The Tennessee General Assembly wrapped up its regular 2019 session after approving a budget for FY 2020, which starts July 1, 2019. Along the way, legislators put their own stamp on Gov. Lee’s proposed budget.

Here are lawmakers’ most notable changes and other legislative actions with budget implications, which affect TennCare, education, criminal justice, online sales tax, sports betting, and the fiscal note process.

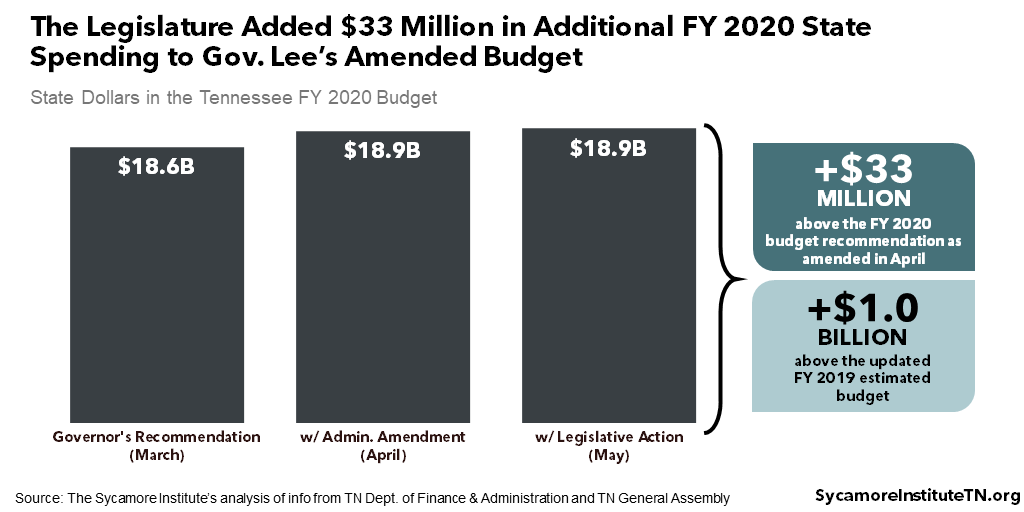

- The FY 2020 budget passed by lawmakers adds $33 million in state spending to Gov. Lee’s amended plan and is $1.0 billion above estimates for the current fiscal year.

- The largest change is $27.3 million to expand access to TennCare for an estimated 3,000 additional children with disabilities.

- The legislature also approved new revenues for online sales tax collection and sports betting, which were partially offset by cuts to the state’s professional privilege tax.

- A bill requiring that the state request a TennCare block grant from the federal government could have implications for the state budget, depending on the end result.

- Lawmakers also made changes to the oversight and process of estimating the cost of legislation, which is a key tool for keeping the state budget in balance.

Figure 1

Changes That Affect State Spending

Lawmakers approved several new policies that significantly affect state spending, including TennCare eligibility expansion, education savings accounts, various legislator initiatives, and changes expected to reduce incarceration.

By the Numbers

The budget passed by the General Assembly increases FY 2020 state spending by about $33 million relative to the Governor’s amended budget— including $33 million in recurring state dollars and a small decrease in non-recurring state spending. (3)

With these changes, the FY 2020 budget passed by the legislature totals $18.9 billion from state revenue sources. This is an increase of 5.8% (or $1.0 billion) over estimates for the current fiscal year.

In total, the legislature’s budget includes $82 million in appropriations, earmarks, and allocations that were not included in the governor’s amended budget. These include:

- $33.5 million for new legislation passed this session — including $27.3 million for Medicaid eligibility expansions (see Katie Beckett)

- $33.2 million for legislator initiatives and earmarks (see Legislator Initiatives)

- $15.0 million for a “Reserve for Future Tax Relief” (see Changes That Affect Revenues)

They are funded by:

- $48.4 million in anticipated spending reductions and new revenues associated with bills passed this session (see Incarceration Savings and Changes That Affect Revenues)

- $9.8 million from earmarked funding sources for additional purposes

- $25.2 million in funds that were already in the governor’s amended budget, including:

- $15.0 million placeholder for legislative initiatives

- $9.3 million of reallocations from expenditures proposed by the governor

- $0.9 million in unallocated funds (3)

Katie Beckett TennCare Waiver

The legislature’s largest expenditure change is a $27.3 million recurring increase to expand access to TennCare for an estimated 3,000 additional children with disabilities. The federal government currently covers about 65% of TennCare’s costs. As a result, the new state spending is expected to draw down an additional $49.5 million in federal funds in FY 2020. (4)

SB 476/HB 498 expands eligibility for some TennCare services to children with disabilities who need the level of care traditionally provided in a hospital or nursing home, regardless of family income or assets. Nationally, this is known as a “Katie Beckett” program. Under the legislation, children with the most significant needs will receive both medical coverage and home- and community-based (HCB) long-term services and supports (LTSS). Other children with less significant needs will receive HCB LTSS. The new program must be approved by the federal government and could begin as early as 2020. Annual spending will be limited by each year’s appropriations. (26)

Legislator Initiatives

The legislature included $33.2 million for nearly 70 budget amendments for targeted legislator initiatives. They range from larger investments in existing state programs and agencies to small grants to specific towns and community-based organizations. The largest of these include:

- $5.5 million in recurring state dollars to increase salaries for existing correctional officers and counselors. This is in addition to the $16 million included in the governor’s recommendation for correctional officer pay raises.

- $4.6 million in non-recurring dollars to pre-fund the long-term costs of other post-employment benefits (OPEB) obligations for retired state employees. These funds are on top of the $12 million in recurring funds included in the governor’s recommendation. For more information on OPEB, see page 40 of our State Budget Primer.

- $1.5 million non-recurring to expand the use of medication assisted treatment (MAT) in drug courts and county jails for individuals with opioid use disorders. That is in addition to $1.0 million in recurring funds included in the governor’s recommendation for this purpose. In FY 2019, $1.3 million in one-time funding was appropriated for this purpose.

- $1.5 million non-recurring for the Department of Health’s primary care safety net grants. This is in addition to the $2.0 million recurring included in the governor’s recommendation.

The final budget also dedicates more recurring resources to maintain pay increases funded in last year’s budget for providers delivering services to individuals with intellectual and developmental disabilities (ID/DD). The governor’s recommendation had included $11.9 million for this purpose — $6.0 of which was non-recurring. The legislature’s budget maintains the total, but $9.9 million will be recurring state dollars and $3.0 million non-recurring.

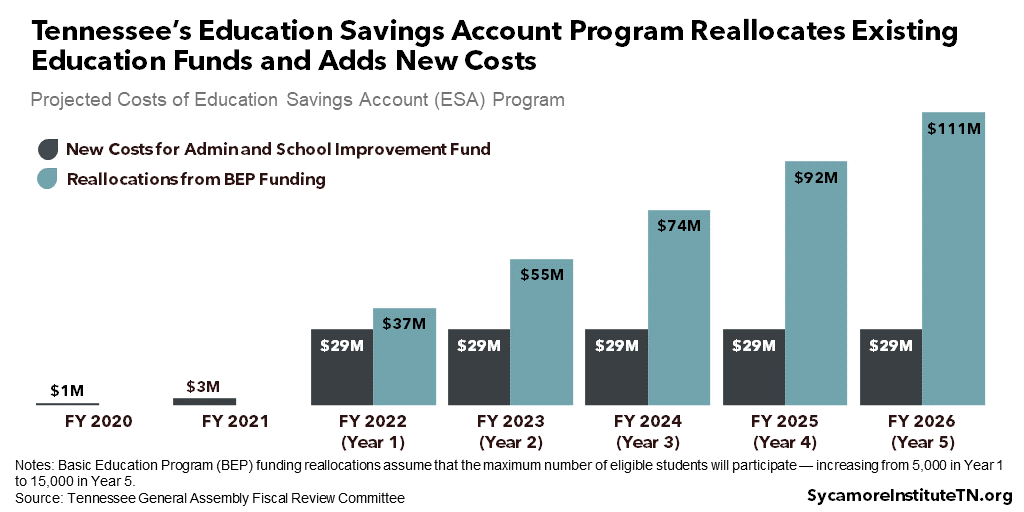

Figure 2

Education Savings Accounts

The final budget includes $0.8 million in FY 2020 for administrative costs associated with a new Education Savings Account (ESA) program — the same as the governor’s amended budget. The ESA initiative, as laid out in SB 795/HB 939, entails three types of costs for the state government — the ESAs, administrative costs, and a new school improvement fund. The state’s existing Basic Education Program (BEP) will fund the ESAs, likely beginning in FY 2022. A separate appropriation will support the administrative costs and, in future years, the school improvement fund.

The administrative costs and school improvement fund are expected to cost $28.7 million per year beginning in FY 2022 (Figure 2). (5) These are new dollars not in the FY 2019 base budget. The FY 2020 budget includes a $25.3 million placeholder in the recurring base budget for ESAs, smoothing the path to fund the program with at least $25.3 million in future years.

The school improvement fund will backfill any loss in state BEP funding a school district might experience due to ESA-related drops in enrollment for the first three years of the program. Remaining dollars in the fund will be awarded to other schools districts with a low-performing school — known as a “priority school.” After the first three years, the purpose of the fund will change to support any priority school in the state — not just those in the three districts affected by ESAs.

The BEP allocation to ESAs is expected to grow from $36.9 million in FY 2022 to $110.6 million in FY 2026 (Figure 2). (5) The legislation’s fiscal note reached that estimate by assuming that the maximum number of students will participate each year. These costs represent a reallocation of existing projections of BEP dollars, which is how a similar program for students with disabilities works. (6) In the first three years, the new school improvement fund will offset some of these reallocations for the three affected school districts.

Additional details, as passed by the General Assembly, include:

- The program will be limited to students zoned to one of three school districts — Metro Nashville (Davidson County), Shelby County, or the Achievement School District.

- Up to 5,000 students can begin enrolling no later than the 2021-2022 school year. This cap can grow to up to 15,000 students by the fifth year, depending on interest in the first four years.

- Eligibility will be limited to students whose families’ incomes are no more than twice the cap for the federal free lunch program.

- Families must verify their income each year by providing either a federal income tax return or proof they are eligible for the state’s temporary assistance for needy families (TANF) program.

- ESAs can be used for things like tuition and fees at participating private schools, textbooks, and tutoring services. They cannot be used for homeschooling expenses. (7)

Incarceration Savings

Two bills passed this session are expected to reduce the state’s incarceration costs by $21.4 million a year.

- SB 403/HB 167, as passed by the legislature, changes penalties associated with motor vehicle offenses, failure to appear in court for some misdemeanors, having certain contraband in a correctional facility, theft of a firearm, and driving under the influence. Together these changes are expected to decrease state incarceration costs by $13.7 million per year. (8)

- SB 215/HB 197 creates a presumption of parole release for individuals convicted of certain non-violent offenses once they have reached their parole eligibility date. This is expected to decrease state incarceration costs by $7.7 million per year. (9)

Changes That Affect State Revenues

The legislature passed three notable changes to the state’s taxes — collecting online sales tax from more merchants, cuts to the state’s professional privilege tax, and new fees and taxes related to online sports betting.

Figure 3

Online Sales Tax

Legislative action to expand online sales tax collections is projected to increase FY 2020 state tax revenues by $44.7 million and city/county local option sales tax revenues by another $17.7 million. (12) SB165/HB 667 gives the Department of Revenue the go-ahead to implement a 2016 rule to collect sales tax from online retailers with at least $500,000 in Tennessee sales. The $44.7 million FY 2020 revenue estimate assumes collections begin October 1, 2019. In future years, the state is expected to collect $59.6 million in state revenue and $23.6 million in local revenue. (13)

The share of consumer spending in Tennessee subject to state sales tax fell in recent decades as commerce shifted from physical stores to the internet (Figure 3). For this reason, some view the decision to collect sales tax from more online retailers as restoring the sales tax base rather than broadening it.

The latest projections are far below earlier estimates. In 2016, the Department of Revenue estimated the policy change would increase state revenues by at least $200 million per year — much higher than current projections. (14) The reduction may be due, in part, to online retailers beginning to voluntarily remit sales tax to the state over the last three years.

Lawmakers dedicated the projected new revenue to both spending increases and tax cuts. $22.1 million is used to offset the professional privilege tax reduction discussed below, and $15 million is reserved for additional tax reductions in future fiscal years. The remaining $7.6 million serves as a funding source for spending increases. (15)

Professional Privilege Tax

The legislature exempted 15 professions from the state’s professional privilege tax, reducing state tax revenues by an estimated $22.5 million each year. (16) SB 398/HB 1262 repeals the $400/year tax for accountants, architects, athlete agents, audiologists, chiropractors, dentists, engineers, landscape architects, optometrists, pharmacists, podiatrists, psychologists, real estate brokers, speech pathologists, and veterinarians. The tax remains in effect for several other professions — including lobbyists, physicians, attorneys, securities agents, broker-dealers, and investment advisers. (17)

Sports Betting

The General Assembly passed a new law permitting online sports betting in Tennessee subject to state taxes and oversight. In May of 2018, the U.S. Supreme Court struck down a 1992 federal ban on sports betting. This ruling effectively returned the power to regulate sports betting to the states. (18) SB 16/HB 1 is expected to increase state revenues by $30.8 million in FY 2020 and $52.3 million in FY 2021 and beyond by making sports betting vendors pay a licensing fee and monthly tax.

The funds are earmarked for the Lottery for Education Account, the Tennessee Promise Scholarship Endowment Fund, administrative costs, and gambling addiction services within the Department of Mental Health and Substance Abuse Services. (19)

Other states who tax sport betting have seen relatively modest revenue increases. Collections have been highest in Nevada and New Jersey, the only two where online wagering is currently available statewide. Nevada collected $20.3 million in 2018, and New Jersey collected $20 million during the first 10 months that sports betting was allowed. Both amounts are less than what was projected for Tennessee’s new law, however, both states also have a lower tax rate on sports betting than Tennessee. (25)

TennCare Block Grant

Lawmakers passed a bill requiring the administration to submit a waiver for a TennCare block grant. As envisioned in the legislation, the state would receive a capped amount of federal Medicaid funding and “maximum flexibility with regard to existing federal mandates and regulation and with implementing cost controls.”

Compared to earlier versions of the bill, the final legislation included more specific parameters for how federal funding would be determined:

- The federal funding cap must account for “the current inaccurate reflection of the state’s labor costs” in Medicare’s payments to Tennessee hospitals. (TennCare is the state’s Medicaid program for certain low-income children, parents, and individuals with disabilities that is jointly funded by the state and federal governments. Medicare is a separate federal program for individuals over 65 and some individuals with disabilities.)

- The cap must be indexed to population growth, inflation, and “other costs.” It could not fall from one year to the next because of deflation or population declines.

- The waiver could include other populations not currently covered by TennCare. (20)

Governor Lee’s administration and the federal government will negotiate the final details, and the legislature must approve any agreement before it can be implemented. It remains unclear if the federal government has the legal authority to approve a waiver like this without changes to federal law.

While this legislation did not affect the FY 2020 budget, the final details of any waiver agreement could have implications for future budgets. Historically, attempts in Congress to convert Medicaid funding into block grants have been designed to constrain the growth of federal spending. The level of constraint on federal funding for TennCare — and the state’s ability to manage the program within those constraints — will depend on the final details of a waiver negotiation. The outcome of those negotiations could create challenges and difficult trade-offs for state policymakers.

Fiscal Note Process

The General Assembly’s fiscal note process saw some notable changes this session. Fiscal notes are an important tool for keeping the state budget in balance because they lay out legislation’s anticipated impact on the budget. If the budget does not fund the estimated first year’s cost of any new legislation, that legislation becomes void. The staff of the General Assembly’s Fiscal Review Committee is responsible for generating fiscal notes.

A new law makes changes to both the Fiscal Review Committee and its staff. Currently, Fiscal Review is a 15-member, bipartisan joint committee made up of six senators and nine representatives. Committee members hire the staff director. Under the new law, the committee will have 14 legislators — half from the House and half from the Senate. Starting in 2020, the House and Senate speakers will jointly appoint the staff director, who will serve at their pleasure. The staff director will make hiring recommendations for the remaining staff, with hiring decisions made by committee members. All staff compensation will be determined by the speakers based on the recommendations of the staff director. (21)

Separate from the new law, the Fiscal Review Committee also adopted a formal appeal process for legislators who disagree with a fiscal note. The new committee process lays out the steps for a dialogue between the bill sponsor and Fiscal Review staff to discuss potential errors or questions about supporting data and research. If these steps do not allay concerns, the sponsor may submit an official appeal to the Fiscal Review Committee. This triggers a meeting between Fiscal Review staff and the sponsor. Each legislator is allowed only one appeal per session. (22) The process does not change who has the final say on the fiscal note. By law, only the Fiscal Review Committee can issue a fiscal note. (23) (24)

References

Click to Open/Close

- State of Tennessee. FY 2019-2020 Tennessee State Budget. March 4, 2019. https://www.tn.gov/content/dam/tn/finance/budget/documents/2020BudgetDocumentVol1.pdf.

- Tennessee Department of Finance and Administration. 2019-2020 Administration Budget Amendment Overview. April 15, 2019. Accessed on April 15, 2019 from https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-overviews_presentations.html.

- Tennessee General Assembly. House and Senate FW&M Action on FY 2019-20 Appropriations Bill SB 1518 / HB 1508. April 29, 2019. https://sycamoretn.org/wp-content/uploads/2019/05/fy-2020-senate-house-budget-schedule-04.29.2019.pdf.

- Tennessee General Assembly Fiscal Review Committee. Fiscal Memorandum: HB 498-SB 476. April 29, 2019. http://www.capitol.tn.gov/Bills/111/Fiscal/FM1464.pdf.

- —. Fiscal Memorandum: HB 939-SB 795. April 23, 2019. http://www.capitol.tn.gov/Bills/111/Fiscal/FM1437.pdf.

- Tennessee Comptroller of the Treasury. Using BEP Funding for Non-Public School Choice Programs. June 2017. https://comptroller.tn.gov/content/dam/cot/orea/documents/orea-reports-2017/2017_OREA_BEPNonPublicSch.pdf.

- Tennessee General Assembly. Conference Committee Report on House Bill No. 939 / Senate Bill No. 795. April 2019. https://sycamoretn.org/wp-content/uploads/2019/05/esa-conference-report.pdf.

- Tennessee General Assembly Fiscal Review Committee. Fiscal Memorandum: HB 167-SB 403. April 8, 2019. http://www.capitol.tn.gov/Bills/111/Fiscal/FM1207.pdf.

- —. Fiscal Memorandum: HB 197-SB 215. [Online] May 2, 2019. http://www.capitol.tn.gov/Bills/111/Fiscal/FM1485.pdf.

- Boyd Center for Business & Economic Research (CBER). An Economic Report to the Governor of the State of Tennessee (2010, 2014, and 2018 editions). University of Tennessee at Knoxville. Accessed via http://cber.haslam.utk.edu/tefslist.htm.

- U.S. Bureau of Economic Analysis (BEA). Total Personal Consumption Expenditures (PCE) by State. Accessed via https://www.bea.gov/itable/.

- Tennessee General Assembly Fiscal Review Committee. Fiscal Memorandum: SB 165-HB 667. April 16, 2019. http://www.capitol.tn.gov/Bills/111/Fiscal/FM1349.pdf.

- Tennessee Department of Revenue. Rulemaking Filing for Rule 1320-05-01-.129 Sales and Use Tax Rules. June 2016. https://publications.tnsosfiles.com/rules_filings/06-12-16.pdf.

- —. Information provided to the Tennessee General Assembly Joint Government Operations Committee. December 2016. Pages 247-264 of http://www.capitol.tn.gov/Archives/Joint/committees/gov-opps/archives/109ga/RulesPackets//Rule%20Review%20Packet%2012-15-16.pdf.

- Tennessee General Assembly. Senate Amendment 3 (SA 0435) to SB 1518/HB 1508. April 30, 2019. [Cited: May 16, 2019.] Accessed from http://www.capitol.tn.gov/Bills/111/Amend/SA0435.pdf.

- Tennessee General Assembly Fiscal Review Committee. Fiscal Memorandum: SB 398-HB 1262. April 29, 2019. http://www.capitol.tn.gov/Bills/111/Fiscal/FM1462.pdf.

- Tennessee General Assembly. House Amendment 1 (HA 0507) to SB 398/HB 1262. May 1, 2019. [Cited: May 16, 2019.] Accessed from http://www.capitol.tn.gov/Bills/111/Amend/HA0507.pdf.

- Farmer, Liz. How the Sports Betting Ruling Will Impact State Budgets. Governing. May 14, 2018. https://www.governing.com/topics/finance/gov-how-legalizing-sports-betting-will-impact-state-budgets.html.

- Tennessee General Assembly Fiscal Review Committee. Fiscal Memorandum: HB 1-SB 16. April 25, 2019. http://www.capitol.tn.gov/Bills/111/Fiscal/FM1428.pdf.

- Tennessee General Assembly. Conference Committee Report on House Bill No. 1280 / Senate Bill No. 1428. April 2019. https://sycamoretn.org/wp-content/uploads/2019/05/tenncare-block-grant-conference-report.pdf.

- —. Conference Committee Report on House Bill No. 1233 / Senate Bill No. 1235. April 2019. https://sycamoretn.org/wp-content/uploads/2019/05/fiscal-review-staff-conference-report.pdf.

- Lee Carsner, Krista. Fiscal Note and Fiscal Memorandum Appeal Process. Tennessee General Assembly Fiscal Review Committee. February 4, 2019. http://www.capitol.tn.gov/Archives/Joint/committees/fiscal-review/archives/111ga/presentations/FRC%20Appeal%20Process.pdf.

- State of Tennessee. TN Code § 3-7-103 (2017). https://law.justia.com/codes/tennessee/2017/title-3/chapter-7/section-3-7-103/.

- —. TN Code § 3-7-107 (2017). https://law.justia.com/codes/tennessee/2017/title-3/chapter-7/section-3-7-107/.

- Auxier, Richard. States Learn to Bet on Sports: The Prospects and Limitations of Taxing Legal Sports Gambling. Tax Policy Center. May 14, 2019. https://www.taxpolicycenter.org/publications/states-learn-bet-sports-prospects-and-limitations-taxing-legal-sports-gambling/

- Tennessee Division of TennCare and Tennessee Department of Intellectual and Developmental Disabilities. Tennessee’s Proposed Katie Beckett Program. May 14, 2019. https://www.tn.gov/content/dam/tn/tenncare/documents/InformationOnTennesseesProposedKatieBeckettProgram.pdf

Image at top by John_from_CT