Key Takeaways

- The Supplemental Nutrition Assistance Program (SNAP) provides low-income children and adults with monthly benefits to pay for groceries.

- Eligibility for SNAP is based on income/asset limits, citizenship/residency rules, and work requirements—all set at the federal level.

- SNAP benefit amounts are determined by a federal formula that considers household size, income, and a maximum benefit amount tied to an estimate of a low-cost, nutritious diet.

- Nearly 700,000 Tennesseans receive monthly SNAP benefits—or about 9.6% of the state’s population and over 80% of those eligible.

- The federal One Big Beautiful Bill (OBBB) Act changed SNAP work requirements and state-federal cost-sharing requirements.

Nutrition is important for Tennesseans’ health and well-being. The Supplemental Nutrition Assistance Program (SNAP) is the largest federal program focused on nutrition. This policy primer explains SNAP, participation and funding in Tennessee, and recent changes under the One Big Beautiful Bill (OBBB) Act.

SNAP Overview

The Supplemental Nutrition Assistance Program (SNAP) is a joint federal-state program that helps low-income households afford nutritious food and maintain food security. Formerly called food stamps, SNAP is administered federally by the U.S. Department of Agriculture (USDA) and by the Tennessee Department of Human Services (TDHS) at the state level. (1) USDA sets eligibility requirements within federal law, while TDHS is responsible for enrolling individuals, verifying eligibility, and issuing monthly benefits. (2) The federal and state governments share in administrative costs, and the federal government covers the full cost of benefits. However, recent federal changes will shift a portion of benefit costs to states that do not meet a payment accuracy benchmark.

Recipients receive monthly SNAP payments via electronic benefit transfer (EBT) (i.e., a debit card) to buy groceries at one of over 6,800 SNAP-authorized retailers in Tennessee. (3) (4) Benefits can be used for groceries but not alcohol, tobacco, medicines, live animals, and non-food items (e.g., pet food, cleaning supplies, hygiene items). (5) In December 2025, the USDA approved Tennessee’s request to restrict SNAP purchases of items such as soda and candy—joining 12 states that already had similar restrictions.(6) (7)

Federal funding for SNAP-supported nutrition education programs ended in October 2025. The SNAP-Ed program supported classroom instruction, demonstrations, and other education materials and activities about healthy diets for SNAP recipients. (9) Under new federal law, however, federal funding for the program was terminated beginning in federal FY (FFY) 2026.

SNAP Eligibility

Eligibility for SNAP is based on income/asset limits, citizenship/residency rules, and work requirements—all set at the federal level.(10) Highlights are discussed below.

Income/Asset Limits

SNAP income and resource calculations are complex and vary based on individual circumstances. Most households must meet both an asset limit and two income tests—one for gross monthly income and another for net income. Pending approval from the Tennessee General Assembly, TDHS is in the process of changing state-level “broad-based categorical eligibility” (BBCE) rules which would simplify and align SNAP income limits with the Temporary Assistance for Needy Families (TANF) program. (12) Current requirements include:

- Gross Income Limit — A household’s gross monthly income cannot exceed 130% of poverty—or $3,483 for a family of four. Gross income includes income from all sources (i.e., wages, cash assistance, Social Security, unemployment, and child support) before any deductions.

- Net Income Limit — Net monthly income cannot exceed 100% of poverty—or $2,680 for a family of four. Net income estimates the money a family has available to afford basic expenses like food. It excludes things like the family’s home, child support payments, a dependent care deduction, and a 20% deduction for earned income (i.e., work). (13)

- Resource Limit — Assets are limited to $3,000 for most households and $4,500 for households with a person with a disability or age 60+. Countable assets include cash on hand, money in checking and savings accounts, certificates of deposits, stocks, bonds, property not up for sale, and lump-sum payments. It does not include the family’s home, retirement plans, and resources from other federal benefit programs like Supplemental Security Income (SSI) and TANF.(14)

- Reverification — To continue receiving benefits, most SNAP recipients must recertify their eligibility as frequently as every 4-6 months. (11)

Work Requirements

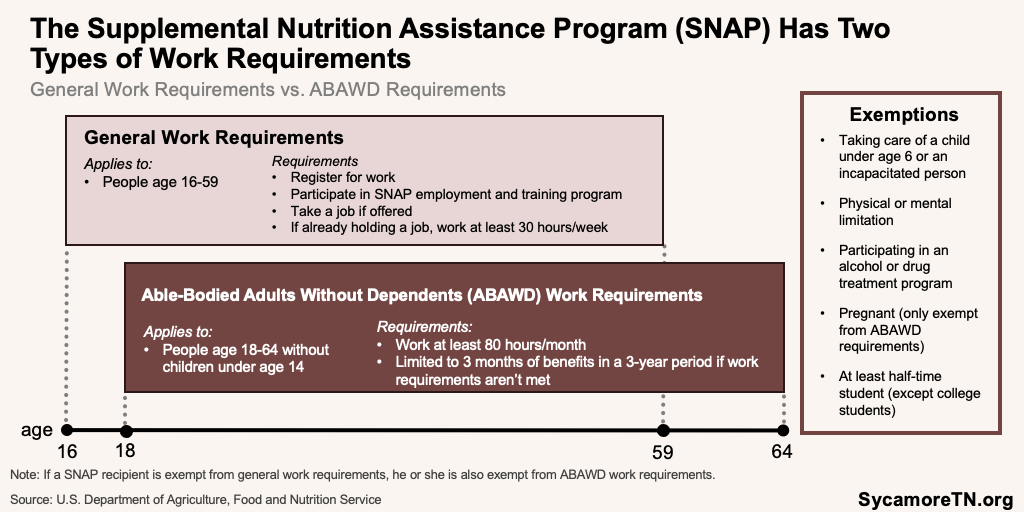

SNAP has two work requirements—a general work requirement and a so-called “ABAWD” work requirement: (Figure 1)

- General Work Requirement —Able-bodied recipients ages 16-59 must meet a general work requirement to receive SNAP, including registering for work or participating in an employment or training program. Employed recipients cannot quit a job without another in place or voluntarily reduce work hours without reasonable cause, and unemployed recipients must accept any suitable employment offers.

- ABAWD Work Requirement — Additional requirements also apply to able-bodied adults without dependents (ABAWD), who are otherwise subject to a three-month limit on benefits. Under the ABAWD requirement, recipients ages 18-64 without a dependent under 14 must report at least 80 hours of work per month to receive more than three months of benefits in a three-year period. (15) (16) Prior to the passage of the OBBB Act, the ABAWD requirement applied to recipients ages 18-54 without a dependent under 18. (17) (18) National estimates project that approximately 52,000 Tennesseans will now have to meet the ABAWD work requirement to continue receiving SNAP benefits. (19) (20)

- Special Rules — Special rules and exemptions apply to older adults ages 60+ and individuals with disabilities (e.g., exemption from gross income test). (21) The OBBB Act removed prior work requirement exemptions for veterans, people experiencing homelessness, and people ages 24+ who aged out of foster care. (17) (18)

Figure 1

Additional Requirements

Certain targeted populations are ineligible for SNAP benefits or must meet additional requirements. For example, people living in the U.S. without legal authorization (i.e., illegal/undocumented immigrants) and felons convicted of certain drug-related offenses are ineligible. Additionally, people cannot qualify for benefits for the first time if they are on strike, but people who were already enrolled in SNAP before the strike may continue to receive benefits if they still meet the eligibility requirements. College students can only receive SNAP if they work at least 20 hours per week, enroll in work-study, care for dependents, or receive TANF. (23)

SNAP Benefits

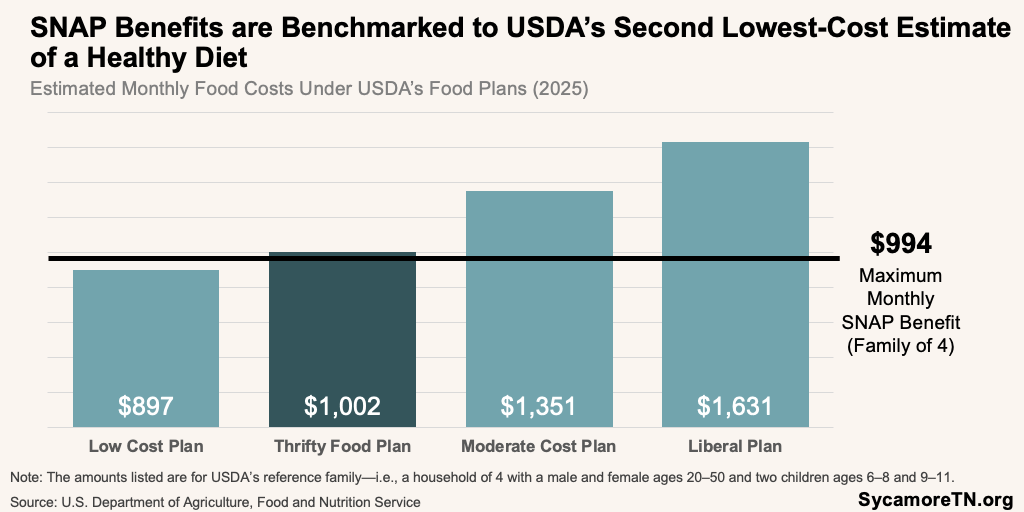

The basis for SNAP benefit amounts is the Thrifty Food Plan (TFP)—USDA’s estimate for a low-cost nutritious diet. USDA publishes four types of food plans–each estimating different cost levels for a healthy diet. (24) The cost of each is based on food prices, food consumption data, consumption patterns, and dietary guidelines for different age groups. (25) The TFP is the second lowest-cost of USDA’s four plans (Figure 2).

Figure 2

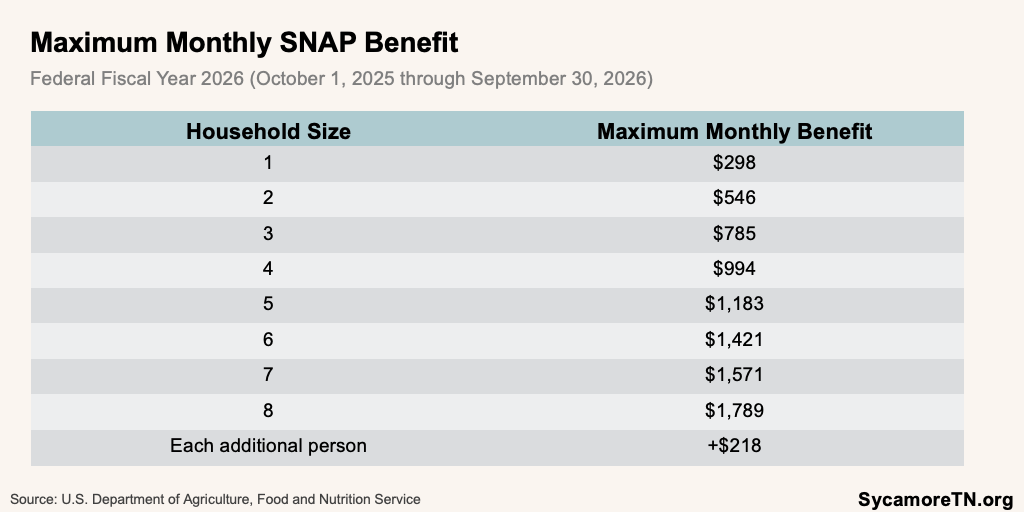

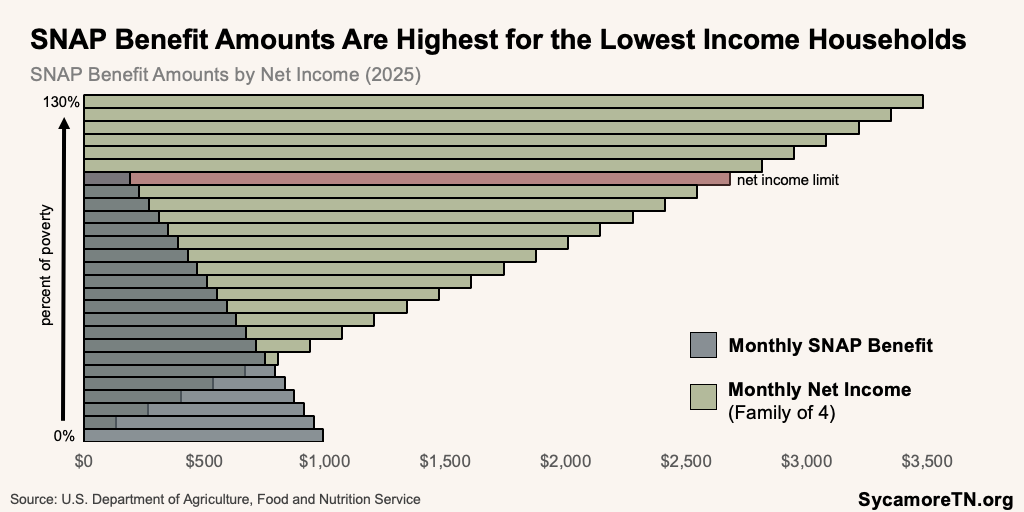

SNAP benefit amounts are determined by a federal formula that considers household size, income, and a maximum benefit tied to the Thrifty Food Plan. The maximum benefit amount is tied to the cost of the TFP for a reference family of four—with benefits tapering down as income increases. The SNAP formula expects people to spend about 30% of their net income on food, so a household’s SNAP benefit is equal to the difference between that amount and the TFP cost.(27) For example, a family of 4 with a $2,000 net monthly income would receive $394 a month, which equals the maximum benefit ($994) minus 30% of their net income ($600) (Table 1 and Figure 3).

Table 1

Figure 3

While benefits are adjusted annually for inflation, any future updates to the Thrifty Food Plan must be cost-neutral. Under a 2018 federal law, the TFP must be reevaluated every five years. (25) The last revision occurred in 2021 and resulted in a 21% increase to the maximum benefit. Under the OBBB Act, however, future updates to the TFP cannot increase benefit amounts aside from inflationary adjustments. (28)

SNAP Participation in Tennessee

Nearly 700,000 Tennesseans receive monthly SNAP benefits—or about 9.6% of the state’s population and over 80% of those eligible.(29) (30) Highlights of participation include:

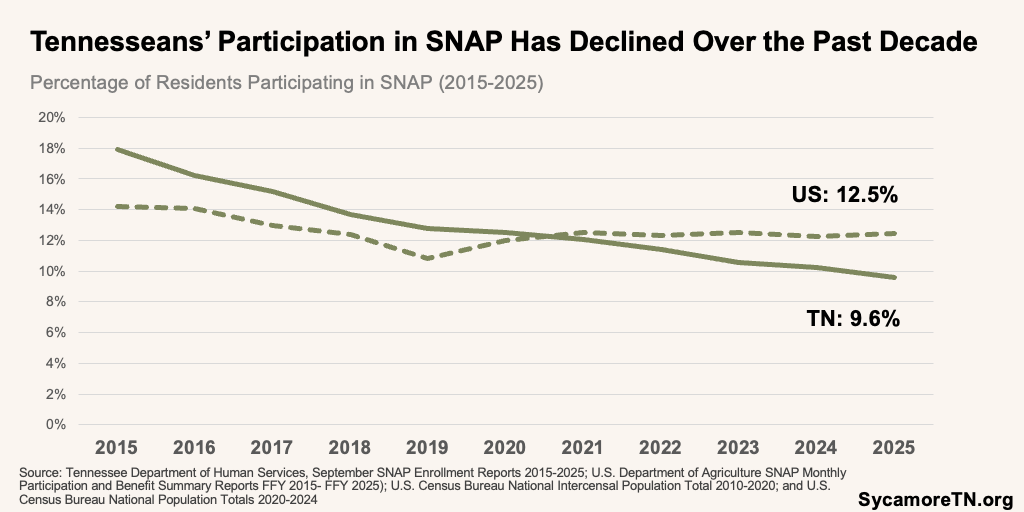

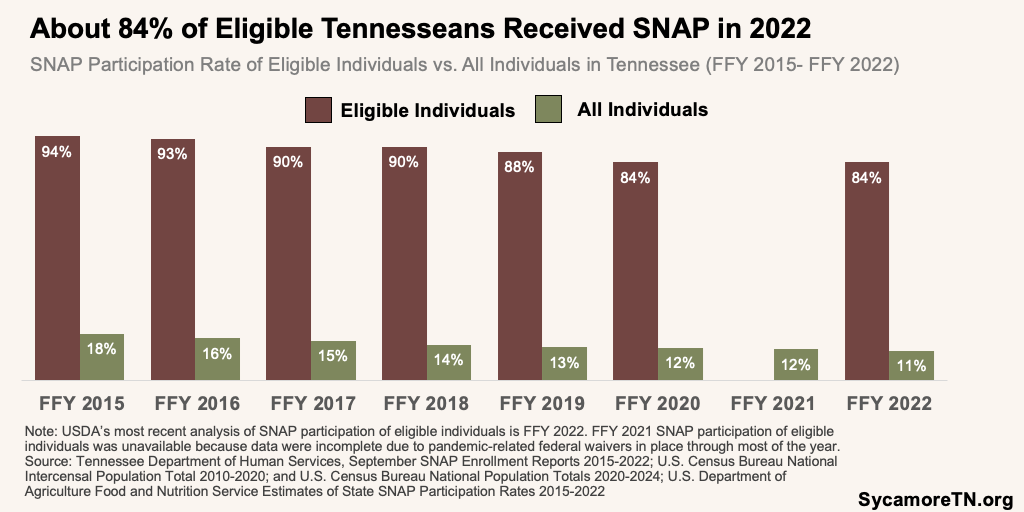

- Enrollment Trends — SNAP enrollment in Tennessee has steadily declined over the past decade—falling by nearly 42% from almost 1.2 million recipients in September of 2015 to just under 700,000 in September of 2025. During this time, overall participation fell from 17.9% of all Tennesseans to 9.6% (Figure 4). Meanwhile, participation among eligible individuals also declined. An estimated 84% of eligible individuals received benefits in 2022, down from 94% in 2015 (Figure 5).(31)(32) (33) (34)

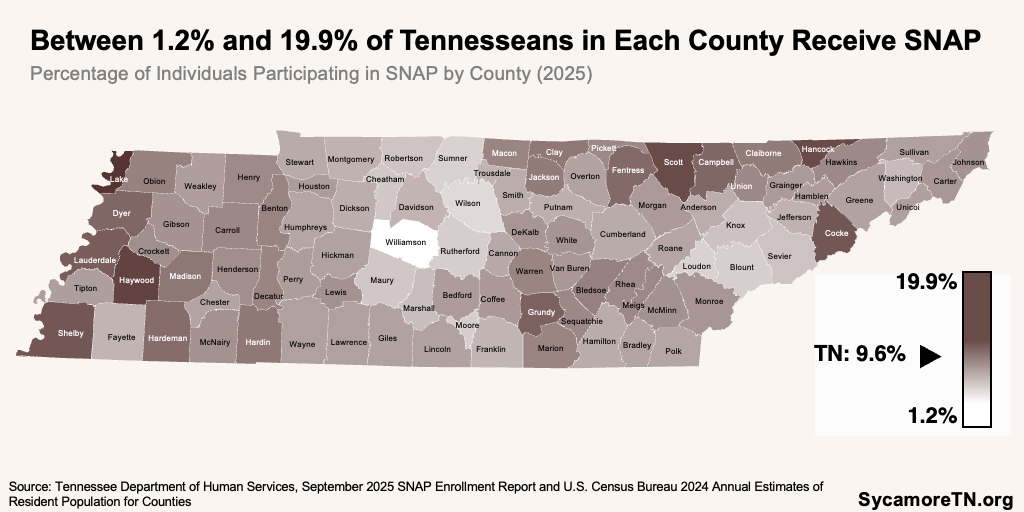

- Geographic Variation — Participation varies significantly across Tennessee’s 95 counties, from a low 1.2% of all Williamson County residents to a high of 19.9% of Lake County residents (Figure 6).

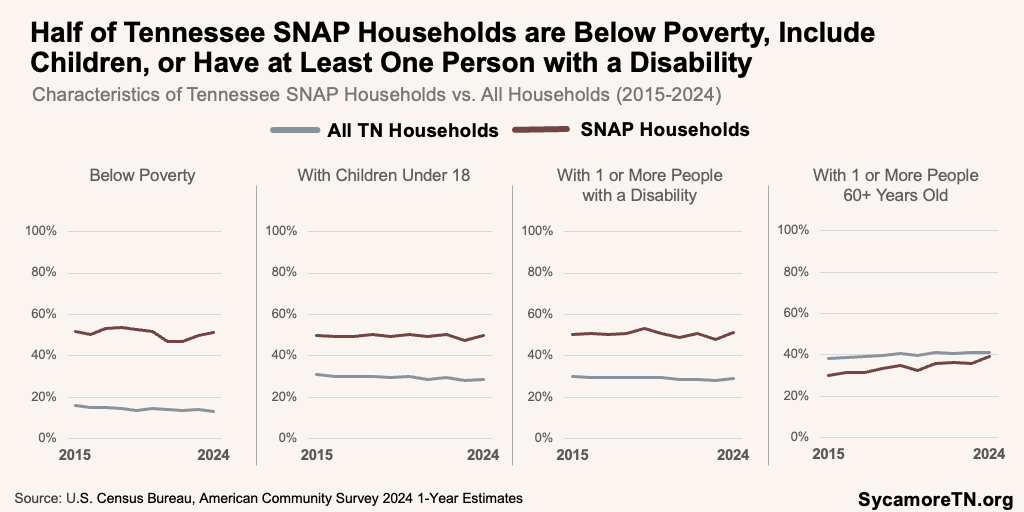

- Recipient Characteristics — In 2024, 51% of SNAP households in Tennessee fell below the poverty line, 50% included children, and 51% had at least one household member with a disability (Figure 7).

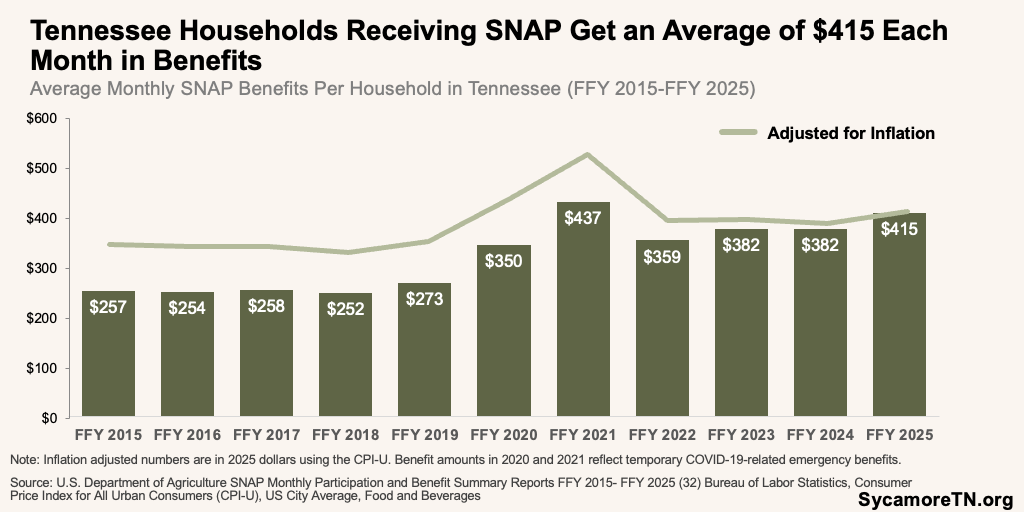

- Average Benefits — On average, Tennessee disbursed about $146 million in benefits each month between January and November 2025, with each household receiving a monthly average of over $400 (Figure 8).

Figure 4

Figure 5

Figure 6

Figure 7

Figure 8

SNAP Funding

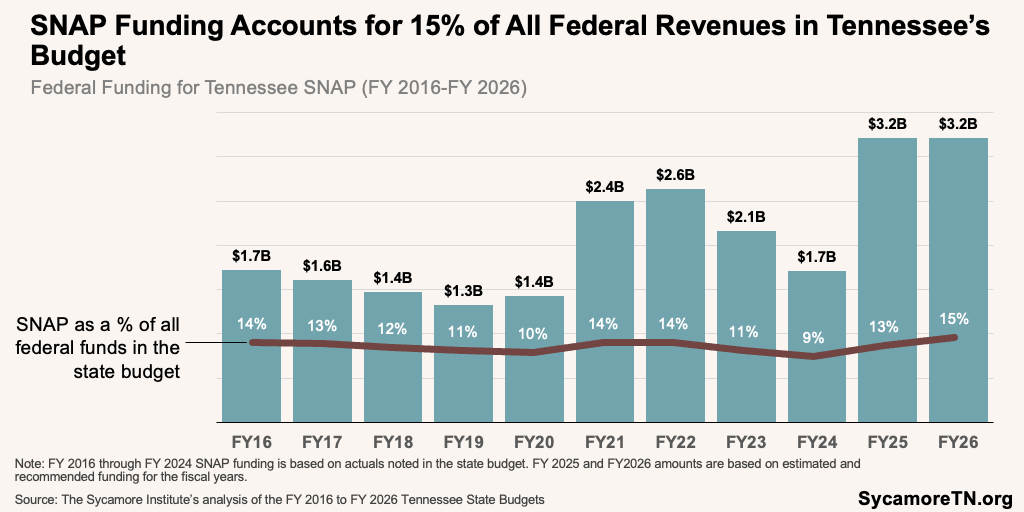

Federal SNAP funds flow through and are accounted for in state budgets. Tennessee receives between $2 billion to $3 billion in federal funding per year for SNAP, which amounted to about 15% of all federal revenues in the FY 2026 state budget (Figure 9).

In recent history, the federal government has also funded SNAP increases during economic downturns. Like many safety net programs, SNAP is considered counter-cyclical because demand for the program typically increases during recessions, and program benefits can be used as a tool to generate economic activity. During both the COVID-19 pandemic and the Great Recession of 2007-2009, the federal government funded temporary benefit increases and granted flexibility to states to waive certain eligibility and administrative program requirements.(35) (41) In FY 2021, for example Tennessee issued over $700 million in emergency benefits to SNAP households. (36)

Figure 9

States must cover a portion of administrative costs—a share that will increase from 50% to 75% beginning October 2026. Administrative costs cover the resources needed to oversee SNAP benefits—such as staffing, technology, and state program operations. Currently, the state and federal governments split these costs evenly, but under the OBBB Act, states must cover 75% of these costs starting in federal FY 2027 (October 1, 2026). (43) In FFY 2023, Tennessee’s SNAP administrative costs totaled $256 million. (44) TDHS estimates that it would need an additional $77 million in recurring state funds to cover the new, higher cost-share. (45)

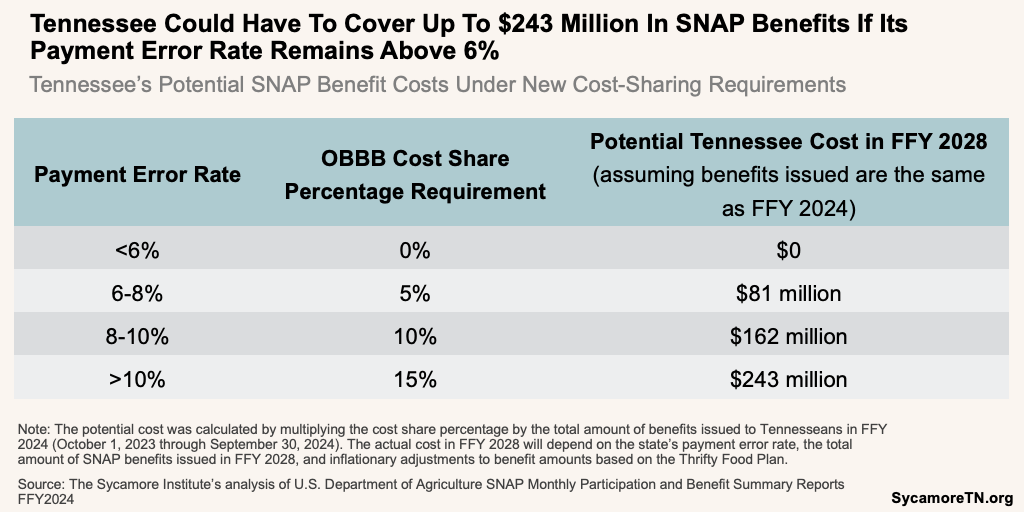

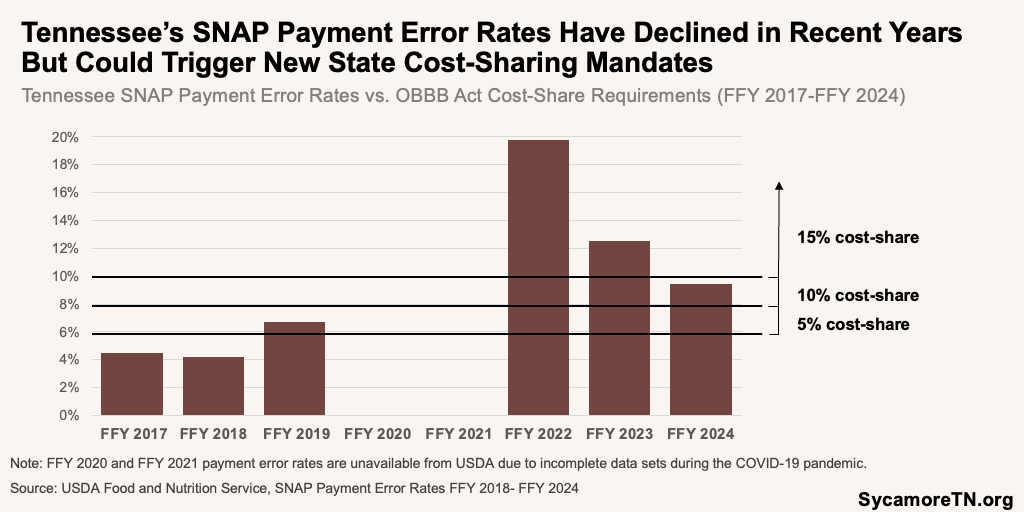

States may also be required to cover up to 15% of the cost of SNAP benefits beginning October 2027. (43) Currently, the federal government fully funds SNAP benefits. Starting in federal FY 2028 (October 1, 2027), new matching requirements may be triggered by a state’s SNAP payment error rate, which measures how accurately a state determines household eligibility and benefit amounts. Under the OBBB Act, states with a payment error rate over 6% will have to cover as much as 15% of benefits costs (Table 2).

Payment error rates include cases where households receive either more (i.e., overpayments) or fewer (i.e., underpayments) benefits than they are entitled to. Payment errors may be the result of household expense calculation errors or out-of-date income information and are often unintentional. USDA calculates each state’s payment error rate using a randomized state-level review of cases and a subsequent federal-level review. If a state’s payment error rate is over 6%, it must implement a corrective action plan that identifies ways to lower the error rate. (46)

Table 2

Tennessee’s federal FY 2024 payment error rate of 9.5% would require the state to cover 10% of SNAP benefit costs if it remains the same (Figure 10).(47) States can choose whether to use their FFY 2025 or FFY 2026 payment error rate to determine the FFY 2028 cost-sharing requirement. Based on Tennessee’s FFY 2024 SNAP benefit expenditures, Tennessee would have to contribute between $81-243 million toward SNAP benefits if the payment error rate remains above 6%. (Table 2)

Figure 10

Parting Words

SNAP provides food assistance to hundreds of thousands of low-income households across the state. Recent changes under the OBBB Act will alter program administration, funding responsibilities, and eligibility requirements. As these provisions take effect, Tennessee will need to monitor their impact on participation, state costs, and program accuracy to ensure effective implementation and support for residents in need.

References

Click to Open/Close

References

- USDA Food and Nutrition Service. Supplemental Nutrition Assistance Program (SNAP). U.S. Department of Agriculture Food and Nutrition Service. [Online] https://www.fns.usda.gov/snap/supplemental-nutrition-assistance-program.

- Tennessee Department of Human Services. Supplemental Nutrition Assistance Program (SNAP). Tennessee Department of Human Services. [Online] [Cited: November 7, 2025.] https://www.tn.gov/humanservices/for-families/supplemental-nutrition-assistance-program-snap.html.

- —. EBT Cards. Tennessee Department of Human Services. [Online] [Cited: November 7, 2025.] https://www.tn.gov/humanservices/for-families/supplemental-nutrition-assistance-program-snap/snap-electronic-benefit-transfer-ebt-cards.html.

- USDA Food and Nutrition Service. SNAP Retailer Management Year End Summary FY 2024. U.S. Department of Agriculture Food and Nutrition Service. [Online] September 30, 2024. [Cited: November 19, 2025.] https://www.fns.usda.gov/data-research/data-visualization/snap-retailer-management-dashboard-fy24.

- —. What Can SNAP Buy? . U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/eligible-food-items.

- —. SNAP Food Restriction Waivers. U.S. Department of Agriculture Food and Nutrition Service. [Online] August 6, 2025. [Cited: November 19, 2025.] https://www.fns.usda.gov/snap/waivers/foodrestriction.

- —. Tennessee SNAP Food Restriction Waiver. U.S. Department of Agriculture Food and Nutrition Service. [Online] December 10, 2025. [Cited: December 11, 2025.] https://www.fns.usda.gov/snap/waivers/foodrestriction/tennessee.

- U.S. Code of Federal Regulations. 7 CFR Part 274. Code of Federal Regulations. [Online] September 26, 2025. [Cited: November 7, 2025.] https://www.ecfr.gov/current/title-7/subtitle-B/chapter-II/subchapter-C/part-274?toc=1.

- USDA Food and Nutrition Service. Supplemental Nutrition Assistance Program Nutrition Education and Obesity Prevention Grant Program (SNAP-Ed) Questions and Answers. U.S. Department of Agriculture Food and Nutrition Service. [Online] August 13, 2025. [Cited: November 7, 2025.] https://www.fns.usda.gov/snap-ed/grant-qas.

- —. SNAP Eligibility. U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/recipient/eligibility.

- Tennessee Department of Human Services. Applying for SNAP in Tennessee. Tennessee Department of Human Services. [Online] [Cited: November 7, 2025.] https://www.tn.gov/humanservices/for-families/supplemental-nutrition-assistance-program-snap/applying-for-services.html.

- —. Notice of Rulemaking Hearing 1240-01-14. Tennessee Secretary of State. [Online] October 1, 2025. https://publications.tnsosfiles.com/rules_filings/10-01-25.pdf.

- USDA Food and Nutrition Service. SNAP Eligibility – Am I Eligible for SNAP? Frequently Asked Questions. U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/recipient/eligibility.

- Tennessee Department of Human Services. SNAP Eligibility Information. Tennessee Department of Human Services. [Online] [Cited: November 7, 2025.] https://www.tn.gov/humanservices/for-families/supplemental-nutrition-assistance-program-snap/supplemental-nutrition-assistance-program-snap-eligibility-information.html.

- —. SNAP Eligbility Information. Tennessee Department of Human Services. [Online] [Cited: November 7, 2025.] https://www.tn.gov/humanservices/for-families/supplemental-nutrition-assistance-program-snap/supplemental-nutrition-assistance-program-snap-eligibility-information.html.

- USDA Food and Nutrition Service. Supplemental Nutrition Assistance Program (SNAP) Provisions of the One Big Beautiful Bill Act of 2025 – ABAWD Exceptions – Implementation Memorandum. U.S. Department of Agriculture Food and Nutrition Service. [Online] October 3, 2025. [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/obbb-ABAWD-exemptions-implementation-memo.

- —. SNAP Work Requirements. U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/work-requirements.

- —. Supplemental Nutrition Assistance Program (SNAP) Provisions of the One Big Beautiful Bill Act of 2025 – ABAWD Exceptions – Implementation Memorandum. U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: November 2025, 7.] https://www.fns.usda.gov/snap/obbb-ABAWD-exemptions-implementation-memo.

- Congressional Budget Office. Estimated Effects of Public Law 119-21 on Participation and Benefits Under the Supplemental Nutrition Assistance Program. Congressional Budget Office. [Online] August 11, 2025. [Cited: November 26, 2025.] https://www.cbo.gov/system/files/2025-08/61367-SNAP.pdf.

- Llobrera, Joseph, Rosenbaum, Dottie and Nchako, Catlin. Senate Agriculture Committee’s Revised Work Requirement Would Risk Taking Away Food Assistance From More Than 5 Million People: State Estimates. Center on Budget and Policy Priorities. [Online] June 27, 2025. [Cited: November 26, 2025.] https://www.cbpp.org/research/food-assistance/senate-agriculture-committees-revised-work-requirement-would-risk-taking.

- USDA Food and Nutrition Service. SNAP Special Rules for the Elderly or Disabled. U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/eligibility/elderly-disabled-special-rules.

- —. SNAP Eligibility. U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: 7 November, 2025.] https://www.fns.usda.gov/snap/recipient/eligibility.

- Tennessee Department of Human Services. SNAP Eligibility Information. Tennessee Department of Human Services. [Online] [Cited: November 7, 2025.] https://www.tn.gov/humanservices/for-families/supplemental-nutrition-assistance-program-snap/supplemental-nutrition-assistance-program-snap-eligibility-information.html.

- USDA Food and Nutrition Service. USDA Food Plans: Monthly Cost of Food Reports. U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: December 2025, 17.] https://www.fns.usda.gov/research/cnpp/usda-food-plans/cost-food-monthly-reports.

- —. Thirfty Food Plan, 2021. U.S. Department of Agriculture Food and Nutrition Service. [Online] August 2021. [Cited: November 7, 2025.] https://www.fns.usda.gov/cnpp/thrifty-food-plan-2021.

- —. USDA Food Plans. U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: November 7, 2025.] https://www.fns.usda.gov/research/cnpp/usda-food-plans.

- —. SNAP Eligibility: How Much Could I Recieve in SNAP Benefits? U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/recipient/eligibility.

- —. SNAP Provisions of the One Big Beautiful Bill Act of 2025 – Information Memorandum. U.S. Department of Agriculture Food and Nutrition Service. [Online] September 4, 2025. [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/obbb-implementation.

- —. SNAP Data Tables, National Level Annual Summary Participation and Costs 1969-2024. U.S. Department of Agriculture Food and Nutrition Service. [Online] August 22, 2025. [Cited: November 7, 2025.] https://www.fns.usda.gov/pd/supplemental-nutrition-assistance-program-snap.

- Tennessee Department of Human Services. SNAP Statistical Information. Tennessee Department of Human Services. [Online] September 2025. [Cited: November 7, 2025.] https://www.tn.gov/humanservices/for-families/supplemental-nutrition-assistance-program-snap/snap-statistical-information.html.

- —. SNAP Statistical Information. Tennessee Department of Human Services. [Online] September 2025. [Cited: November 7, 2025.] https://www.tn.gov/humanservices/for-families/supplemental-nutrition-assistance-program-snap/snap-statistical-information.html.

- USDA Food and Nutrition Service. SNAP Data Tables. U.S. Department of Agriculture Food and Nutrition Service. [Online] August 2025. [Cited: 7 November, 2025.] https://www.fns.usda.gov/pd/supplemental-nutrition-assistance-program-snap.

- United States Census Bureau. National Intercensal Population Totals 2010-2020. U.S. Census Bureau. [Online] 2020. [Cited: November 7, 2025.] https://www.census.gov/data/datasets/time-series/demo/popest/intercensal-2010-2020-national.html.

- —. National Population Totals and Components of Change: 2020-2024. U.S. Census Bureau. [Online] December 2024. [Cited: November 7, 2025.] https://www.census.gov/data/datasets/time-series/demo/popest/2020s-national-total.html.

- USDA Food and Nutrition Service. SNAP COVID-19 Waivers. U.S. Department of Agriculture Food and Nutrition Service. [Online] January 10, 2024. [Cited: December 1, 2025.] https://www.fns.usda.gov/disaster-assistance/snap-covid-19-waivers.

- Tennessee Department of Human Services. Tennessee Department of Human Services Annual Report. Tennessee Department of Human Services. [Online] 2021. [Cited: December 1, 2025.] https://www.tn.gov/content/dam/tn/human-services/documents/Department%20of%20Human%20Services%20Annual%20Report_2021_Final.pdf.

- USDA Food and Nutrition Service. Report Series – Estimates of State SNAP Participation Rates (Reaching Those in Need). U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: November 26, 2025.] https://www.fns.usda.gov/research/snap/state-participation-rates.

- United States Census Bureau. County Population Totals and Components of Change: 2020-2024. United States Census Bureau. [Online] March 2025. [Cited: November 7, 2025.] https://www.census.gov/data/datasets/time-series/demo/popest/2020s-counties-total.html.

- U.S. Census Bureau . American Community Survey 1-Year Estimates. U.S. Census Bureau. [Online] September 2015-2024. [Cited: November 15, 2025.] https://data.census.gov/.

- U.S. Bureau of Labor Statistics. Consumer Price Index Database. U.S. Bureau of Labor Statistics. [Online] September 2025. [Cited: November 26, 2025.] https://data.bls.gov/toppicks?survey=cu.

- Zedlewski, Sheila, Waxman, Elaine and Gundersen, Craig. SNAP’s Role in the Great Recession and Beyond. s.l. : Urban Institute, 2012.

- Tennessee Department of Finance and Administration. Budget Publications Archive. Tennessee Department of Finance and Administration. [Online] [Cited: November 7, 2025.] https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive/fiscal-year-2025-2026-budget-publications.html.

- USDA Food and Nutrition Service. SNAP Provisions of the One Big Beautiful Bill Act of 2025 – Information Memorandum. U.S. Department of Agriculture Food and Nutrition Service. [Online] September 4, 2025. [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/obbb-implementation.

- —. Supplemental Nutrition Assistance Program State Activity Report FY 2023. Food and Nutrition Service, U.S. Department of Agriculture. 2025. p. 12.

- Tennessee Department of Human Services. Fiscal Year 2026-2027 Budget Hearing. [Online] November 2025. [Cited: November 7, 2025.] https://www.tn.gov/content/dam/tn/finance/budget/documents/governorhearingsfy2027/FY27%20Gov%20Hearing%20-%20Dept%20of%20Human%20Services.pdf.

- USDA Food and Nutrition Service. SNAP Quality Control. U.S. Department of Agriculture Food and Nutrition Service. [Online] [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/qc.

- —. SNAP Payment Error Rates. U.S. Department of Agriculture Food and Nutrition Service. [Online] June 2025, 30. [Cited: November 7, 2025.] https://www.fns.usda.gov/snap/qc/per.