The ability for businesses to use the courts to collect debts helps ensure they remain financially solvent. Ensuring that people in debt meet their financial obligations can safeguard access to and mitigate increases in the costs of credit (or other services) for others. However, the over- or misuse of lawsuits involves trade-offs for both courts and defendants.

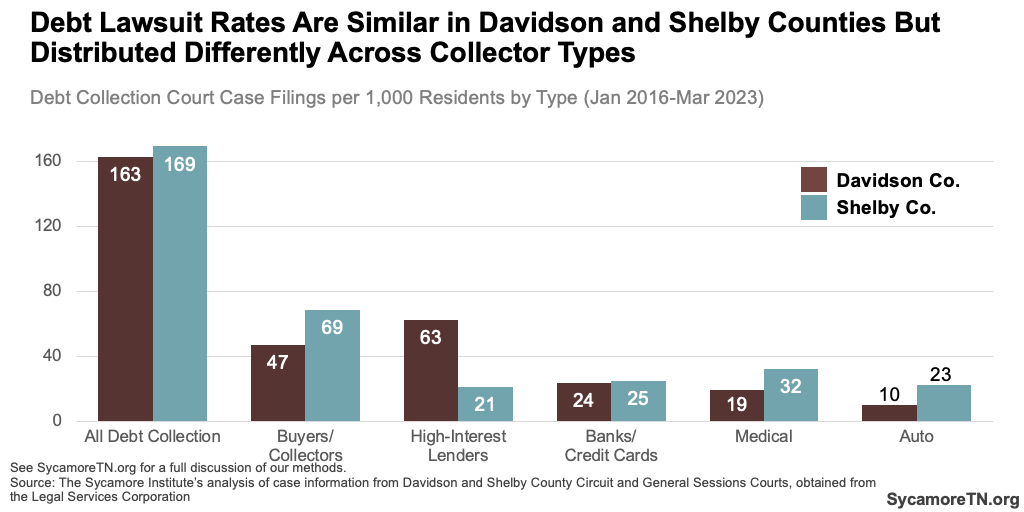

In this study, we explored consumer debt collection lawsuits in Davidson and Shelby Counties, Tennessee. Using civil court data for January 2016 through March 2023, we analyzed how creditors use courts to collect consumer debt in each county, the kinds of debts most likely to end up in court, and who is most affected (Figures 1 and 2). Read more about debt collection in Davidson County and Shelby County.

Figure 1

Figure 2

*Figure 1 was updated on January 22, 2024 to correct an error in the total number of Shelby Co. debt collection cases displayed.