On March 4, 2019, Tennessee Governor Bill Lee released his recommendation for the state’s FY 2020 Budget – along with re-estimates and recommended changes for the FY 2019 Budget. (1) (2) It is now the job of the legislature to consider and act on this recommendation.

Key Takeaways

- Gov. Lee’s FY 2020 recommended budget is 1.1% (or $424 million) higher than estimates for the current fiscal year. Spending from state revenues is 4.1% (or $737 million) higher.

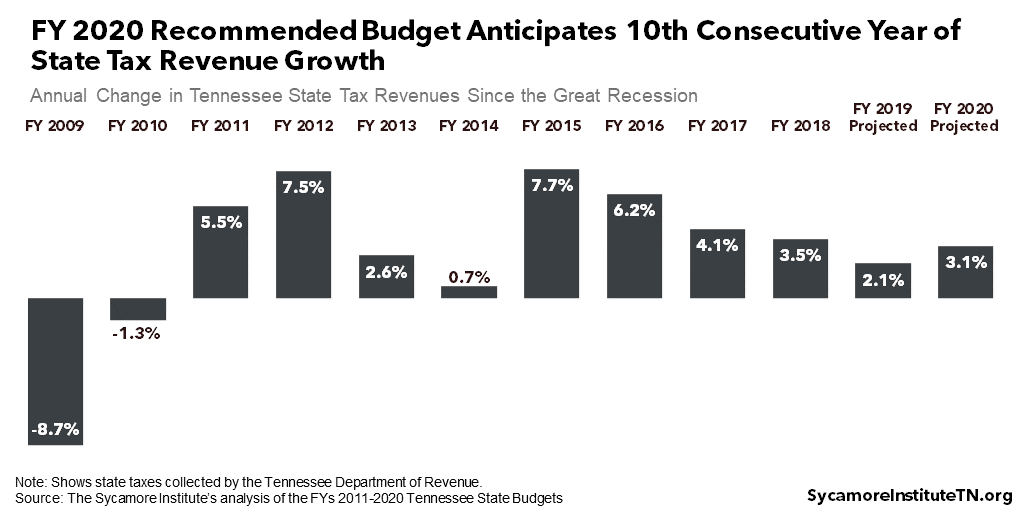

- The Budget projects state tax revenues will grow by 3.1% in FY 2020 — the 10th consecutive year of revenue growth since the Great Recession.

- The largest spending increases are recommended for salaries and benefits, TennCare, K-12 education, higher education, economic development, and capital improvements.

- Noteworthy spending reductions are recommended in TennCare and the Department of Corrections.

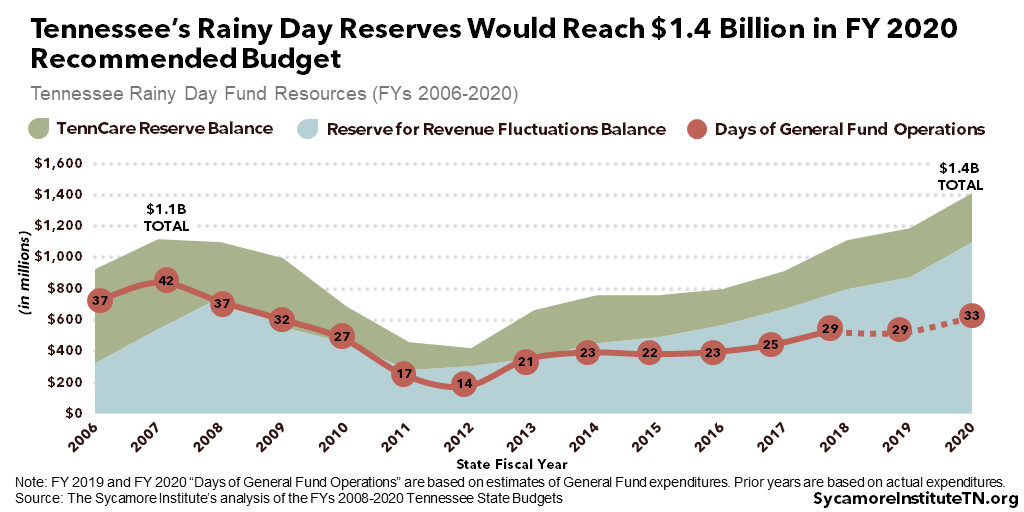

- The two main rainy day reserves’ combined FY 2020 balance would top $1.4 billion and cover about 33 days of General Fund operations — 4 more than the current budget but 9 fewer than in FY 2007 before the Great Recession.

Overview

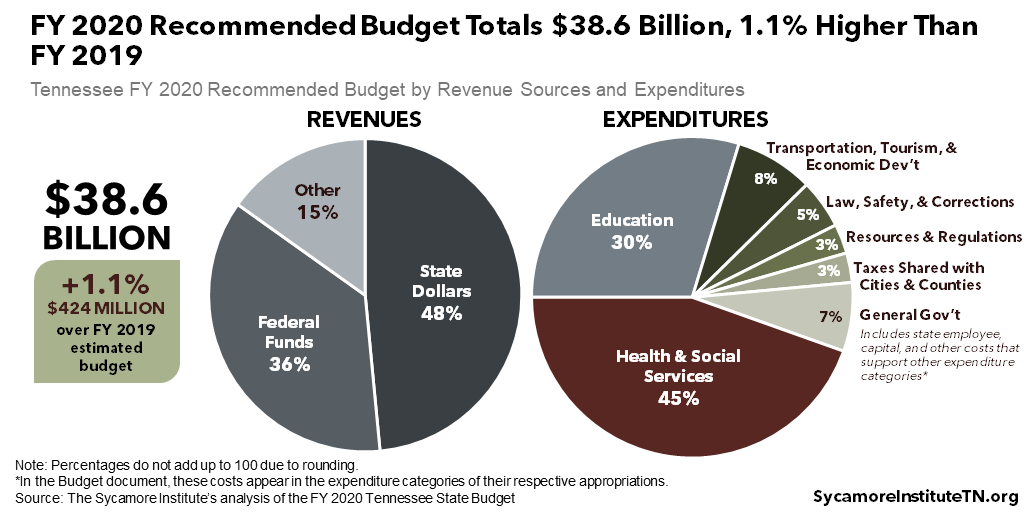

The FY 2020 recommended budget totals $38.6 billion from all revenue sources, an increase of 1.1% (or $424 million) over estimates for the current fiscal year. The funding mix is 48% state dollars, 36% federal funding, and 15% from other sources. Education (30%) and Health and Social Services (45%) account for three-quarters of total expenditures (Figure 1).

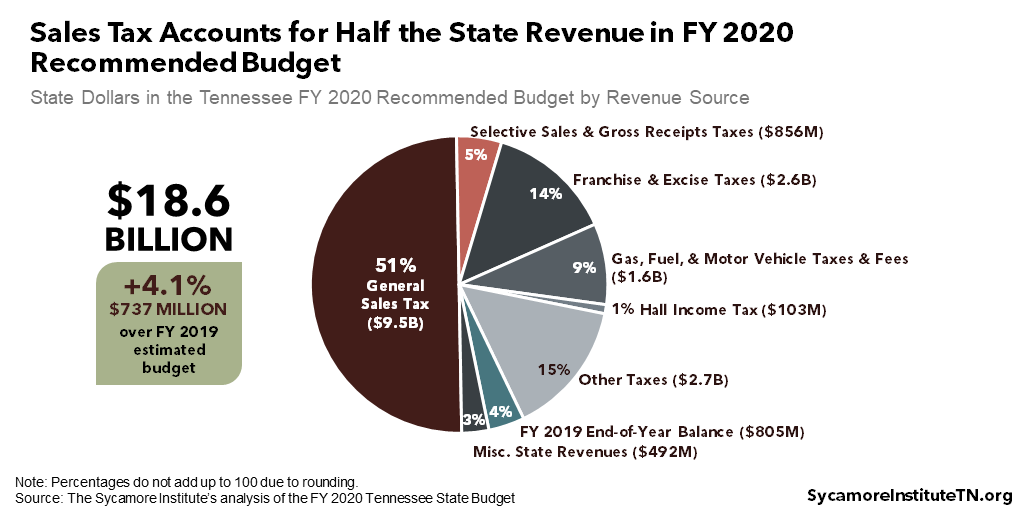

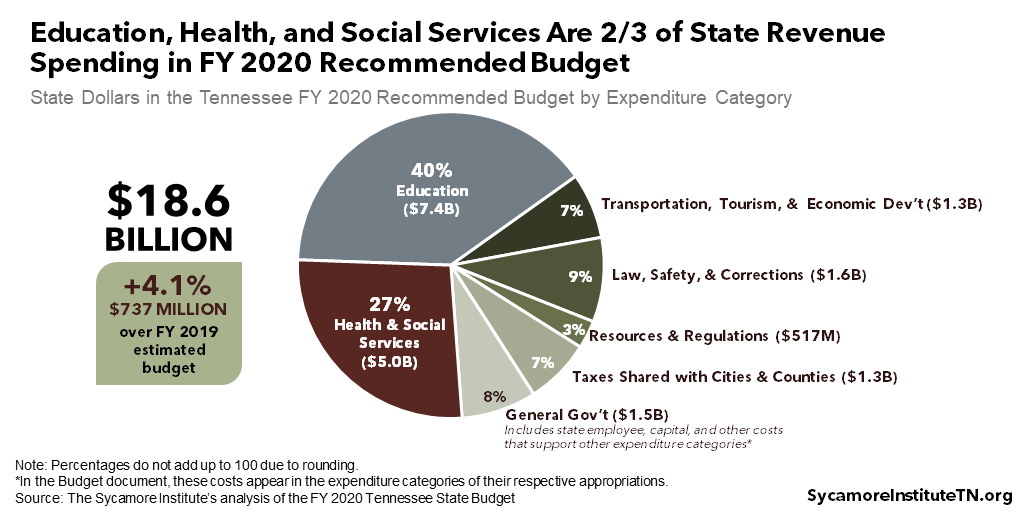

State dollars in the recommended budget total $18.6 billion, an increase of 4.1% (or $737 million) from the current year. State revenues predominately come from sales taxes (51%) and taxes on businesses (14%) (Figure 2). Education (40%) and Health and Social Services (27%) account for about two-thirds of expenditures from state appropriations (Figure 3).

Recommended Reading

Our Tennessee State Budget Primer provides deeper discussions, related information, additional context, and a glossary of terms for the governor’s current budget recommendation.

Figure 1

Figure 2

Figure 3

The General Fund in Context

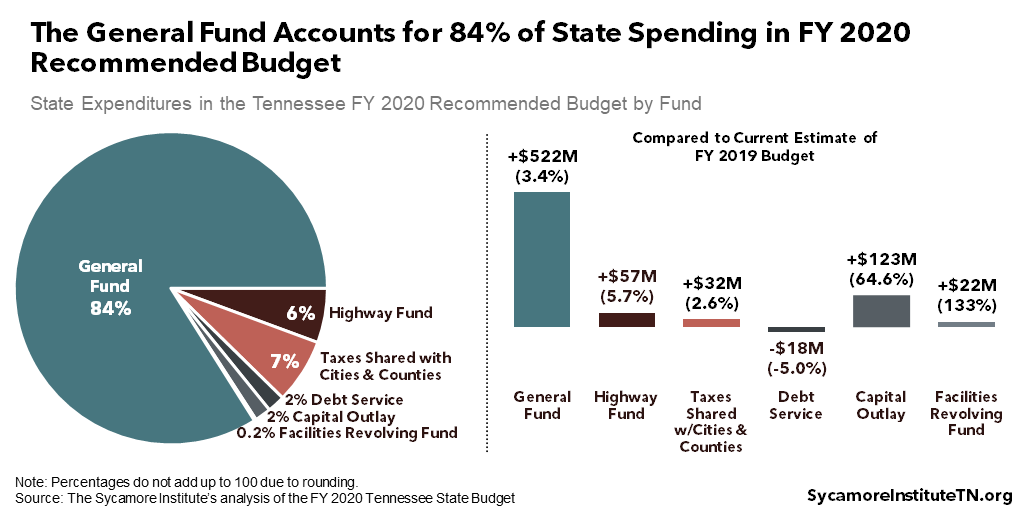

The administration’s budget document and presentations often focus on state dollars in the General Fund, which accounts for 84% of all state spending (Figure 4). That number does not include state appropriations for the Capital Outlay Program and Facilities Revolving Fund, which many discussions and calculations lump in with the General Fund because they are partly funded by General Fund revenue.

Figure 4

Recommended Cost Increases and One-Time Spending

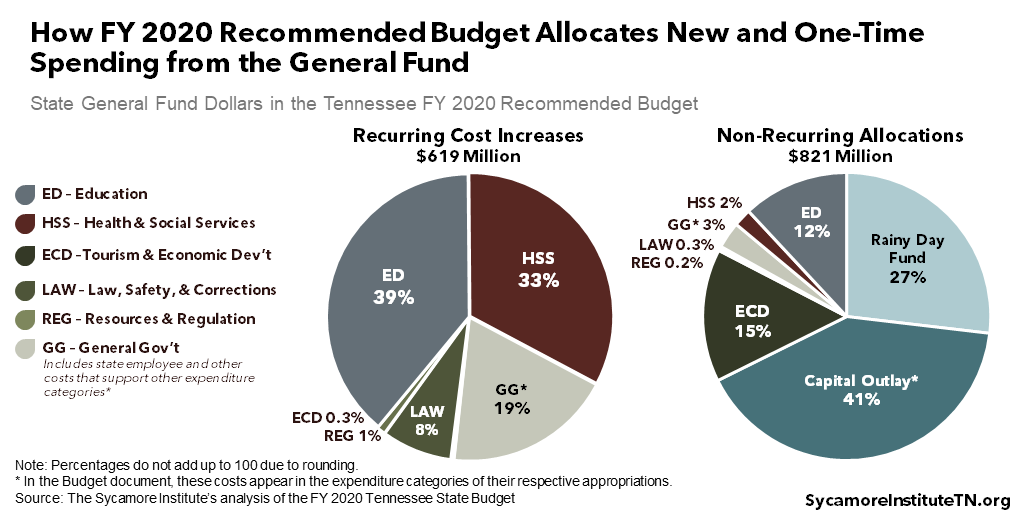

The Budget recommends $619 million in recurring General Fund spending increases and a total of $821 million in non-recurring General Fund allocations (Figure 5). (3) In general, this additional money pays for rising costs in existing programs as well as the cost of new initiatives and investments.

The Budget’s Largest Recurring Increases

- +$210 million for personnel-related costs for state employees, teachers, and higher education (e.g. salary increases, retirement contributions, and health insurance cost increases).(3)

- +$152 million for TennCare to reflect a decrease in the federal match rate and to cover expected increases in pharmaceutical spending and health care costs as well as IT system upgrades. The additional state dollars will draw down a net increase of $192 million in recurring federal funding. See pages B132—B134 of the Budget. (3)

- +$89 million for K-12 Education (excluding salary and benefit increases), including +$46 million to fund Basic Education Program (BEP) formula growth. See pages B78—B82 of the Budget. (3)

- +$52 million for Higher Education (excluding salary and benefit increases), including outcomes-based formula increases for state colleges and universities that have achieved greater productivity. See pages xxi and B82—B87 of the Budget. (3)

The Budget’s Largest Non-Recurring Allocations

- $338 million for the Capital Outlay program, which supports the improvement and maintenance of state buildings. See page xxviii, A131-A133, and A153 of the Budget. (3)

- $225 million to the state’s Reserve for Revenue Fluctuations. See pages xxix and A41 of the Budget.(1)

- $114 million for the Department of Economic and Community Development to help recruit and expand business and workforce opportunities to the state broadly and rural areas specifically. See pages xxvi-xxvii and B295—B296 of the Budget. (3)

Figure 5

Summary of Gov. Lee’s Policy Initiatives

Several of Gov. Lee’s new policy initiatives affect the FY 2020 recommended Budget in a significant way. The total recurring increases and one-time spending discussed in the previous section include the costs summarized below.

Vocational & Technical Education

The Budget includes $29 million for the proposed Governor’s Investment in Vocational Education (GIVE) Act. Within this total, $25 million in one-time dollars would support regional partnerships that create work-based learning, apprenticeship, and other opportunities for job skills training. Another $4 million from lottery funds would expand opportunities for high school students to dual enroll in trade and technical programs. (4)

School Choice

The increases for K-12 Education include $12 million in non-recurring spending to support property and improvement costs for new charter schools. (5) The distribution of the BEP takes into account both operating and capital costs for local school districts. However, districts have flexibility in how they spend their BEP dollars. The charter school proposal is specific, targeted funding outside the BEP.

Gov. Lee has also proposed a new education savings account (ESA) program — including $25 million in new recurring spending for school districts that would lose BEP funding as a result. In the first year of enrollment, up to 5,000 students in low-performing public school districts could get approximately $7,300 for private school tuition and other eligible education expenses. The recommended recurring increase is meant to offset any loss in BEP funding a school district might experience due to ESA-related drops in enrollment. (5)

Separate legislation will determine the future and details of the proposed ESA program, such as student eligibility criteria, annual caps on the number of eligible students, and the school districts in which ESAs would be available. (6) (7)

School Safety

School safety grants account for a $10 million recurring increase and $20 million in one-time funding. In the current fiscal year, this program has $35 million in total funding — $10 million in recurring and $25 million non-recurring. The details will depend on separate legislation.

Behavioral Health

The Budget includes funds to bolster ongoing efforts to curb the state’s epidemic of opioid abuse and substance use disorders. Examples include:

- $5 million to expand recovery courts and services for people in the justice system with drug abuse issues. This amount includes a $1.7 million recurring increase to expand recovery court capacity by 20%, a $1.5 million recurring increase and $0.5 million in one-time spending for a new statewide women’s residential recovery court, and a $1 million recurring increase to provide more recovery courts with access to medication-assisted treatment (MAT) for opioid use disorder (8);

- A $3 million recurring increase for the Creating Homes Initiative to provide supportive housing to an additional 200 low-income Tennesseans with mental health and/or substance use disorders (9);

- A $1 million recurring increase to expand criminal justice liaisons to additional counties. Liaisons help connect people in the justice system with mental health and/or substance use disorders to treatment and recovery services.

The Budget also includes a $5 million recurring increase to provide mental health care safety net services to an additional 7,000 low-income, uninsured Tennesseans with mental illness.

Criminal Justice

A total of $24 million in new funding aims to address state prison staff turnover, expand education opportunities for inmates, and increase community supervision capacity. This includes recurring increases of $16 million for correctional officer pay raises, $4 million for career and technical education opportunities, and $2 million for 40 additional probation and parole officers. (8)

Health Services

The FY 2020 recommendation includes additional funding for health care for the underserved and those with complex health care needs. Examples include:

- $11.9 million ($6 million recurring and $6 million non-recurring) to maintain pay increases funded in last year’s budget for providers delivering services to individuals with intellectual and developmental disabilities (ID/DD). The state dollars would draw down an additional $22.5 million in federal funding.

- A $9.3 million recurring increase to serve an additional 300 individuals in TennCare’s Employment and Community First (ECF) CHOICES program, which provides home- and community-based long-term services and supports to individuals with ID/DD. The state dollars would draw down an additional $17.5 million in federal funding.

- A $3 million recurring increase to support medical students who agree to work in an underserved area after graduation. These state dollars would draw down an additional $5.7 million in federal funds.

- A $2 million recurring increase for the primary care safety net, divided equally among federally-qualified health centers (FQHCs) and community- and faith-based clinics. The safety net provides primary care services to low-income, uninsured adults.

- $1 million in non-recurring funding for the Rural Hospital Transformation Act. FY 2020 is the 2nd year of a three-year program that provides consulting to rural areas facing hospital closures and delivery capacity issues.

Rural Initiatives

The Budget includes a total of $35 million aimed at economic development in rural areas, including $20 million in non-recurring funds for broadband accessibility grants and $13.5 million non-recurring to support business development in rural areas.

Recommended Spending Reductions

The Budget recommends ‑$42 million in recurring General Fund reductions and -$21 million in non-recurring reductions. (2) These targeted decreases affect specific programs or departments that may still experience an overall funding increase.

The Budget’s Largest Recurring Base Reductions

- -$24 million from TennCare related primarily to savings expected from limiting opioid prescriptions, lower-than-projected Medicare Part D premiums, and Intellectual and Development Disabilities waiver utilization. See pages 23-24 of Vol. 2 of the Budget.(2)

- -$6 million from K-12 Education from reducing the number of new student test items. See page 29 of Vol. 2 of the Budget. (2)

- -$4 million from the Department of Correction related to debt service costs at a contract prison. See page 27 of Vol. 2 of the Budget. (2)

The Budget’s Non-Recurring Reductions

- -$24 million from CoverKids associated with a temporary increase in the federal match rate. See page 38 of Volume 2 of the Budget. (2)

Funds Reserved for Legislative Action

The Budget reserves $5 million in recurring and $10 million in non-recurring funds for initiatives and amendments of the legislature. (3) Another $10 million in recurring and $10 million in non-recurring funds are reserved for the Administration Amendment expected later in the legislative session. (3)

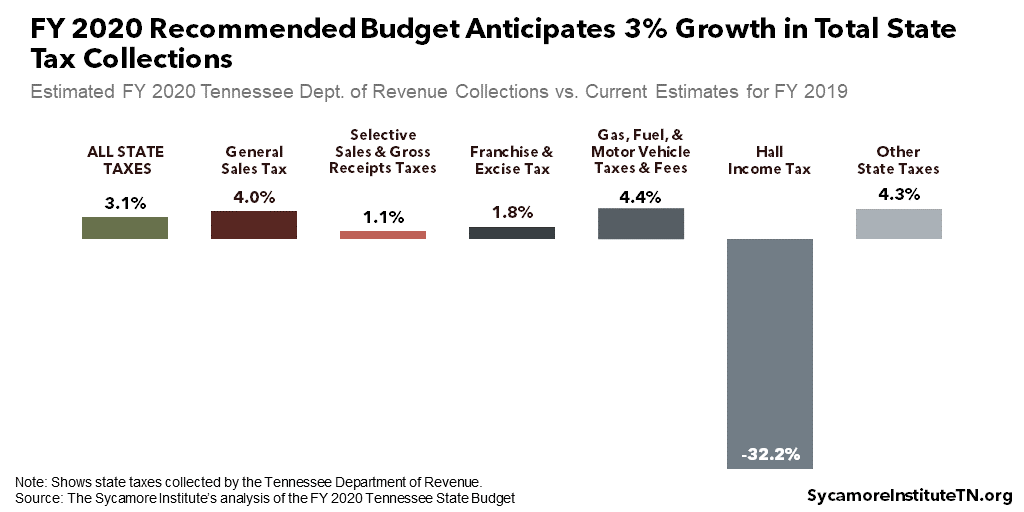

State Tax Revenue Growth

The Budget expects state tax collections to grow by 3.1% (or $463 million) in FY 2020 (Figure 6). This would be the 10th consecutive year of revenue growth since the Great Recession (Figure 7). (1)

The State Funding Board recommended a range of 2.7–3.1% growth in recurring state tax revenues based on estimates from a University of Tennessee economist (3.4%), the Fiscal Review Committee (3.0%), the Department of Revenue (3.7%), and an East Tennessee State University economist (2.7%). (1)

Figure 6

Figure 7

Revenue Growth Highlights

The direction and degree of expected change varies by revenue type (Figure 6):

- +4.0% gain ($364 million) in general sales tax collections

- +1.1% gain ($9 million) in selective sales and gross receipts taxes collections

- +1.8% gain ($46 million) in franchise and excise tax collections from businesses

- +4.4% gain ($67 million) in gas, fuel, and motor vehicle taxes and fees collections

- -32.2% drop ($49 million) in Hall income tax collections (to be phased out by 2021 under the 2017 IMPROVE Act)

- +4.3% gain ($25 million) in other state tax collection

Rainy Day Reserves

The Budget recommends a combined balance of $1.4 billion in the Reserve for Revenue Fluctuations and the TennCare Reserve by the end of FY 2020 (Figure 8). These rainy day reserves represent Tennessee’s ability to respond to an economic downturn.

History suggest Tennessee is likely to face a recession during Gov. Lee’s time in office, and current reserves may not be enough to avoid tax hikes or spending cuts. Reserve balances provide a revenue cushion during recessions, which often increase demand for state programs and services but decrease the revenues that fund them.

Figure 8

Rainy Day Reserves Highlights

- The combined balance of $1.4 billion would cover about 33 days of state-funded General Fund operations at the governor’s FY 2020 recommended funding levels. That is 4 more than the current budget but 9 fewer than in FY 2007 before the Great Recession.

- The Budget hits that mark by adding $239 million to the Reserve for Revenue Fluctuations — including an extra $14 million deposit for FY 2019 and a $225 million deposit in FY 2020. These deposits would grow that account to $1.1 billion — the highest dollar amount ever.

- The combined balance would give the budget about 21% less cushion than just before the Great Recession (compared to 37% less today). In FY 2007, the combined balance was about $292 million lower but represented almost 42 days of General Fund operations.

- State law sets a target balance for the Reserve for Revenue Fluctuations at 8% of General Fund revenues. The FY 2020 recommended balance in that account represents 7.3% of those revenues[i] — $101 million short of the 8% target.

- If the Reserve for Revenue Fluctuations met the 8% target in FY 2020, the combined balance with the TennCare Reserve would cover about 35 days of General Fund operations.

Changes to the FY 2019 Budget

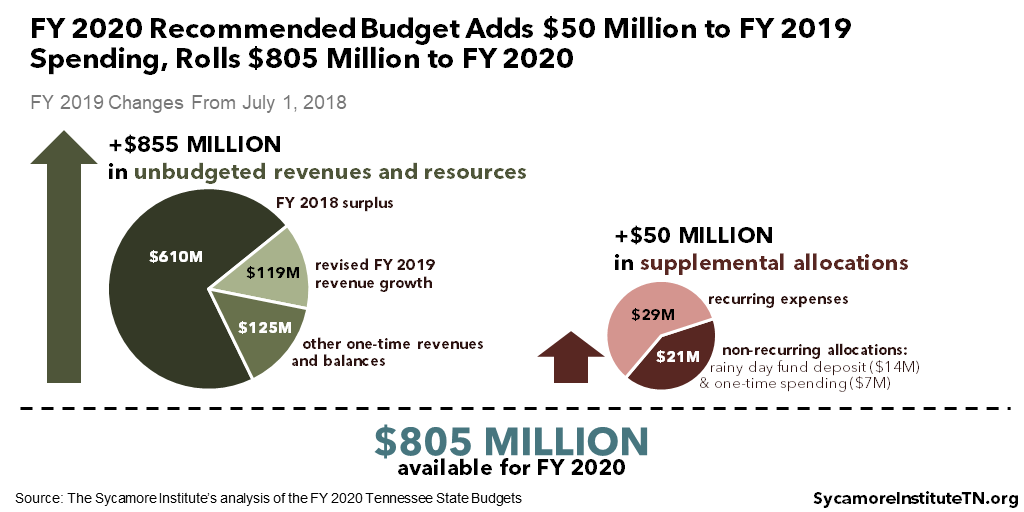

The Budget also includes $50 million of supplemental recommendations in FY 2019, the current fiscal year. Those funds come from $855 million of revenue and resources that were not budgeted when FY 2019 began on July 1, 2018. The remaining $805 million would become available as non-recurring revenue for FY 2020 (Figure 9). The Budget allocates these dollars to the FY 2020 non-recurring recommendations discussed earlier.

Year-end balances vary considerably with each budget recommendation and, in recent years, reflect multiple years of surplus. For example, the FY 2018 Budget anticipated a $1.2 billion FY 2017 surplus, which primarily came from two years of higher-than-budgeted revenues. The FY 2019 Budget expected a $445 million FY 2018 surplus. The FY 2020 Budget’s $805 million FY 2019 surplus is made up of the actual $610 million FY 2018 budget surplus, $119 million in unbudgeted FY 2019 revenue based on actual collections, and $125 million in other one-time revenues and balances. (3)

Governors’ recommended budgets for the upcoming fiscal year often include changes for the current fiscal year because actual revenues and spending needs are often higher or lower than originally estimated. Of the $50 million supplemental recommendation, the largest portion is $22 million (recurring) for TennCare to cover increased costs in the Department of Children’s Services. (3)

Figure 9

Key FY 2020 Budget Documents

For more details on Gov. Lee’s FY 2020 recommended Budget, see the following documents.

- FY 2020 Budget Document

- FY 202 Budget: Volume 2 – Base Budget Reductions

- Budget Overview: FY 2020

- The Commissioner of Finance and Administration’s FY 2020 Budget Presentation

[i] Calculated by adding Department of Revenue and Other State Revenue allocations to the General Fund, Education Fund, and Debt Service Fund minus the Gas Tax allocation to the Debt Service Fund (from page A-65 of the Budget).

Note: This post was updated shortly after publication to clarify the funding mechanisms related to the proposed ESA program.

References

Click to Open/Close

- State of Tennessee. FY 2019-2020 Tennessee State Budget. [Online] March 4, 2019. https://www.tn.gov/content/dam/tn/finance/budget/documents/2020BudgetDocumentVol1.pdf.

- —. FY 2019-2020 Tennessee State Budget: Volume 2 – Base Budget Reductions. [Online] March 4, 2019. https://www.tn.gov/content/dam/tn/finance/budget/documents/2020BudgetDocumentVol2.pdf.

- Tennessee Department of Finance and Administration. Budget Overview: FY 2019-2020. [Online] February 25, 2019. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/20AdReq21.pdf.

- State of Tennessee. Gov. Bill Lee Announces the Future Workforce Initiative. [Online] February 13, 2019. https://www.tn.gov/governor/news/2019/2/13/gov-bill-lee-announces-the-future-workforce-initiative.html.

- —. Gov. Bill Lee Delivers First State of the State Address. [Online] March 4, 2019. https://www.tn.gov/governor/news/2019/3/4/gov–bill-lee-delivers-first-state-of-the-state-address.html.

- Aldrich, Marta. Tennessee Governor Reveals Details About His ‘Parent Choice’ Proposal. Chalkbeat. [Online] March 14, 2019. https://www.chalkbeat.org/posts/tn/2019/03/14/tennessee-governor-reveals-details-about-his-parent-choice-proposal-including-its-75-million-price-tag-in-first-year/.

- Sher, Andy. Lee’s Private Voucher Plan Could Hit $125 Million, Impact 15,000 Kids by Year 5. Times Free Press. [Online] March 14, 2019. https://www.timesfreepress.com/news/breakingnews/story/2019/mar/14/tennessee-education-savings-account-plan-cost-125-million/490594/.

- State of Tennessee. Gov. Bill Lee Announces Strategies to Improve Criminal Justice System. [Online] February 28, 2019. https://www.tn.gov/governor/news/2019/2/28/gov–bill-lee-announces-strategies-to-improve-criminal-justice-system.html.

- —. Gov. Bill Lee Announces Initiatives for Mental Health and Suicide Prevention Efforts. [Online] February 26, 2019. https://www.tn.gov/governor/news/2019/2/26/gov–bill-lee-announces-initiatives-for-mental-health-and-suicide-prevention-efforts–.html.

- Tennessee Department of Finance and Administration. Commissioner’s Presentation: FY 2019 Recommended Budget. [Online] January 30, 2018. https://www.tn.gov/content/dam/tn/finance/budget/documents/FY19RecBudget%20FINAL.pdf.