Fines and fees are a central part of Tennessee’s criminal justice system – both to punish criminal acts and to fund essential government functions. However, incomplete data make it hard to track how much people are charged and by whom, as well as how any collected money gets used. Collecting more robust data would help Tennessee policymakers better understand and address any downsides of criminal fees and fines. This report highlights basic questions that existing information does not answer, best practices to collect better information, and other areas with potential for improvement.

Key Takeaways

- A lack of information makes it harder to understand the costs and benefits of criminal fees and fines, their effect on broader policy goals, and the best starting points for reform.

- State and local officials should have clear rules and adequate resources for reporting data to a central, publicly accessible repository with safeguards to protect individual privacy.

- Policymakers can also expand courts’ reporting requirements, tap existing information on public finances, and connect data across systems, agencies, and other relevant actors.

Defining the Problem

Tennessee’s complex fee and fine framework, decentralized court system, and limited data collection obscure the full scope and impact of legal financial obligations (LFOs). Since 2005, Tennessee has added at least 50 new fees and fines to state law. (1) Yet, there is little research or available data to help answer key questions like:

Basic Landscape of Fees & Fines in Tennessee

- What is the typical amount of fees and fines people can expect to face for any given crime?

- Are fees and fines for different offenses proportional to the severity of the crime?

- What practices are typically used to determine legal financial obligations, a person’s ability to pay them, and the system’s ability to collect?

- To what extent are fees and fines used to fund the criminal justice system and other parts of government?

- How do each of these things vary from one jurisdiction to another?

- What groups or areas are most affected by fees and fines?

Benefits and Costs of Fees & Fines in Tennessee

- Are fees and fines an efficient source of government revenue and a net positive for public safety?

- What impact do fees, fines and related collection methods have on people who owe them?

- How do fees and fines affect broader issues like crime, incarceration, and economic security?

This lack of information makes it harder to understand the costs and benefits of criminal fees and fines, their effect on broader policy goals, and the best starting points for reform. The rest of this report summarizes best practices for criminal justice data collection and four potential ways to accumulate the information needed to answer the questions listed above. See the Appendix for a longer set of questions that a more robust data system could start to answer.

Best Practices and Promising Approaches

Tennessee can look to several other states for examples of enhanced data collection and reporting in this area. According to recent research, most states do not currently collect the data required to understand the role that fees and fines play in their criminal justice systems. (2) However, states that stand out from the pack include:

- Florida – In 2018, Florida created a standard set of information that county governments must collect and make publicly available. These measures encompass data about pretrial release, ability-to-pay determinations, and the demographics of people involved with the criminal justice system. (3)

- Texas – Under Texas’ Collection Improvement Program, court officials tracked costs associated with collecting court fees and fines and reported them to the state in an effort to boost collection rates – the only such statewide program in the country. While the program’s general intent was to raise revenues, these data also let stakeholders evaluate the impact and efficiency of local collection practices across the state. (4) Texas ended the entire program – including the reporting on collection costs – in 2019 due in part to funding concerns. (5) (6) (7) (8)

- Illinois – Illinois’ Access to Justice Act of 2015 created a bipartisan task force with members from across all government branches to review the state’s fee and fine policies and practices. (9) The task force’s report led to the Criminal and Traffic Assessment Act of 2018, which, among other things, streamlined fees and fines and clarified procedures for ability-to-pay reviews. (10) As of mid-2021, lawmakers were working to convene a new task force to evaluate the impact of the 2018 policy changes. (11)

- Pennsylvania – By order of the Pennsylvania Supreme Court, the state adopted a digital reporting system that collects case-level information for all criminal court proceedings. (12) Fully implemented and publicly accessible by 2006, this system sheds significant light on the role LFOs play in criminal justice and their efficiency as a revenue source. (13) (14) The state also uses the system to publish and maintain user-friendly online caseload and LFO data dashboards. (15)

As with any dataset, information like this is a tool that people can use in a wide variety of ways. While better LFO data would create significant opportunities for research and evaluation, there is also potential for it to affect the actions of judges, law enforcement, policymakers, and other relevant parties. For example, North Carolina publishes data each year on how often judges waive courts costs for people deemed unable to pay them. (16) Some local advocates and judges have criticized these reports as a “shaming” effort meant to pressure judges to grant fewer waivers. (17) (18)

Recent research suggests that key aspects of a fee and fine data system should include: (19) (2) (20)

- Clear Standards – Complete data will require the participation of hundreds of local officials across the state. To lower the burden of their participation, officials should be equipped with standardized measures, clear guidelines for how to collect and record them, and explicit requirements for making the data available.

- Available and Accessible – A centralized data repository would reduce the burden of reporting for local authorities while also making the data available and accessible to researchers and the public. Ideally, data would be available in downloadable, machine readable formats and be maintained by staff with the time, training, and expertise to ensure systems run properly.

- Adequate Support – Local authorities will need the necessary resources, training, and infrastructure to comply with any new reporting requirements.

- Evaluation and Flexibility – Evaluating the rollout of any data infrastructure programs and pivoting as needed would help to ensure that data collection programs are effective, efficient, and useful. Clear protocols from the start for monitoring new systems and requirements would help avoid complications, bottlenecks, or blind spots that might undermine the goals of data collection.

Four Ways to Gain More Insight into Fees & Fines

Expand and Standardize Court Data

The decentralized nature of Tennessee’s court system makes it difficult to evaluate court fees and fines across the state. Tennessee’s judicial system is a mix of state and local courts. (21) The state has 31 judicial districts that hear criminal cases. All 95 counties also have their own courts of limited jurisdiction that hear criminal cases, and the types of cases any given court (e.g. general sessions, circuit, etc.) has jurisdiction over varies from county to county. (1) (21) The result is a court system with overlapping authorities, diverse funding sources, and disparate reporting capabilities.

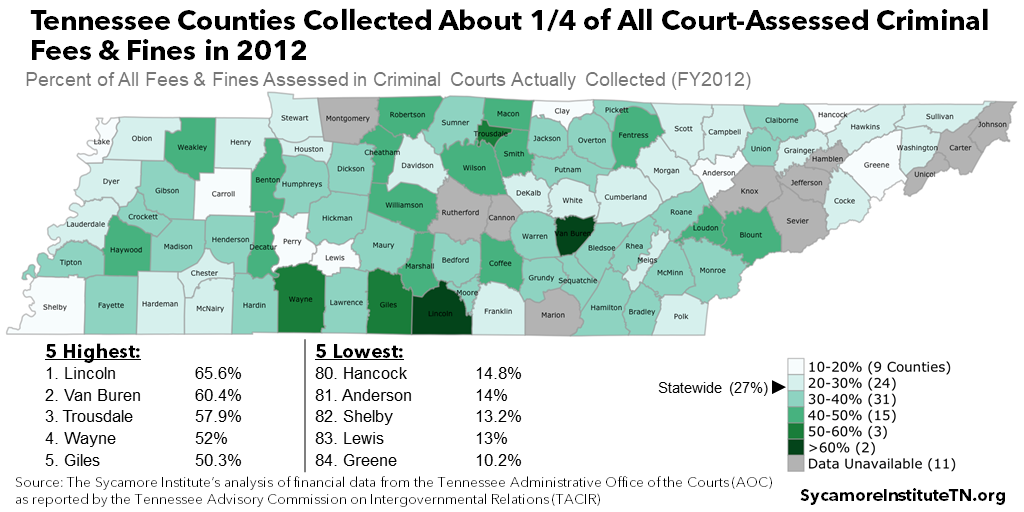

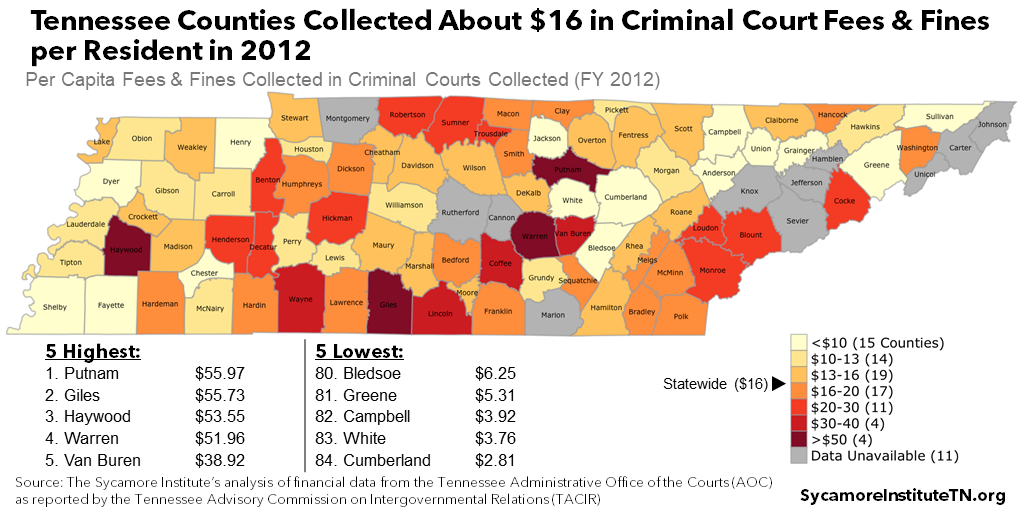

Available data on court fees and fines show wide variation and low collection rates, but there are significant limitations (Figure 1). Several years ago, the Tennessee Administrative Office of the Courts (AOC) compiled information from 84 counties on civil and criminal courts’ fee, fine, and tax assessments and collections. However, the data are from 2012 only, reflect only topline numbers, and do not include information from municipal and appellate courts. Without more details, it is impossible to answer basic questions about the typical costs people accrue from different criminal charges and how that has changed over time.

Policymakers could expand courts’ existing reporting requirements to information related to fee and fine assessments and collections. Current state law requires court clerks to send the AOC monthly case-level data, which include charges and case outcomes for each defendant. (22) Broader rules might cover defendant characteristics (e.g. demographics, income), the amount of fees and fines assessed to each person, amounts collected, costs of collection, and the basis for decisions on pretrial release, ability to pay, and sentencing. (23)

Figure 1

Tap Existing Public Accounting Info

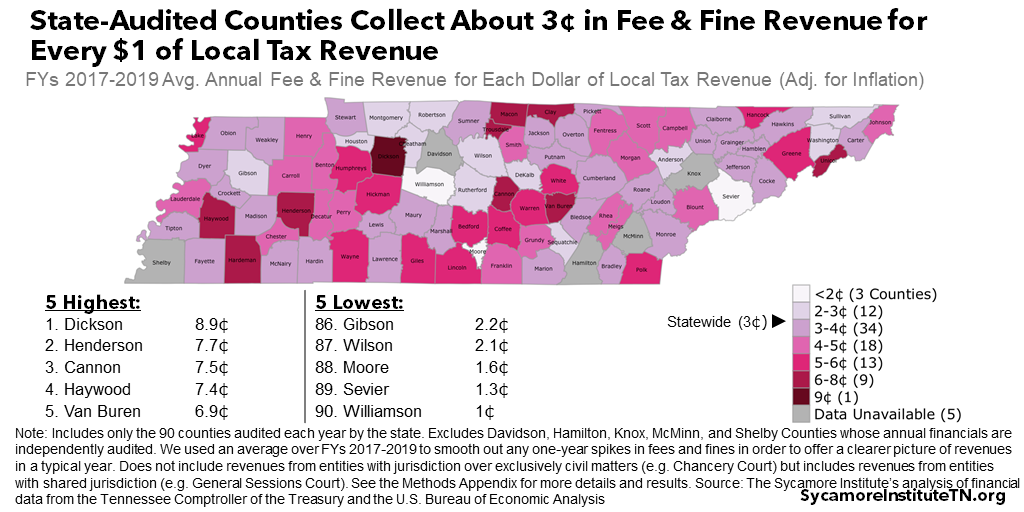

Tennessee makes public some data on the extent to which state and local budgets rely on legal financial obligations, but important gaps remain. The state comptroller audits, compiles, and reports standardized financial information for 90 counties – which shows wide variation in local revenue from fees and fines (Figure 2). However, these data likely include significant revenue from civil cases and do not shed any light on the state’s municipalities or most populous counties.

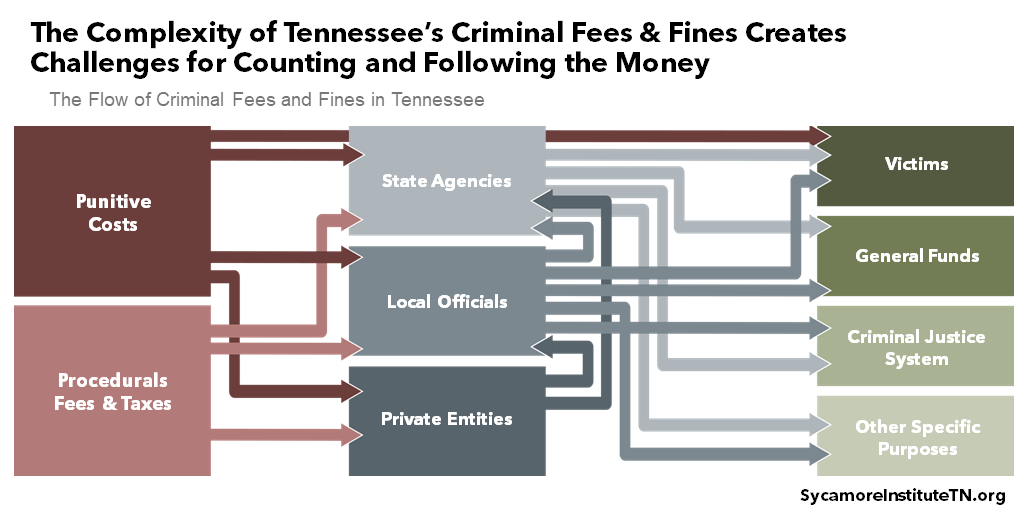

Policymakers could leverage existing accounting systems related to state and local budgets to get more clarity on criminal fine and fee revenues and how they are allocated. Tracking the flow of money can be hard because both state and local entities collect LFOs, and the formulas for allocating these funds are often complex (Figure 3). (26) (1) Clear state and local-level reporting of how each dollar collected gets distributed would help policymakers evaluate the role of fees and fines as a revenue source and the likely effect of any reforms.

Meanwhile, clear accounting of the costs of fee and fine collection would shed light on their net financial impact. Attempts to collect unpaid LFOs often require staff time, court hearings, and physical resources. Tennessee has no statewide data on these costs, but some information does exist at the local level. For example, a 2020 study found Davidson County spent nearly $725,000 in FY 2018 on personnel and postage costs related to LFO collection efforts. (27) Some agencies also pay to retain private debt collectors. Research from other states has even found jurisdictions that spent more trying to collect fees and fines than they ultimately took in as revenue. (20)

Figure 2

Figure 3

Connect Data Across Systems and Actors

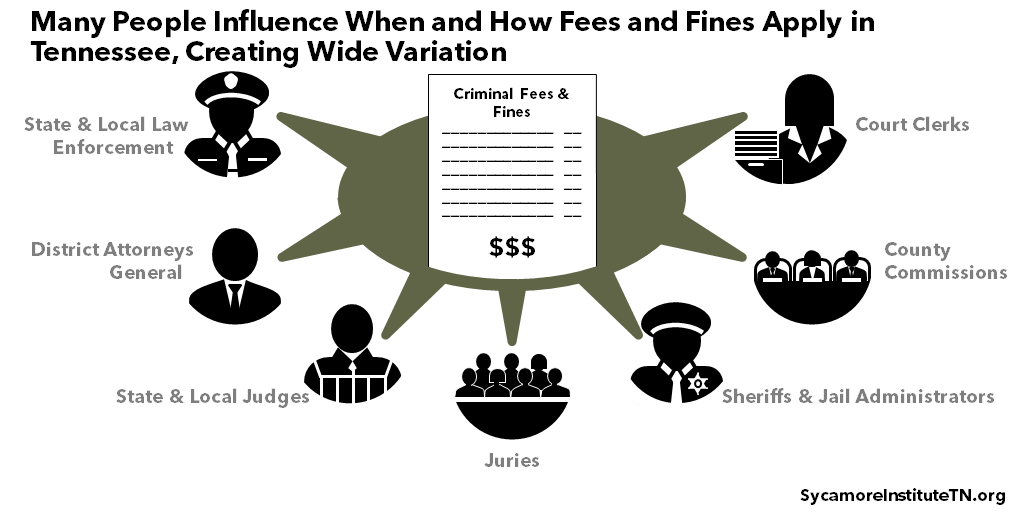

Additional information from multiple parts of the criminal justice system would help explain what and who drives differences in fees and fines across the state. State law creates the framework under which all jurisdictions assess LFOs, but many local entities help determine what a given person ultimately owes (Figure 4). There are also large differences in how local officials assess fees and fines (Figure 5) and how much they collect (Figure 6) – variation that differing crime rates generally do not explain. (21) (27) (28) More transparency around these actors’ decisions and practices could help to clarify what drives different outcomes across Tennessee.

Including information from local officials and service providers outside the courthouse would show a fuller picture of the financial obligations people face. Court data alone may not capture all financial obligations. For example, some fees may go to private service providers (e.g. bail bondsmen, jail phone providers), and sheriffs and jail administrators may charge fees for commissary items.

Figure 4

Figure 5

Figure 6

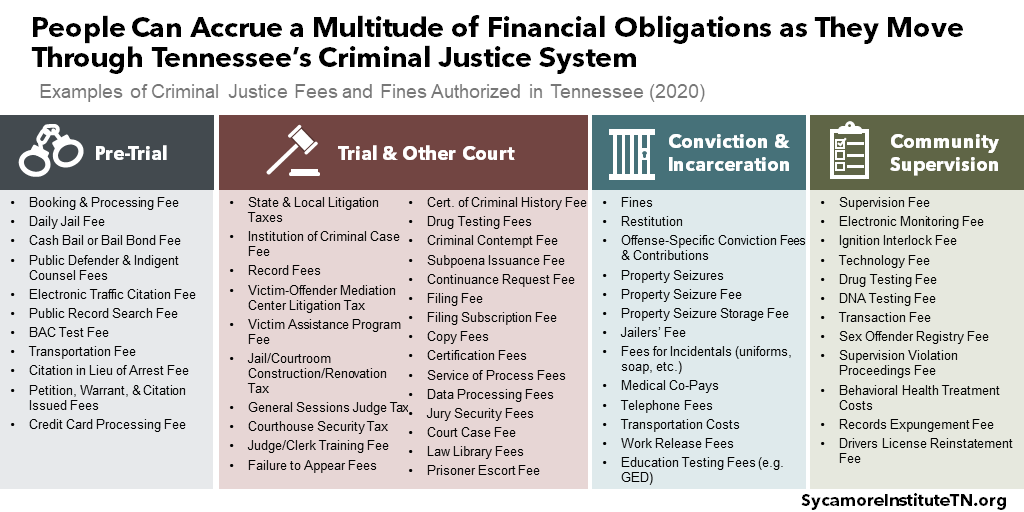

Storing this data in a central repository could also help officials decide if and when to assess additional LFOs. Tennesseans can accumulate fees and fines at each stage of an interaction with the criminal justice system (Figure 7). A statewide system to track on an ongoing basis what individuals already owe and to whom could be a useful tool for actors such as judges, law enforcement agencies, and district attorneys when they determine whether to assess or waive new financial obligations.

Connecting information about fees and fines with data from other state systems would help to understand the full costs and benefits of LFOs in Tennessee. Cross-systems data from courts, corrections, and other agencies would allow for a more meaningful assessment of any relationships between financial obligations, criminal involvement, public safety, recidivism, and long-term post-release outcomes like financial security.

Make Data Transparent and Accessible

Tennessee will only realize the full potential of this data if it is available and accessible for research and analysis. Publicly available data – with the proper privacy safeguards – would allow stakeholders and researchers to evaluate the role LFOs play in the criminal justice system, uncover inefficiencies, and highlight opportunities for improvement. Making this data publicly available may also help to build community trust. (29)

Figure 7

Parting Words

Fees and fines help fund Tennessee’s criminal justice system and punish people convicted of crimes. However, wide variation in their application across the state and a lack of robust data make it hard to gauge their impact on public safety, public finances, and the personal finances of affected families and individuals. Policymakers need better data at each stage of the process to understand how this system functions and evaluate its outcomes.

References

Click to Open/Close

- Barrie, Jennifer, et al. Tennessee’s Court Fees and Taxes: Funding the Courts Fairly. Tennessee Advisory Commission on Intergovernmental Relations (TACIR). [Online] January 26, 2017. https://www.tn.gov/content/dam/tn/tacir/documents/2017_CourtFees.pdf

- Hammons, Briana. Tip of the Iceberg: How Much Criminal Justice Debt Does the U.S. Really Have. Fines & Fees Justice Center. [Online] April 28, 2021. https://finesandfeesjusticecenter.org/2021/04/28/new-ffjc-report-how-much-criminal-justice-debt-does-the-u-s-really-have/

- State of Florida. Public Chapter 2018-127. [Online] March 30, 2018. https://www.flsenate.gov/Session/Bill/2018/1392

- Crowley, Michael F., Menendez, Matthew J. and Eisen, Lauren-Brook. If We Only Knew the Cost: Scratching the Surface on How Much it Costs to Assess and Collect Court Imposed Criminal Fees and Fines. UCLA Criminal Justice Law Review. [Online] 4(1) 2020. https://escholarship.org/uc/item/19p8b9r6

- Texas Judicial Branch. Fines & Fees. [Online] [Cited: July 28, 2021.] https://www.txcourts.gov/fines-fees/ (This website was later taken down)

- Crowley, Mike. The Unknown Cost of Criminal Fees and Fines. The Brennan Center. [Online] June 18, 2020. https://www.brennancenter.org/our-work/analysis-opinion/unknown-cost-criminal-fees-and-fines

- Texas State Legislature. Conference Committe Report for Tex. S.B. 891, 86(R). [Online] May 25, 2019. https://lrl.texas.gov/scanned/86ccrs/sb0891.pdf#navpanes=0

- Smith, Michael. Collection Improvement Plans. Texas Municipal Courts Education Center. [Online] May 17, 2019. https://www.tmcec.com/files/4515/5863/3914/00_-_Collection_Improvement_Mike_Smith.pdf

- Statutory Court Fee Task Force. Illinois Court Assessments: Findings and Recommendations for Adressing Barriers to Access to Justice and Additional Issues Associated with Fees and Other Court Costs in Civil, Criminal, and Traffic Proceedings. Illinois State Supreme Court. [Online] June 1, 2016. https://www.illinoiscourts.gov/Resources/4b970035-98ba-4110-86fc-60e02b6a126b/2016_Statutory_Court_Fee_Task_Force_Report.pdf

- Fines & Fees Justice Center. Illinois HB 4594: The Criminal and Traffic Assessment Act. [Online] February 1, 2018. https://finesandfeesjusticecenter.org/articles/illinois-hb-4594-criminal-traffic-assessment-act/

- Agnew, Stephanie. Criminal Justice Advisory Committee Co-Chair Appointed to the Illinois Supreme Court’s Statutory Court Fees Task Force by the Governor. Chicago Appleseed Center for Fair Courts. [Online] May 3, 2021. https://www.chicagoappleseed.org/2021/05/03/cjac-co-chair-appointed-to-il-statutory-court-fee-task-force/

- The Administrative Office of Pennsylvania Courts. A Guide to Collections in the Pennsylvania Courts. [Online] https://help.pacourts.us/PortalHelpDocs/CollectionsHandout.pdf

- Supreme Court of Pennsylvania. Report of the Administrative Office of Pennsylvania Courts – 2006. The Unified Judicial System of Pennsylvania. [Online] https://www.pacourts.us/Storage/media/pdfs/20210208/171341-annualreport2006.pdf

- Ward, Jeffrey T., Link, Nathan W. and Christy, Andrew. Imposition and Collection of Fines, Costs, and Restitution in Pennsylvania Criminal Courts. ACLU of Pennsylvania. [Online] December 18, 2020. https://www.aclupa.org/sites/default/files/field_documents/fines_and_costs_report_12.18.2020_0.pdf

- The Unified Judicial System of Pennsylvania. Data Dashboards. [Online] https://www.pacourts.us/news-and-statistics/research-and-statistics/dashboard-table-of-contents

- State of North Carolina. North Carolina General Statutes § 7A-350: Annual Report on Criminal Court Cost Waivers. [Online] https://law.justia.com/codes/north-carolina/2020/chapter-7a/article-29/section-7a-350/

- Nichol, Gene. Forcing Judges to Criminalize Poverty in North Carolina. UCLA Criminal Justice Law Review. [Online] 4(1) 2020. https://escholarship.org/uc/item/6sz5z4kv

- ACLU of North Carolina. At All Costs: The Consequences of Rising Court Fines and Fees in North Carolina. [Online] 2017. https://www.acluofnorthcarolina.org/sites/default/files/field_documents/aclu_nc_2019_fines_and_fees_report_17_singles_final.pdf

- Measures for Justice. Model Legislation. [Online] https://www.measuresforjustice.org/state-of-the-data/what-can-i-do

- Menendez, Matthew and Eisen, Lauren-Brooke. The Steep Costs of Criminal Justice Fees and Fines. The Brennan Center. [Online] November 21, 2019. https://www.brennancenter.org/our-work/research-reports/steep-costs-criminal-justice-fees-and-fines

- Morgan, John G., Denton, Denise and Adamson, Bonnie S. Tennessee’s Court System: Is Reform Needed? Tennessee Comptroller of the Treasury. [Online] January 30, 2004. https://comptroller.tn.gov/content/dam/cot/orea/documents/orea-reports-2004/2004_OREA_CourtReform.pdf

- Tennessee Comptroller of the Treasury. Local Government Audit. Transparency and Accountability for Governments. [Online] November 2020. https://apps.cot.tn.gov/TAG/

- U.S. Bureau of Economic Analysis. Table 1.1.4. Price Indexes for Gross Domestic Product. Interactive Data: National Income and Product Accounts. [Online] November 2020. https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=3&isuri=1&select_all_years=0&nipa_table_list=4&series=a&first_year=2007&last_year=2019&scale=-99&categories=survey&thetable=

- Tennessee Supreme Court. Rule 11: Supervision of the Judicial System. [Online] https://tncourts.gov/rules/supreme-court/11

- Tennessee Administrative Office of the Courts. Criminal Case Reporting Guidelines. [Online] September 17, 2017. https://tncourts.gov/sites/default/files/docs/tjis_criminal_instruction_manual_91217.pdf

- State of Tennessee. Tenn. Code Ann. § 67-4-606: Apportionment of Revenue. [Online] https://law.justia.com/codes/tennessee/2019/title-67/chapter-4/part-6/section-67-4-606/

- PFM Center for Justice & Safety Finance. Reducing Reliance on Fines & Fees. Metro Government of Nashville & Davidson County, Tennessee. [Online] 2020 October. https://filetransfer.nashville.gov/portals/0/sitecontent/MayorsOffice/docs/news/Cooper/FinesFeesReport.pdf

- Tuggle, Bryce. Fees, Fines, and Criminal Justice in Tennessee: How it All Works and Why it Matters. The Sycamore Institute. [Online] December 22, 2020. https://www.sycamoretn.org/fees-fines-and-criminal-justice-in-tennessee/

- American Bar Association Presidential Task Force on Building Public Trust in the American Justice System. Ten Guidelines on Court Fees and Fines. [Online] August 2018. https://www.americanbar.org/content/dam/aba/administrative/government_affairs_office/aba-ten-guidelines_.pdf