Last week, Speaker Paul Ryan of the U.S. House of Representatives introduced the American Health Care Act (AHCA). The AHCA is the proposed replacement plan for the Affordable Care Act (ACA). We took a closer look at the bill’s Medicaid financing provisions HERE and HERE, but the AHCA’s changes to the ACA will also impact access to private health insurance in Tennessee.

The Individual Health Insurance Market

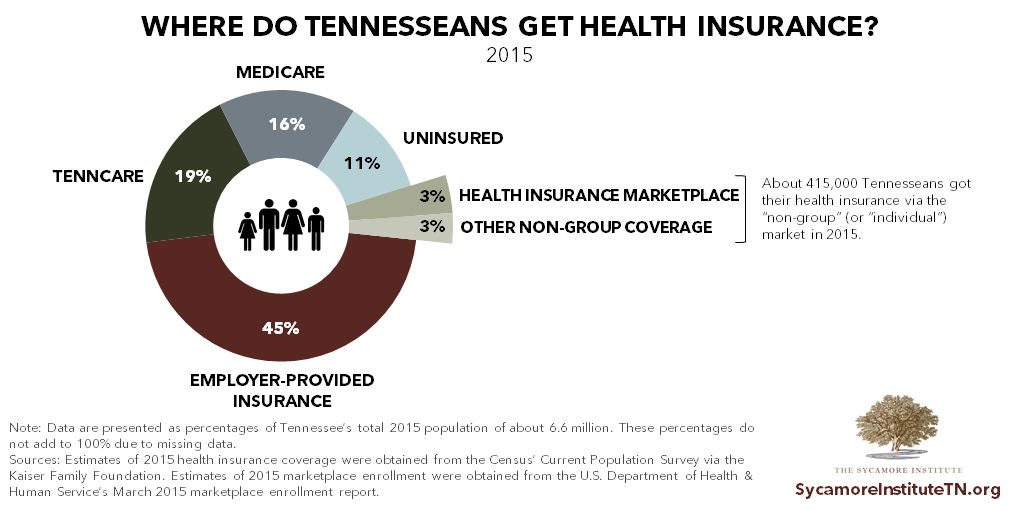

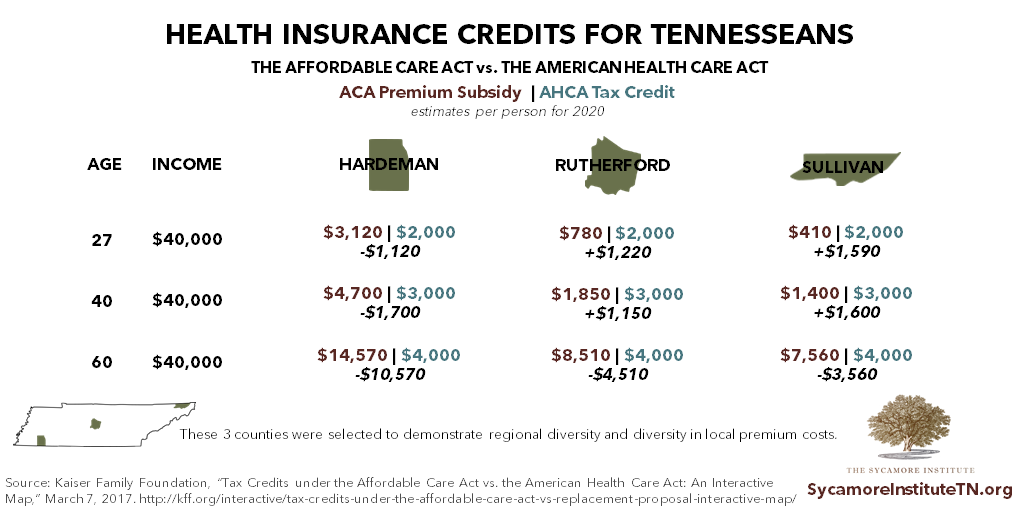

Outside of Medicaid, coverage changes in the AHCA largely affect the individual health insurance market. This market (sometimes also referred to as the nongroup market) is essentially all health insurance not provided by employers or through the government. Today, that includes both the ACA’s health insurance Marketplace (i.e. healthcare.gov) and the “off-exchange” market. About 6% of Tennesseans (or 415,000) got their health insurance through the individual market in 2015.

ACA Premium Subsidies vs. AHCA Tax Credits

One key part of the AHCA replaces the ACA’s Marketplace premium and cost-sharing subsidies with refundable tax credits. The ACA’s Marketplace subsidies are based on an individual’s income and the cost of health insurance premiums and cost-sharing requirements in a person’s local area. The value of the AHCA’s tax credits, which would take effect in 2020, would vary according to a person’s age and change only with annual inflation.

Several organizations have estimated how the bill might change the assistance that people get to purchase individual health insurance. County- and state-level estimates have been released by the Kaiser Family Foundation (KFF), the New York Times, and the Center on Budget and Policy Priorities. Based on these sources, the image below shows how the financial impact on Tennesseans earning $40,000 per year could vary by age and location. These estimates only compare the ACA premium subsidies with the AHCA’s tax credits. They do not include the ACA’s cost-sharing subsidies, which are available to those with incomes under 250% of poverty (about $30,000 for an individual in 2017). Test your own scenarios using KFF’s interactive map here.

Overall, these estimates concluded that the AHCA’s credits are more generous in the short-term for some Tennesseans – specifically, individuals with higher incomes or in areas of the state with relatively lower premiums.

On Monday, the nonpartisan Congressional Budget Office (CBO) released its estimates of the bill. It similarly concluded that the bill’s subsidies would be less generous than the ACA’s for people in areas with higher premiums and individuals with lower incomes. When combined with provisions that increase how much older individuals can be charged, subsidies relative to premiums would also be smaller for older individuals.

Judging the full financial impact of the AHCA isn’t quite so simple, of course. Individuals’ health insurance options and costs may also be different than they are today

More Lower-Premium/Less Generous Plans

Because the AHCA lifts certain requirements on how generous individual market plans must be, CBO expects insurers to offer more lower-premium plans with higher deductibles and out-of-pocket requirements. If a significant number of people shift to these plans, market forces would likely dictate that more generous but higher-premium plans (like those currently required under the ACA) would become even more expensive.

These details, along with others that change the incentives for getting coverage, will all play a role in impacting not only the affordability of health insurance but also access to needed health care services.

The Big Picture

As the AHCA makes its way through Congress, it will be important to consider the big picture:

- How would changes to current law impact the affordability of health insurance – both immediately and over time?

- How would insurance plans’ cost-sharing requirements impact access to the health care services needed by Tennesseans?

- How would the enrollee incentives created by cost-sharing requirements affect underlying health care costs?

- And, most importantly, how will all these changes impact the health and well-being of Tennesseans?

If you are interested in additional details about the AHCA, the U.S. House’s section-by-section summaries of the bill are available here and here. For an independent summary, we recommend this one by the Kaiser Family Foundation.