEP requires. As a result, the actual ratio of state vs. local education funding is smaller than the BEP formula implies and tends to vary more among districts with similar fiscal capacity indices (Figure 4). (14) Other bottom-line adjustments also affect the end result – including one adjustment to ensure districts receive no less funding than they did in FY 2016. (13) (5)

Figure 4

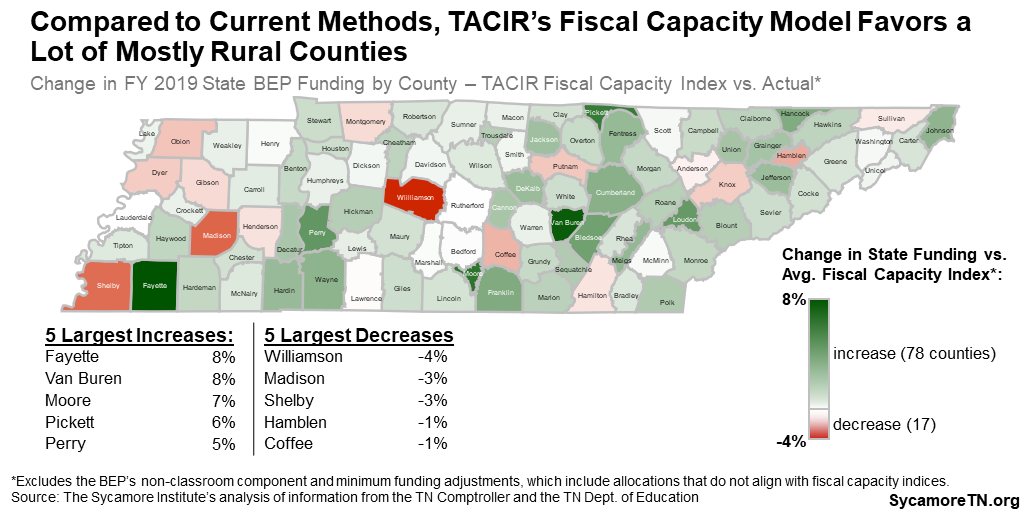

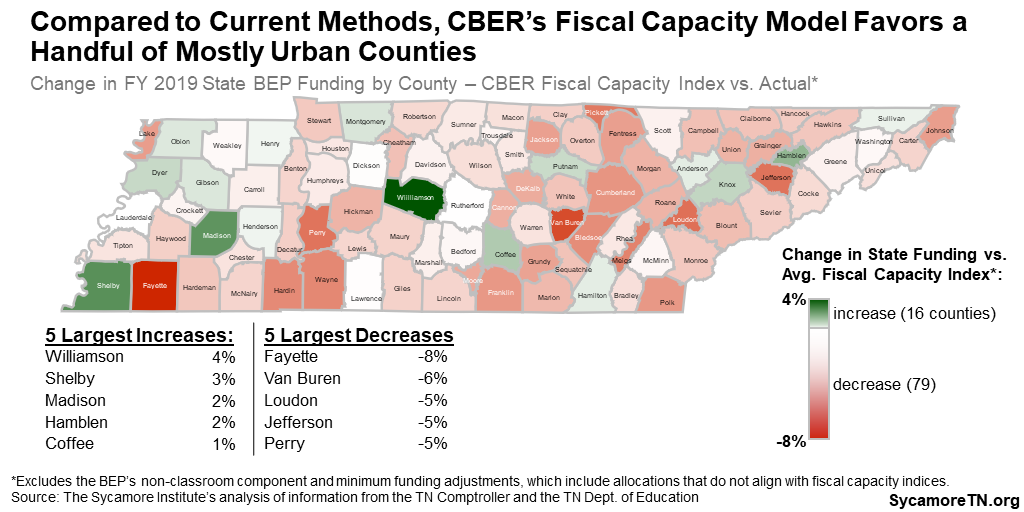

Because the two models used to estimate fiscal capacity create slightly different indices, they each allocate state dollars differently. Compared to the blended model currently in use, TACIR’s model would generally send more state money to the majority of school districts at the expense of a handful of mostly urban counties (Figure 5), while CBER’s model trends in the other direction (Figure 6). (13) (5)

Figure 5

Figure 6

Textbox 2.

How Fiscal Capacity Affects State Funding for Local Districts: A Simplified Example

Imagine the BEP estimates it would cost $100 to fund K-12 education this year statewide, based on all the components of the BEP formula and expected student enrollment in each district. Per Tennessee law, the state would contribute $66 and localities $34.

Let’s say there are three countywide school districts in the state. The BEP calculates the cost of giving every student an adequate education at $50 for County A, $25 for County B, and $25 for County C. Altogether, these three counties could raise an estimated $50 in local revenues – with 50% coming from County A, 30% from County B, and 20% from County C.+

In this scenario, the BEP requires County A to contribute $17, County B $10, and County D $7 – or 50%, 30%, and 20% of the total statewide local share, respectively. The state would then cover the rest of each County’s BEP calculation – $33 for County A, $15 for County C, and $18 for County C.

|

District |

BEP Calculation | Fiscal Capacity | Relative Fiscal Capacity | Local Share of BEP |

State Share of BEP |

| County A |

$50 |

$25 | 50% | 50% x $34= $17 |

$50 – $17 = $33 |

| County B |

$25 |

$15 | 30% | 30% x $34 = $10 |

$25 – $10 = $15 |

| County C |

$25 |

$10 | 20% | 20% x $34 = $7 |

$25 – $7 = $18 |

| Total |

$100 |

$50 | 100% | $34 |

$66 |

|

State Share (66%) |

$66 |

||||

|

Local Share (34%) |

$34 |

+ The actual formula uses the average of two different calculations to arrive at these percentages.

Parting Words

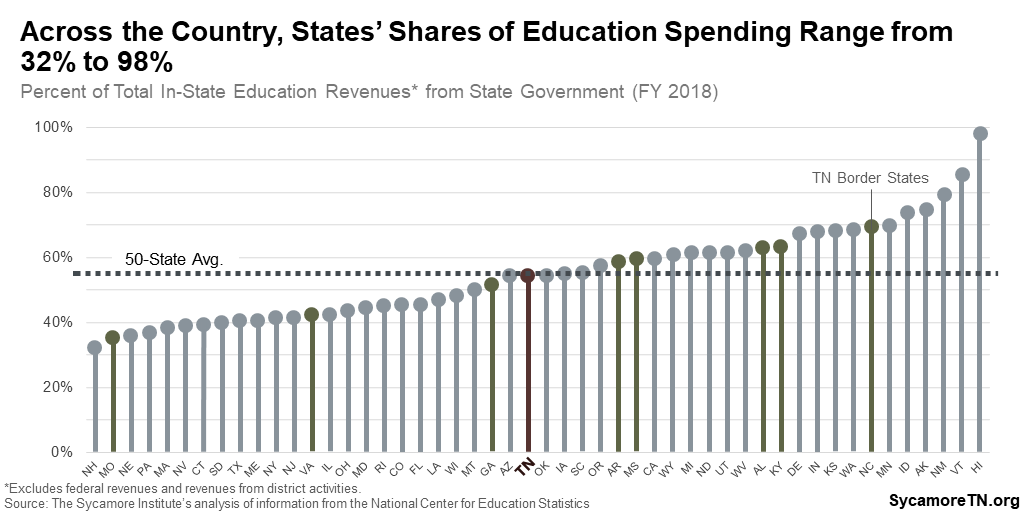

This report explains the mechanics of how Tennessee allocates state funding for K-12 education to local school districts. There is no inherently right or wrong way to do that, and the method a state chooses will depend on the values and priorities of its citizens and policymakers. Looking across the country, for example, the proportion of education spending covered by each state varies from 32% in New Hampshire to 98% in Hawaii (Figure 7). (15)

However, policymakers should not lose sight of the first core question the BEP is intended to answer: how much money is enough to adequately educate every Tennessee student? As noted above, many school districts spend much more from local revenues than the BEP requires. Costs not covered by the BEP create an additional burden for every district, but districts with less fiscal capacity – less ability to cover those additional costs – face the greatest disadvantage.

Figure 7

References

Click to Open/Close

- Tennessee State Collaborative on Reforming Education (SCORE). Modernizing Education Funding to Support Every Tennessee Student. [Online] 2022. https://tnscore.org/wp-content/uploads/2022/01/Modernizing-Education-Funding_2022_digital_FINAL.pdf

- Skinner, Rebecca. State and Local Financing of Public Schools. Congressional Research Service. [Online] August 26, 2019. https://www.everycrsreport.com/files/20190826_R45827_7a8d531e7ae1e7fabafeffb87cdfd1b3d03ced49.pdf

- EdBuild. A National Overview of State Education Funding Policies. FundEd: National Policy Maps. [Online] 2022. [Cited: February 15, 2022.] http://funded.edbuild.org/national#local-share

- State of Tennessee. Tenn. Code Ann. § 49-3-307(a)(2)(B). [Online] 2022. Accessed via Lexis Nexus.

- Tennessee Comptroller’s Office of Research and Education Accountability. FY 2019 BEP Calculator. [Online] February 16, 2022. Accessed from https://comptroller.tn.gov/office-functions/research-and-education-accountability/interactive-tools/bep.html

- —. Basic Education Program. [Online] [Accessed on February 18, 2022.] https://comptroller.tn.gov/office-functions/research-and-education-accountability/interactive-tools/bep.html

- Tennessee State Board of Education. The Basic Education Program. [Online] [Accessed on February 15, 2022.] https://www.tn.gov/sbe/committees-and-initiatives/the-basic-education-program.html

- The Sycamore Institute’s review of public records and consultation with numerous officials who have worked on the BEP in recent decades. February 2022.

- Tennessee State Collaborative on Reforming Education (SCORE). Funding for Learning: An Analysis of K-12 Education Finance in Tennessee. [Online] 2021. https://tnscore.org/wp-content/uploads/2021/10/Funding-For-Learning_digital_FINAL.pdf

- Supreme Court of Tennessee. Opinion in Tennessee Small School Systems vs. McWherter. [Online] March 22, 1993. Accessed via https://www.casemine.com/judgement/us/5914bea5add7b049347a9700.

- Hurder, Alex J. Tennessee Small School Systems v. McWherter. Tennessee Encyclopedia. [Online] October 8, 2017. [http://tennesseeencyclopedia.net/entries/tennessee-small-school-systems-v-mcwherter/

- Tennessee Advisory Commission on Intergovernmental Relations (TACIR). County Fiscal Capacity for FY 2021-FY 2022. [Online] October 11, 2021. [Cited: February 9, 2022.] https://www.tn.gov/content/tn/tacir/fiscal-capacity-for-education/information-for-tennessee-counties/county-fiscal-capacity-for-fy-2021-fy-2022.html

- Tennessee Department of Education. Tennessee Basic Education Program Handbook for Computation. [Online] September 2018. [Cited: February 18, 2022.] https://www.tn.gov/content/dam/tn/stateboardofeducation/documents/bepcommitteeactivities/2019-bep/BEPHandbook%20revised%20September%202018.pdf

- —. Financial Summaries – Revenue – Total from All Sources. Annual Statistical Reports for FY 2019. [Online] 2020. Data retrieved from https://www.tn.gov/education/data/department-reports.html.

- U.S. Department of Education. Local Education Agency (School District) Finance Survey (F-33) Data for 1992-1998. National Center for Education Statistics Common Core of Data (CCD). [Online] Data accessed from https://nces.ed.gov/ccd/files.asp.

- Roehrich-Patrick, Lynnisse & Green, Harry. A Users’ Guide to Fiscal Capacity in the Basic Education Program. TN.gov. [Online] Tennessee Advisory Commission on Intergovernmental Relations, November 2004. https://www.tn.gov/content/dam/tn/tacir/documents/Users_Guide_to_Fiscal_Capacity.pdf

- State of Tennessee. The Constitution of the State of Tennessee. [Online] November 4, 2014. https://www.capitol.tn.gov/about/docs/tn-constitution.pdf

Note: This report was updated on March 17, 2022 to correct an explanation of the CBER fiscal capacity model, which erroneously stated that it is calculated on a per pupil basis.