The Trump White House released its first federal budget proposal this week. While Congress holds the power to set tax and spending levels for the federal government, the president’s suggestion serves as a reminder that federal funds account for a large share of Tennessee’s state budget. The following excerpt from our Tennessee State Budget Primer explains where this money goes and the rules that determine how Tennessee can spend it.

Highlights:

-

- Nearly 40¢ of every dollar spent by the state of Tennessee comes from the federal government.

- Federal funding in Tennessee often comes with restrictions that limit the discretion of state policymakers or can amplify the effects of state decisions about how to spend money.

- Only 18% of the state’s General Fund was considered discretionary in FY 2015-2016. Discretionary spending often receives more attention and scrutiny during the annual budget process than non-discretionary spending.

The full excerpt from our Tennessee State Budget Primer is below.

Digging Deeper: Federal Funding

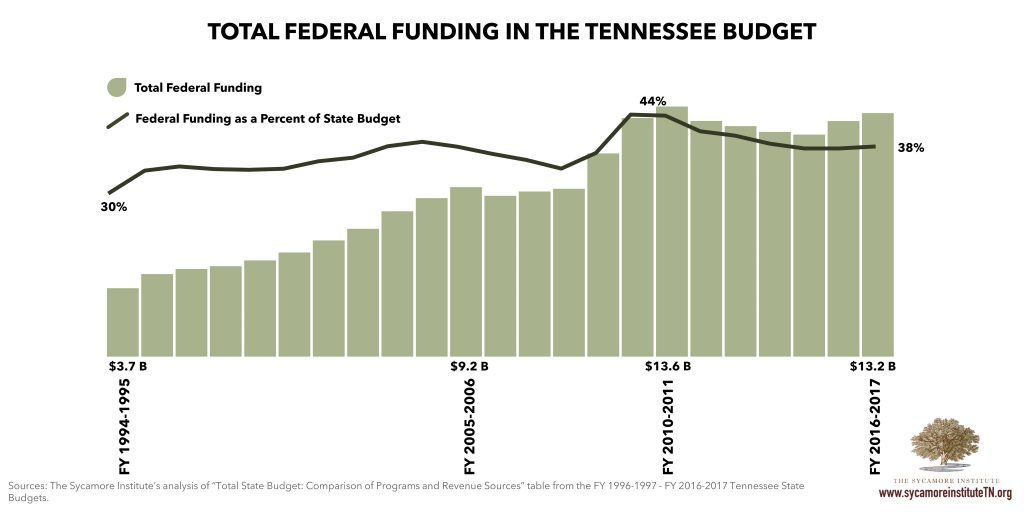

The recommended Budget for FY 2016-2017 included $13.2 billion in funding from the federal government. These amounts peaked in FYs 2009-2010 and 2010-2011, when the U.S. Congress – through the American Recovery and Reinvestment Act (ARRA) – provided an infusion of one-time federal funds to help states recover from the Great Recession.

The recommended Budget for FY 2016-2017 included $13.2 billion in funding from the federal government. These amounts peaked in FYs 2009-2010 and 2010-2011, when the U.S. Congress – through the American Recovery and Reinvestment Act (ARRA) – provided an infusion of one-time federal funds to help states recover from the Great Recession.

Of every dollar currently spent by the state of Tennessee, 38¢ comes from the federal government. Tennessee relies more heavily on federal revenues than any other state except Mississippi, Arizona, and Michigan. [1]

These dollars represent only those in the state Budget – not all the federal dollars being spent to serve Tennesseans. In state FY 2015-2016, for example, the Budget included $12.8 billion in federal funds, but in federal FY 2016, an estimated $66.4 billion in federal funds were sent into Tennessee via direct awards, contracts, and benefits. [2]

Federal funds awarded directly to the departments and agencies of the state government to carry-out programs and deliver services are included in the state Budget. Examples include Medicaid, Temporary Assistance for Needy Families (TANF), block grants for substance abuse and mental health prevention and treatment, the Army and Air National Guards, and clean water activities.

Other federal funds are awarded directly to local governments or non-governmental organizations to carry-out programs and deliver services or are made as direct payments or benefits to individuals. These are not included in the state Budget. Examples include Medicare, Social Security, Pell Grants, and grants for scientific research.

Some funding is awarded to both states and other organizations. For example, federal support for transportation, education, and housing are all provided to the state and directly to local governments. Only the funds awarded directly to the state government are included in the state Budget.

Digging Deeper: “Strings Attached”

A sizable portion of the Tennessee state Budget’s revenues has some fairly serious strings or limitations attached. For example, the nearly 40% of our state budget that is federal funding comes with many restrictions. Some strings limit the amount of discretion that either the Governor or the General Assembly has to adjust numbers. Other strings can amplify the effects associated with a given state funding decision.

State-Level Earmarks: First, the use of some state revenue streams are dictated – or “earmarked” – in permanent law. For example, about 55¢ of every 62¢-tax paid on a pack of cigarettes goes to the Education Fund. The money in these funds can only be used for their designated purposes. Lottery proceeds, for example, can only be used for college scholarships and a handful of other education expenses.

Federal Limits on Spending Purpose: All federal funding is awarded to states for specific purposes, and state governments often have limited authority to repurpose those dollars. For example, the nearly $2 billion that comes into the state from the federal government for the Supplemental Nutrition Assistance Program (SNAP) (commonly referred to as food stamps) within the Department of Human Services cannot be spent by the Department of Correction on state prisons. In fact, SNAP dollars must be spent in a very particular way.

18%: The proportion of the total General Fund that was considered discretionary in FY 2015-2016.

Federal Matching Requirements: Furthermore, the federal government almost always requires the states to pitch-in in the form of matching and/or maintenance-of-effort requirements – meaning state dollars must also be invested in the program alongside federal dollars. Matching provisions also multiply the impact of state funding decision. For example, 65% of most of TennCare (i.e. Tennessee’s Medicaid program) costs are covered by the federal government. So, for every state dollar put into TennCare, the state receives $1.54 from the federal government, and for every state TennCare dollar cut, the overall Budget falls by $2.54.

Court Mandates: Additionally, the outcomes of lawsuits can play a significant role in placing funding obligations on the state. For example, in ongoing court challenges that began in the 1980s, local school systems charged that the state education funding allocations were inadequate. The courts agreed. The result was a court-mandated funding formula for public education in Tennessee known as the Basic Education Program (BEP).

The federal government’s “strings” can also place a price tag on non-budgetary decisions. Prime example: The recent change in DUI laws for underage drinkers put $60 million in federal funding at risk and required a special legislative session to untangle.

Double Counting: Finally, some of the money you see in the Budget is actually accounted for in multiple locations because departments provide services and supplies to one another. For example, departments often pay the Department of General Services to “rent” office space in state-owned buildings. In this example, those dollars show up in the Budget for both departments – as expenses for departments paying the rent and as departmental or “other” revenue for the Department of General Services.

Why Understanding Strings is Important: According to the Budget, about $5.4 billion in recurring state expenditures were considered discretionary for the purposes of budgeting for FY 2016-2017. This amounts to 18% of the total FY 2015-2016 General Fund and 41% of the state appropriation portion of the General Fund. [3] This is referred to in the Budget as the “discretionary base.” The discretionary base tends to be the most scrutinized in annual spending decisions, and even within that, the most attention is paid to incremental changes to these numbers rather than the base itself.

Sources

[1] The Sycamore Institute analysis of National Association of State Budget Officers, “Table 1: Total State Expenditures – Capital Inclusive,” State Expenditure Report Examining FY 2013-2015 State Spending. LINK

[2] U.S. Government, “State Summary: Tennessee, FY 2016,” USASpending.gov. LINK

[3] The Sycamore Institute analysis of State of Tennessee, “Departmental Comparison of 2016-2017 Recurring Appropriations, 2016-2017 Discretionary Base, and 2016-2017 Base Budget Reductions (State Appropriation)” table from the FY 2016-2017 State Budget: Volume 2 – Base Budget Reductions. The Tennessee Advisory Commission on Intergovernmental Relations, The Citizen’s Guide to the Tennessee Budget, February 2002. LINK