Note: This was first published as a newsletter to our email subscribers. Be the first to see new content like this by signing up for emails!

It’s May, and we have new resources for you on what’s going on in DC and how it could all play out in Tennessee. March’s newsletter included helpful links to trackers. This month, we’re focusing on President Trump’s “skinny budget” and Congress’ progress on budget reconciliation, which could have far-reaching effects on tax policy and large, federally-funded programs.

Congressional Moves

- Time to Reconcile ~ One of the biggest items on Congress’s fiscal to-do list is addressing the 2017 tax cuts, which are set to expire at the end of 2025. This is a task they plan to accomplish with “reconciliation,” a process that bypasses the Senate’s usual 60-vote filibuster rule. The House and Senate have both passed budget resolutions, setting that process in motion. The rub: the House and Senate resolutions envision a reconciliation outcome with very different federal deficit effects. Compared to what is expected under current law, the House plan would increase the deficit by about $3.3 trillion while the Senate’s would increase it by about $5.7 trillion.

- Implications for States ~ As part of reconciliation, Congress is also considering changes that could affect programs jointly administered by states—like Medicaid (TennCare), the Supplemental Nutrition Assistance Program (SNAP), and Temporary Assistance for Needy Families (TANF). The National Conference of State Legislatures’ take: “The nation may be on the precipice of significant cost shifts to the states.” House Committees are expected to start moving forward with their bills this week. Check out our latest dashboard to explore enrollment and expenditures in these programs by county.

- A 3rd Third Rail? ~ Nearly everyone agrees that a key House committee can’t hit its targets without finding savings in the Medicaid program. Cutting Social Security and Medicare have often been thought of as a political “third rail” for federal lawmakers, but reports indicate that finding savings in Medicaid is also turning out to be politically tricky. The cost-savings options on the table include rolling back the 90% federal match for Medicaid expansion (which TN hasn’t adopted), limiting provider taxes (one of the ways TN funds its portion of Medicaid costs), moving to a per capita cap funding model, and more frequent eligibility checks.

Presidential Actions

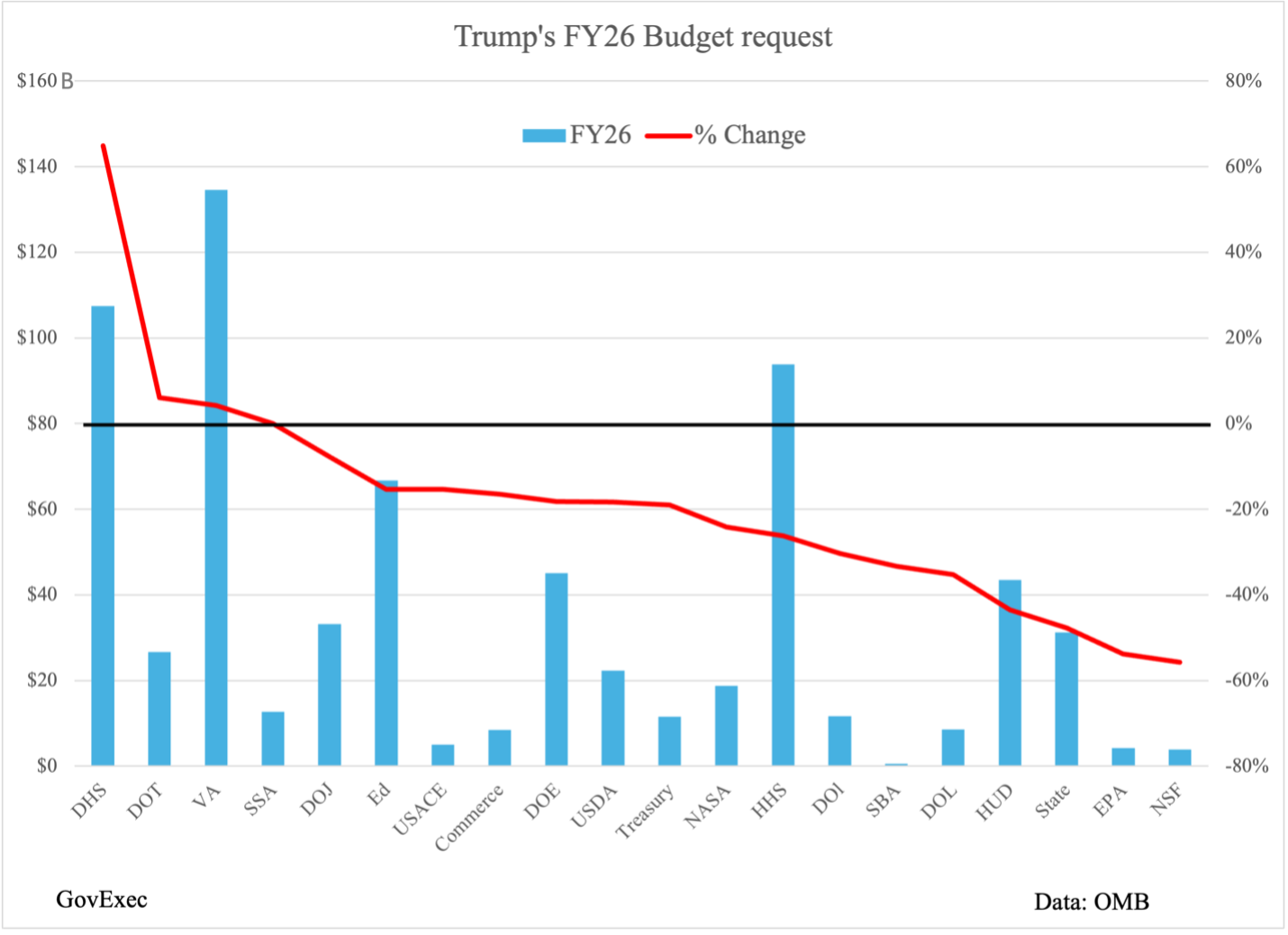

- “Skinny” Budget ~ On May 2nd, President Trump dropped a preliminary version of his proposed budget for FY 2026, which begins October 1. Common in the weeks after a president’s inauguration, the 46-page outline is known as a “skinny budget” because it doesn’t include the line-by-line a typical budget includes. (That is expected in the coming weeks.) The recommendation proposes cutting non-defense discretionary spending by 23% and boosting defense spending by 13%.

- Key Takeaways ~ The largest cuts—on a percentage basis—are proposed to the Departments of Health & Human Services, Interior, Labor, Housing & Urban Development, and State, the Small Business Administration, the Environmental Protection Agency, and the National Science Foundation (see chart below).

- A Policy Statement ~ Constitutionally, Congress holds the power of the purse, so the budget proposal is—more than anything else—a statement of the president’s policy priorities. Early reports suggest that the cuts proposed in President Trump’s plan may be politically challenging for Congress to enact.

Rated G for Graphic

Source: GovExec

Source: GovExec

ICYMI

- Federal Funding in TN ~ Check out our fully-interactive dashboard to explore federal funding within each Tennessee county and by federal agency in FY 2024.

- Worth Repeating ~ Did we use too many new budget terms? We’ve got you. Dive into the Congressional budget process here.