With Congress once again shelving its latest proposal to partially repeal and replace the Affordable Care Act (ACA), U.S. Senator Lamar Alexander has restarted bipartisan efforts to stabilize the law’s healthcare.gov Marketplaces for 2018 and 2019. One key aspect of those discussions is how to deal with something called “CSR payments.” The outcome of that question will have a significant effect on Tennessee’s Marketplace, which covers about 200,000 Tennesseans (1).

What Are CSR Payments?

The ACA’s CSR or “cost-sharing reduction” provisions were designed to send federal payments to insurers to reduce out-of-pocket costs for low-income enrollees. The law requires insurers to limit cost-sharing (like deductibles and co-insurance) in silver plans for Marketplace enrollees with incomes between 100-250% of the federal poverty level. Insurers incur higher costs as a result, which the federal government reimburses via CSR payments.

Why Are CSR Payments Controversial?

The ACA “authorizes” (i.e. allows) CSR payments, but there is a legal dispute about whether it also “appropriates” (i.e. provides) the money. The Obama administration held that the funding is both allowed and provided under the ACA. The U.S. House of Representatives sued the Obama administration, arguing that funding is not provided and the payments are illegal without Congressional action to appropriate it. That lawsuit is still pending in the courts.

The Trump administration continues to make CSR payments but has publicly warned they may stop at any time. Congress could end this uncertainty by either repealing the ACA’s cost-sharing reduction provisions or explicitly providing the money to make CSR payments.

Many have argued that uncertainty about CSR payments is destabilizing the Marketplaces — driving up premiums and reducing insurer participation. Recently, both Governor Bill Haslam and Commerce and Insurance Commissioner Julie Mix McPeak asked Senator Alexander’s committee to consider temporary CSR funding as a way to bring down premium increases in Tennessee. (2) (3)

3 Ways Uncertainty About CSR Payments Affects Tennessee

The Tennessee Department of Commerce and Insurance recently approved Marketplace premiums for 2018. These preliminary rates assume insurers will still be required to reduce cost-sharing for low-income enrollees next year but will not receive offsetting CSR payments. To find out how uncertainty about CSR payments is affecting Tennessee’s Marketplace, we dug into insurers’ rate filings for 2018. Here are 3 things we learned:

1. Uncertainty about CSR payments is a significant factor in Tennessee insurers’ decisions about Marketplace premiums and offerings.

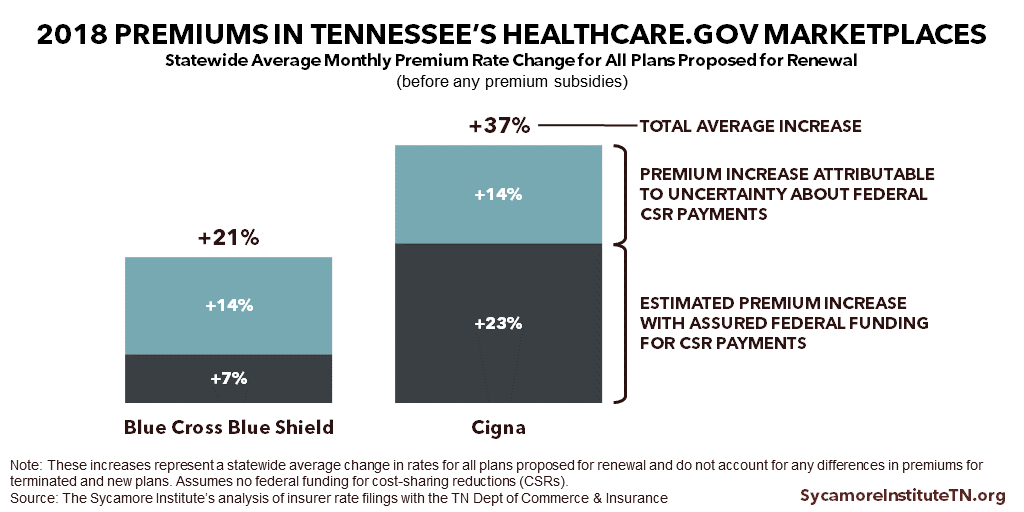

While these decisions hinge on a variety of factors, BlueCross BlueShield of Tennessee (BCBST), for example, attributed nearly two-thirds of its average premium increase to uncertainty about federal payments for CSRs. (5)

Sources: The Tennessee Department of Commerce and Insurance (6)

Average preliminary rates for plans renewed by BCBST and Cigna will increase 21% and 37%, respectively. (4) These averages do not account for terminated or new plans from either insurer or those offered by Oscar (a new insurer for 2018 in the Greater Nashville area). The total average premium increase for Marketplace plans next year will depend on how the plans Tennesseans choose compare to what they chose in 2017.

Both BCBST and Cigna estimated that uncertainty about CSR payments accounted for 14 percentage points of their average rate increase request. (5) (7) CSR uncertainty accounted for 17% of Oscar’s total requested rates for silver plans. (8)

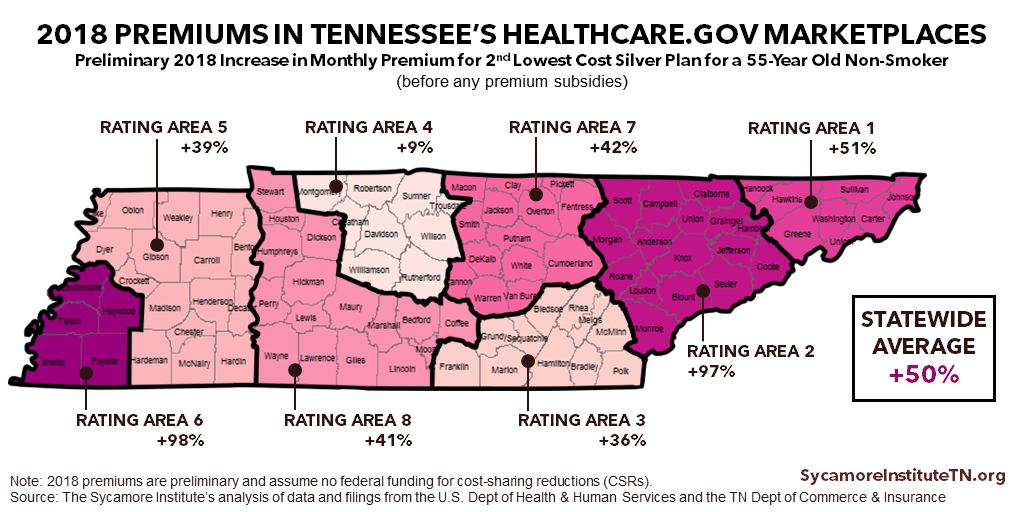

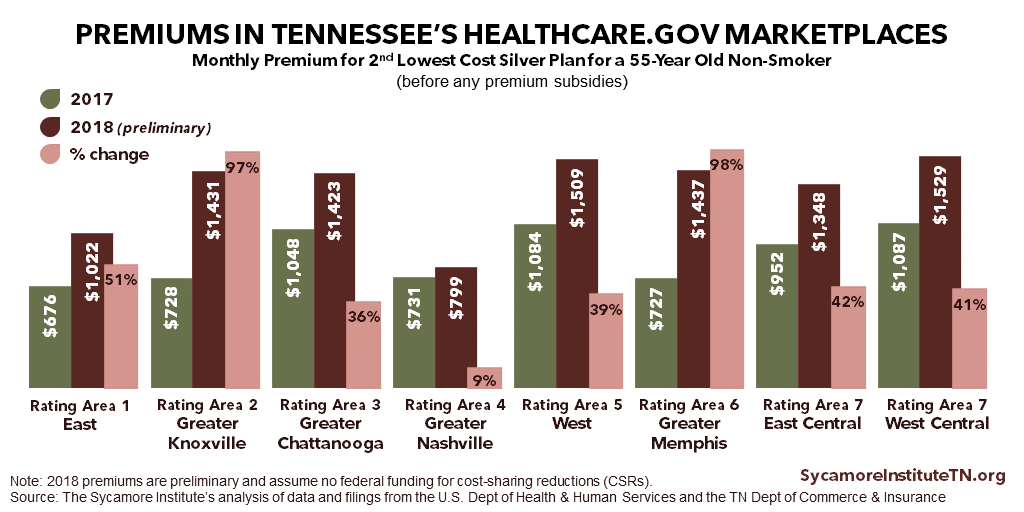

2. Without CSR payments, premiums for one of the Marketplace’s most popular plans will rise about 50% on average.

Premium increases for the 2nd lowest cost silver plan* in each rating area vary from a low of 9% in the Greater Nashville area to about 100% (or double) in the Greater Memphis and Knoxville areas.

Sources: U.S. Department of Health and Human Services (7) (8) and the Tennessee Department of Commerce and Insurance (6)

* To analyze premium changes, we used the 2nd lowest cost silver plan in each rating area. This plan is often used to analyze Marketplace premium changes (example) for 2 primary reasons. First, silver plans are the most popular. During 2017’s open enrollment period, 72% of Tennesseans in the Marketplace enrolled in silver plans. (9) Second, premium subsidies are based on the 2nd lowest cost silver plan in each rating area. The vast majority of Marketplace enrollees receive premium subsidies. In 2017, 88% of Tennesseans with Marketplace coverage receive premium assistance. (1)

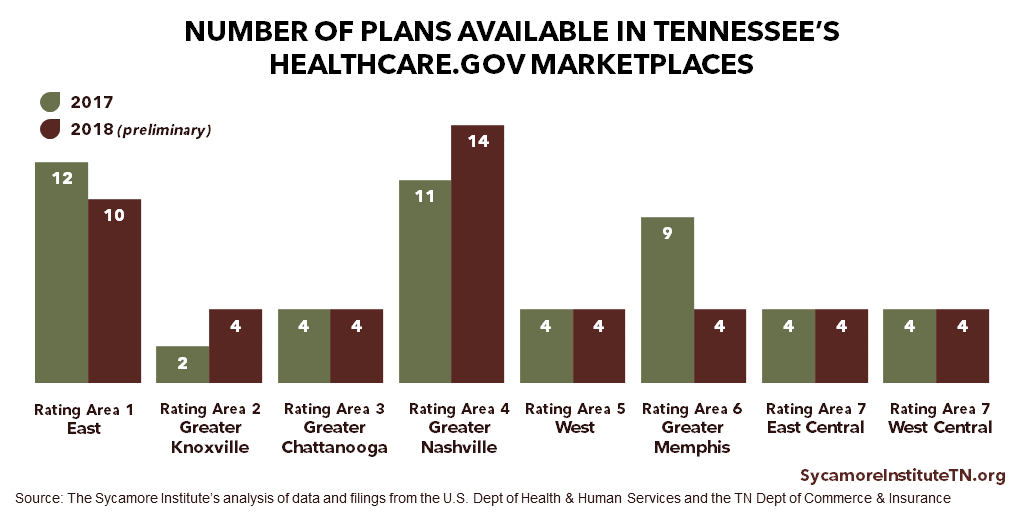

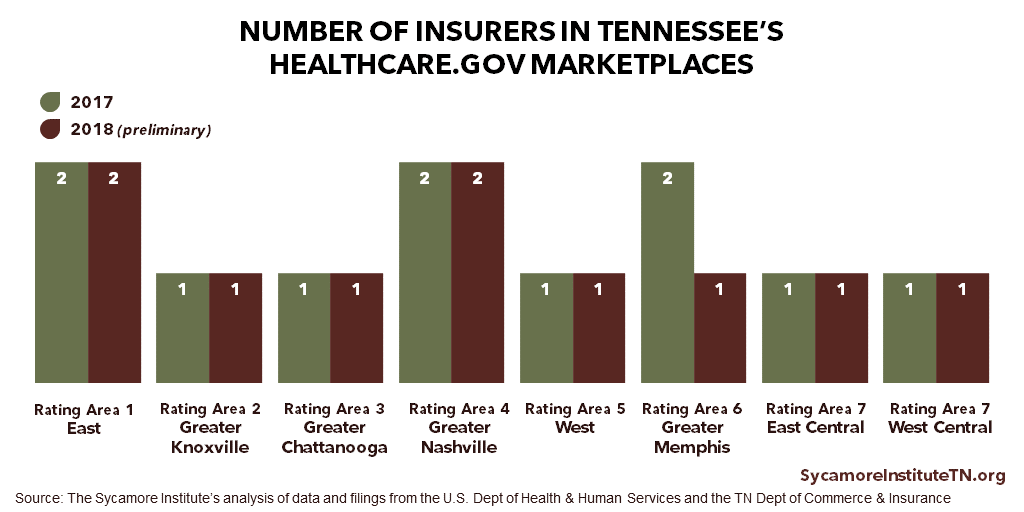

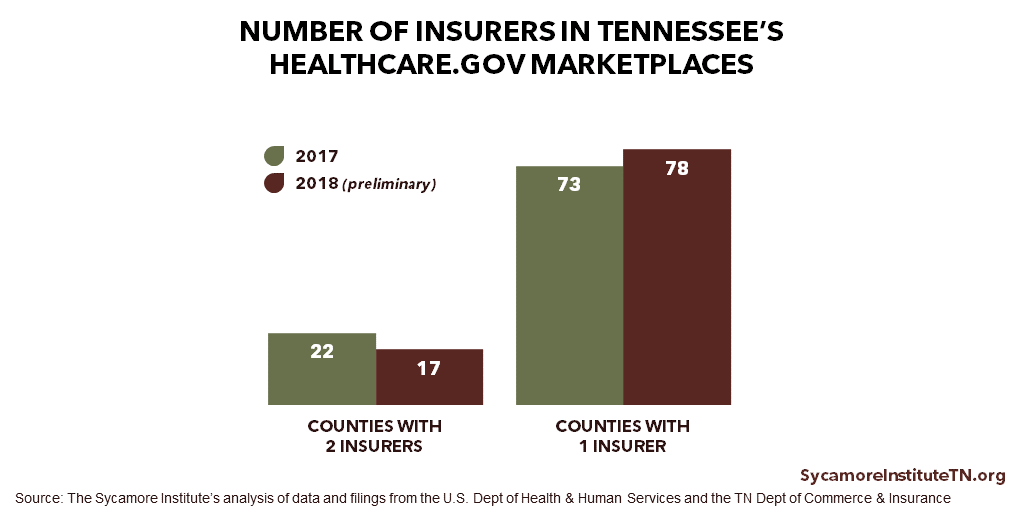

3. Most areas of Tennessee are expected to have about the same number of plans to choose from in 2018.

- 57 counties in 4 rating areas (Greater Chattanooga, West, East Central, and West Central) may have the same number of plan options.

- 25 counties in 2 rating areas (Greater Knoxville and Greater Nashville) may have additional plan options.

- 13 counties in 2 rating areas (East and Greater Memphis) may have fewer plan options.

- The Greater Memphis area may have one fewer insurer — increasing the number of Tennessee counties with only 1 insurer from 73 to 78.

Sources: U.S. Department of Health and Human Services (7) (8) and the Tennessee Department of Commerce and Insurance (6)

What Now?

If Congress ends the uncertainty about CSRs in the near future, Tennessee insurers could potentially resubmit lower premiums for 2018. Although the state has approved premiums for 2018, open enrollment does not begin until November 1. If Congress addresses CSR payments in October, Tennessee and the federal government may be able to work with insurers to revise their 2018 rates.

What happens with CSR payments could affect premiums for over 70% of Tennesseans enrolled in the Marketplace, not just the 59% with reduced cost sharing. (9) (1) Insurers’ 2018 rate filings show that if they do not get CSR payments to recoup the expense of limiting cost-sharing for low-income enrollees, premiums for silver plans will increase more than they otherwise would.

The Trade-Offs of President Trump & Congress’ CSR Options

Like any public policy decision, the options available to Congress and the Trump administration involve trade-offs.

Option 1: Fund CSR Payments

Explicitly funding CSR payments could limit Marketplace premium increases without substantially increasing federal spending (due to the effect on premium subsidies). This may stabilize the Marketplaces and give Congress more time to work on an Obamacare replacement measure. However, opponents of the ACA may also view this as reducing the “political pain” of failure to repeal the law.

Option 2: Repeal Obamacare’s CSR Requirements

Repealing the ACA requirements that Marketplace insurers reduce cost sharing for low-income enrollees could limit Marketplace premium increases. However, it would also increase out-of-pocket costs and make Marketplace insurance less affordable for many Tennesseans.

Option 3: End CSR Payments Without Repealing CSR Requirements

Tennessee required Marketplace insurers to assume this scenario when requesting rate increases for 2018. As explained above, this option results in larger premium increases than would otherwise occur. Federal spending on premium subsidies (paid to enrollees) would increase as a result, even as federal spending on CSR payments (paid to insurers) goes down.

Option 4: Change Nothing

This is where things stand today. The Trump administration is making CSR payments, but there is no certainty about how long that will continue. This may be the path of least resistance, but as discussed above, it results in higher premiums for most Tennesseans enrolled in the Marketplace.

These trade-offs all but guarantee more debate about health reform in the days and weeks ahead.

Related Work by The Sycamore Institute

Reinsurance & High-Risk Pools: What Are They and Why Do They Matter for Tennessee?

(April 6, 2017) Explains what reinsurance and high-risk pools are in the context of Obamacare and the individual health insurance market and how they relate to emerging federal funding opportunities for TN.

Health Insurance Markets 101 – Key Concepts that Influence Access and Affordability

(April 5, 2017) Discusses key health insurance terms and concepts that influence insurance access and affordability (e.g. risk pooling).

Options for Stabilizing Tennessee’s Marketplace

(July 20, 2017) Explains 3 things the state could do under current law and the trade-offs involved with each choice.

References

Click to Open/Close

- Centers for Medicare and Medicaid Services (CMS). 2017 Effectuated Enrollment Snapshot. [Online] June 12, 2017. https://downloads.cms.gov/files/effectuated-enrollment-snapshot-report-06-12-17.pdf.

- Haslam, Governor Bill. Statement before the U.S. Senate Committee on Health, Education, Labor, and Pensions. [Online] September 7, 2017. https://www.help.senate.gov/imo/media/doc/Haslam.pdf.

- McPeak, Commissioner Julie Mix. Statement before the U.S. Senate Committee on Health, Education, Labor, and Pensions. [Online] September 6, 2017. https://www.help.senate.gov/imo/media/doc/McPeak2.pdf.

- Tennessee Department of Commerce and Insurance (TDCI). TDCI Announces Approval of Rates for 2018 Individual Marketplace. [Online] September 20, 2017. https://www.tn.gov/commerce/news/2017/9/20/tdci-announces-approval-of-rates-for-2018-individual-marketplace.html.

- BlueCross BlueShield of Tennessee, Inc. Consumer Narrative: 2018 Individual/Marketplace Rate Filing. [Online] July 1, 2017. Accessed via https://filingaccess.serff.com/sfa/home/TN. BlueCross BlueShield of Tennessee, Inc. What You Need to Know About 2018 Individual Plan Rates. [Online] June 30, 2017. https://bcbstnews.com/insights/what-you-need-to-know-about-2018-individual-plan-rates/.

- Tennessee Department of Commerce and Insurance (TDCI). 2018 Rate Filings for Individual Market Major Medical Coverage (H16I). SERFF Filing Access. [Online] July 1, 2017. [Accessed on: September 27, 2017.] https://filingaccess.serff.com/sfa/home/TN.

- U.S. Department of Health and Human Services (HHS). Preview of 2017 Health Insurance Plans & Prices. [Online] [Accessed on: September 27, 2017.] Accessed via https://www.healthcare.gov/see-plans/.

- —. 2017 QHP Landscape Data. [Online] August 9, 2017. https://www.healthcare.gov/health-plan-information-2017/.

- Centers for Medicare and Medicaid Services (CMS). 2017 OEP County-Level Public Use File. 2017 Marketplace Open Enrollment Period Public Use Files. [Online] May 11, 2017. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/Plan_Selection_ZIP.html.