This week, Governor Lee released his final budget recommendation for FY 2027. The following excerpts from our Tennessee State Budget Primer highlight what happens next and some of the key features of Tennessee’s process.

1. Tennessee’s budget process is more than tradition—it’s the law. Tennessee’s constitution requires the legislature to approve (i.e., appropriate) all public spending. Constitutional amendments added in the 1970s also require the budget to balance. This means in any given fiscal year, state spending cannot exceed the state’s revenue collections and reserves. In other words, the state cannot spend more than it has on hand.

State laws dating back to 1937 detail many of the steps in the budget process. These laws require the governor to send the legislature a budget recommendation, dictate what information the budget must include, and—to some extent—define the steps necessary to prepare the budget. (1)

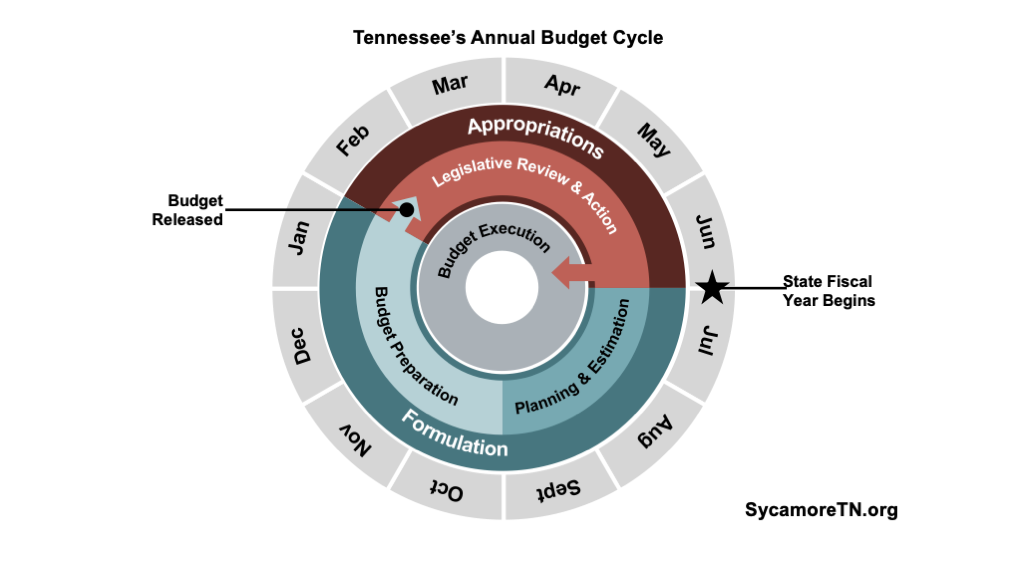

2. Tennessee’s fiscal year spans July 1st-June 30th. Acceptable shorthand terms include FY 2025-2026, FY 25-26, or FY 2026 (using the current fiscal year at publication as an example). The federal fiscal year is October 1st-September 30th.

Our state government often works on as many as three fiscal years at once. After a new fiscal year begins, work continues into December to close out and audit the prior fiscal year. At the same time, the governor and executive branch start working on the recommended budget for next fiscal year – while implementing and monitoring the current year’s enacted budget.

3. Tennessee largely takes an incremental approach to budgeting. Much of the focus is on funding increases and decreases compared with the prior year. Executive branch officials use the prior fiscal year’s “recurring base budget” as their starting point for creating the governor’s budget recommendation. As a result, non‑recurring expenses (i.e., one-time costs) and new recurring costs (i.e., expenses reasonably expected to occur every year) often get the most scrutiny.

4. The release of the governor’s budget in February is the culmination of months of work. For example, the governor’s Commissioner of Finance and Administration sent “budget instructions” to agencies back in August 2025—which request that departments project and justify needs and wants. Like most years, the instructions also directed departments to identify opportunities for savings. The governor and staff use this and other information provided by career staff to decide on a final budget recommendation, which must balance with projected revenues.

5. The release of the governor’s budget also kicks off the legislative appropriations process—led by the House and Senate Finance, Ways & Means Committees. Every dollar spent—including federal funds—must be approved by the legislature. As a result, the recommendation is translated into legislative language, known as the appropriations bill. The Finance Committees hold hearings and consider amendments to the bill, which represent incremental changes to the recommended budget (i.e., stipulate specific increases or reductions to the governor’s recommendation). The Finance Committees get the first opportunity to make changes, and then the full House and Senate consider additional amendments and approve their respective versions of the bill. Ultimately, an identical bill must pass both chambers.

6. The appropriations bill must fund the estimated first year’s cost of any new legislation or the legislation becomes void. As a result, the Finance Committees must consider all legislation with a fiscal impact as estimated in a “fiscal note.” Those bills are placed “behind the budget.” That is, the Finance Committees hold the legislation until the appropriations bill passes out of the committee. Those not funded in the budget typically do not receive further legislative consideration.

7. The executive branch remains highly involved during the appropriations phase. They and the General Assembly’s Office of Legislative Budget Analysis provide updated estimates to ensure the appropriations bill stays balanced as it is amended and revenue projections change. In addition, the governor typically submits an administration amendment based on updated revenue projections and other last-minute changes to the budget.

8. Appropriations usually get approved and signed into law during the final weeks of the legislative session, typically in April. In the rare event that this does not occur by June 30th, the state would be unable to spend most of the money it collects until an appropriations bill becomes law. Only twice in modern history has the legislature passed a short-term appropriations bill to continue state operations while budget issues were resolved after June 30th. This occurred in 2001 and 2002 during contentious debates about tax increase and reform proposals.

References

Click to Open/Close

- State of Tennessee. Tenn. Code Ann. § 9-4-5101 through 5119. [Online] Accessed via Lexis.