Key Takeaways

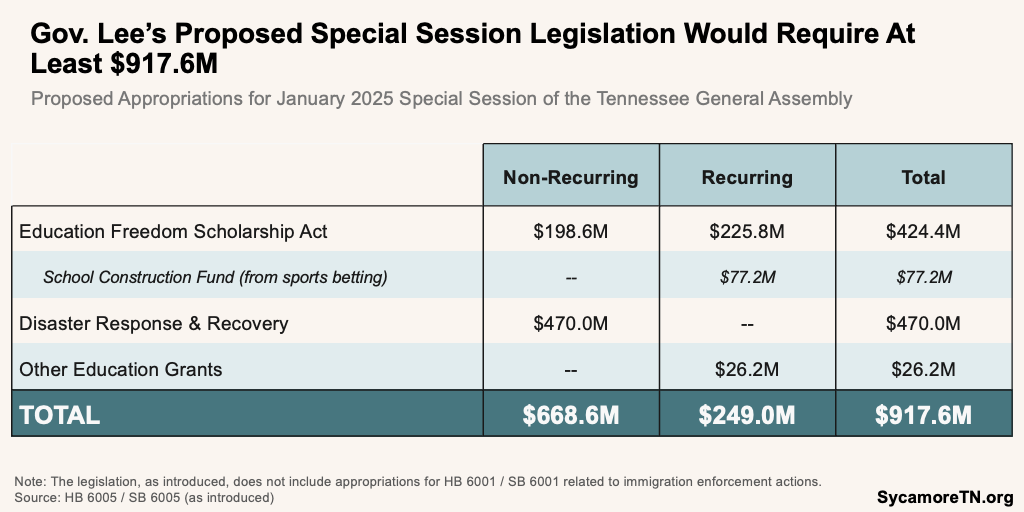

- As introduced, Gov. Lee’s proposed special session legislation would require at least $917.6 million, not including any amounts related to immigration enforcement actions.

- Policymakers likely have at least $1.7 billion in non-recurring and as much as $1.2 billion in recurring General Fund resources available in FYs 2025 and 2026, respectively.

- This includes a large FY 2024 surplus, recurring revenues used for one-time purposes in prior budgets, and some modest revenue growth in FY 2026.

- Part of Gov. Lee’s proposal is funded with sports betting taxes that—along with the state lottery—currently fund college scholarships.

- These taxes, lottery proceeds, and college scholarship costs have all been volatile recently, and projections suggest scholarship costs may exceed net lottery proceeds at some point over the next five years.

Governor Bill Lee has called a special session of the Tennessee General Assembly to begin on January 27th to consider legislation related to Education Freedom Scholarships, disaster recovery efforts, and anticipated federal immigration actions. (1) (2) This brief reviews the current proposed costs and where those dollars might come from.

Proposed Special Session Costs

As introduced, Gov. Lee’s proposed legislation would require at least $917.6 million, not including any amounts related to immigration enforcement actions. This total includes $668.8 million in non-recurring funding and $249.0 million in recurring (Table 1). Most of these dollars would come from the General Fund. However, the plan also diverts $77.2 million in recurring revenues from a sports betting tax currently dedicated to the state’s Lottery Account, which finances state-offered college scholarships. Recurring funding for the proposed 20,000 Education Freedom Scholarships is already funded in the base budget. So far, the governor has not proposed any new spending for legislative changes related to immigration enforcement actions. However, those actions are expected to have a fiscal impact.

Table 1

Tripped up on terminology?

Download our Tennessee State Budget Primer.

Available General Fund Resources

Policymakers likely have at least $1.7 billion in non-recurring and as much as $1.2 billion in recurring General Fund resources available in FYs 2025 and 2026, respectively. These include typical revenue sources that policymakers have drawn from in recent years to use in the special session and the regular FY 2026 budget process. During both, the administration is likely to share information that is not yet public about other available resources—such as money freed up by potential spending cuts.

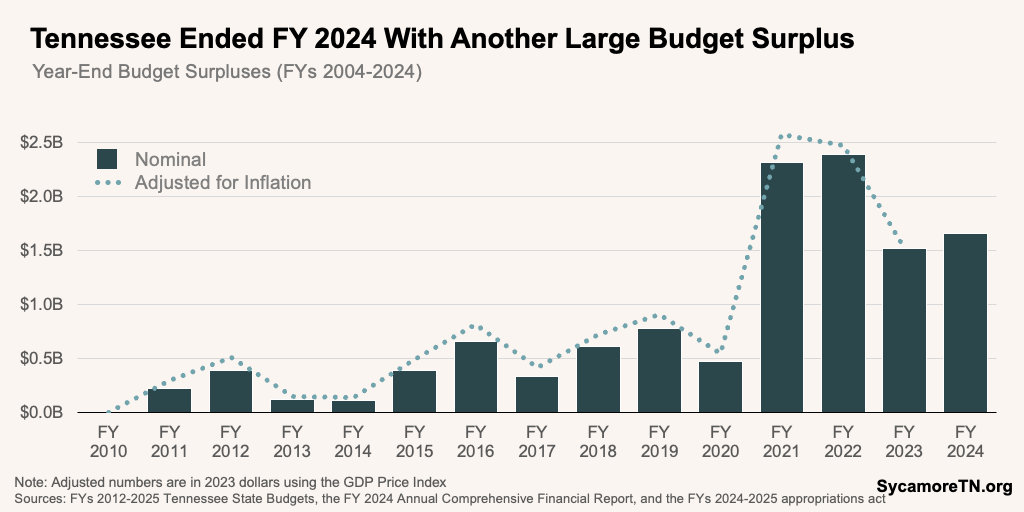

Figure 1

Non-Recurring Revenue

The state ended FY 2024 with another historically large $1.7 billion surplus (Figure 1)—funds that can be used for non-recurring items in FY 2025. (3) (4) This includes about $113 million in FY 2024 General Fund overcollections (i.e., actual tax collections above those expected under the mid-year revised projection). (5) Details are not currently available on the source of the rest of these funds. However—if it is any indication—FY 2023’s surplus came largely from earnings from the Treasurer’s investment of state funds and agencies’ historically large reversions of unspent money to the General Fund.

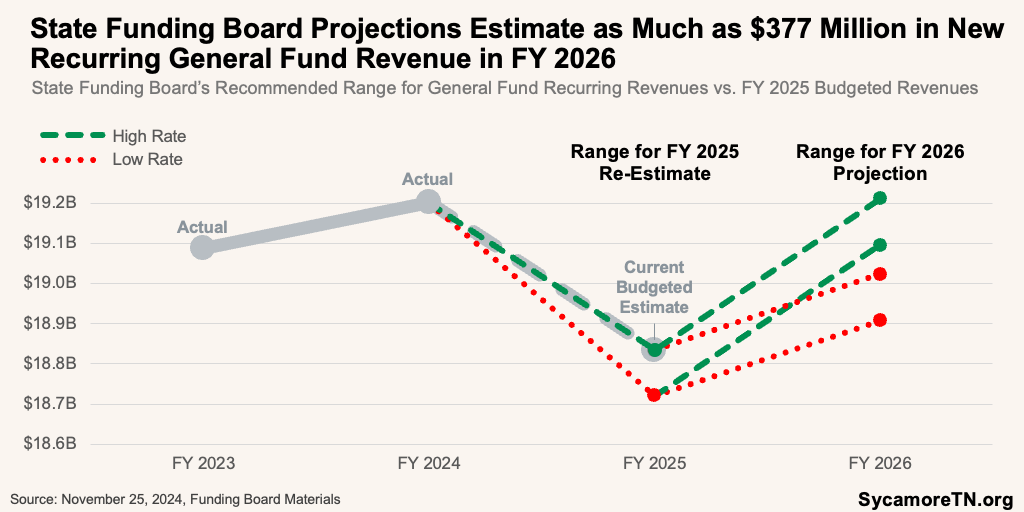

Recurring Revenues

Over $800 million in recurring revenue that the FY 2025 budget allocated for non-recurring purposes is available to use in FY 2026. (10) The last several budgets have used new recurring revenues for one-time purposes due to concerns that revenue collections could slow or decline. By not tying these dollars up for long-term recurring commitments, they remain unallocated for future years.

Additionally, as much as $377 million in recurring revenue may be available from new FY 2026 tax growth. The State Funding Board met in November 2024 to recommend a range of revenue predictions for revisions to the current fiscal year and an estimate for next year (Figure 2). This recommendation sets the range for governors’ budgets. In recent years, budgets have used the highest recommended growth rates. In this case, the highest recommended rates would leave the FY 2025 estimate unchanged and produce $377 million in new recurring General Fund revenue for FY 2026. (5) (11)

Figure 2

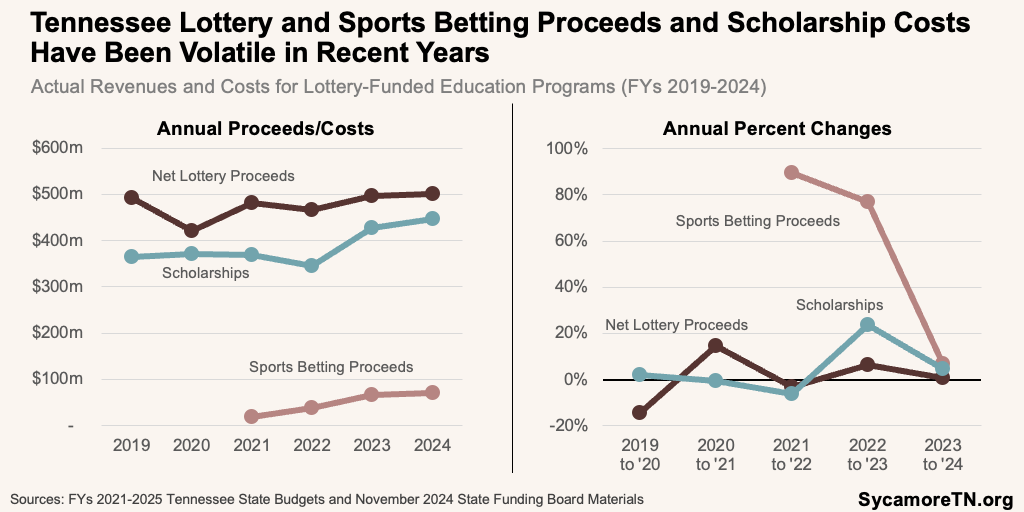

Sports Betting Revenues

A special session bill proposes to fund a K-12 school construction initiative with sports betting taxes that currently go towards lottery-funded college scholarships. Under current law, 80% of privilege tax collections on licensed sportsbooks go to the state Lottery for Education Account. This allocation is expected to amount to about $73.6 million in FY 2025 and $77.2 million in FY 2026. (12) The Lottery Account primarily consists of state lottery proceeds, and it funds many of the state’s post-secondary scholarships like HOPE and Tennessee Promise. (13) Prior to legalization of sports betting, the Lottery Account was funded entirely by state lottery proceeds.

Figure 3

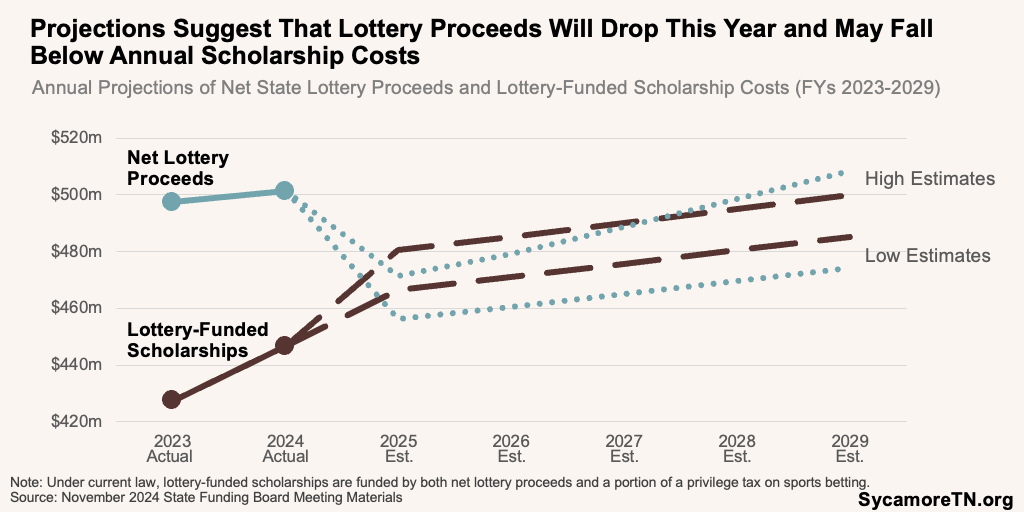

Sports betting tax collections, state lottery proceeds, and scholarship costs have all been relatively volatile in recent years—each for different reasons (Figure 3). For example:

- Sports Betting — Sports betting is still relatively new; it only became legal in Tennessee in 2019. Collections did not accrue in the Lottery Account until FY 2021, ramped up significantly in FYs 2022 and 2023, and then grew at a more moderate 6% in FY 2024—the most recent full fiscal year (Figure 3).(8) (5) (12) This provides little historical experience for understanding what “typical” revenues or growth might look like.

- State Lottery Proceeds — It’s still unclear the extent to which sports betting affects lottery sales and proceeds. Sports betting in other states has had mixed or unclear effects on lottery sales.(14) (15) (16) (17) However, Tennessee lottery officials say sports betting is negatively affecting their sales. In fact, proceeds are expected to drop as much as 9% this year (Figure 4), and earlier this month, the state lottery launched an app hoping to boost sales and compete with online sports betting options. (5) (18)

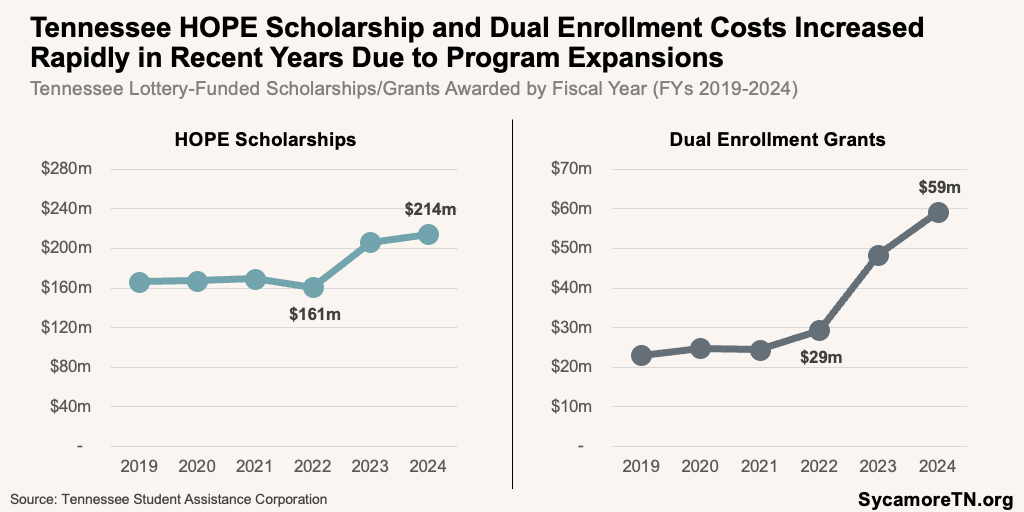

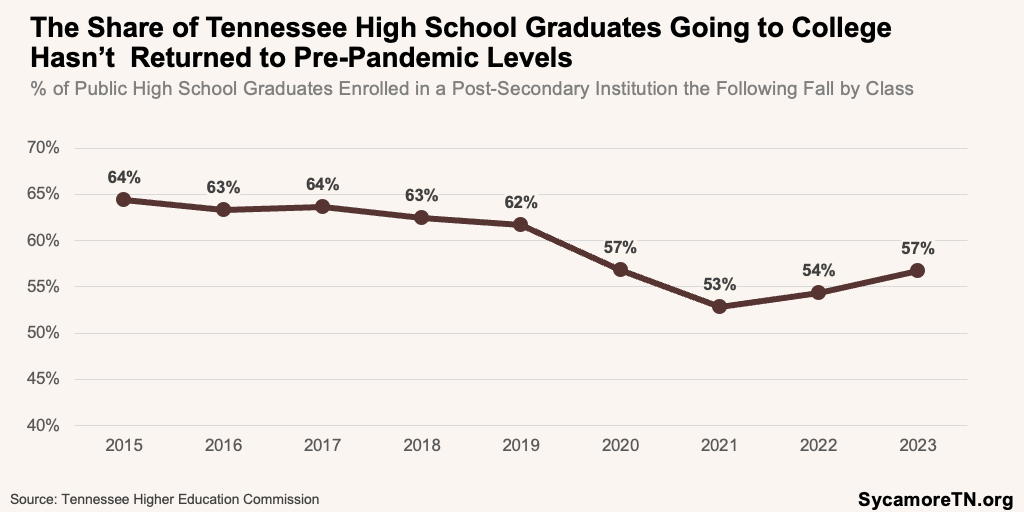

- Scholarship Costs — Lottery-funded scholarship costs have fluctuated in recent years due to pandemic-related disruptions and policy changes. The share of students attending college declined during the pandemic. (19) Then, HOPE Scholarship amounts were increased for the first time in decades beginning with the 2022-23 school year, and dual enrollment grants were expanded the same year. As a result, HOPE scholarship costs increased by 33% between FYs 2022 and 2024, and dual enrollment awards more than doubled (Figure 5). (20) (21) These trends and changes could have longer-term effects on scholarship costs that may not have fully stabilized yet. For example, college-going rates have rebounded but not fully returned to pre-pandemic levels (Figure 6). (19)

Figure 4

Figure 5

Figure 6

Projections suggest annual scholarship costs could exceed net lottery proceeds alone (i.e. without the additional funding from sports betting) at any point over the next five years (Figure 4). Projections for both lottery proceeds and lottery-funded scholarships show a wide range of potential proceeds and costs over the next five years. Those projections suggest scenarios under which lottery proceeds alone might fall short of scholarship costs in any given year. (11) (12) (5) However, this does not account for other factors like statutorily mandated reserves that the lottery fund must carry over yearly.

Limitations

As stated above, this brief discusses the status of several known available sources of revenue that policymakers have drawn from in recent years during the budget process. This is based on publicly available documents. It does not reflect other items that have yet to be determined or announced, which will affect available revenues and resources for FYs 2025 and 2026.

References

Click to Open/Close

References

- State of Tennessee. Proclamation by the Governor: January 27, 2025 Special Session. [Online] January 17, 2025. https://tnsos.net/publications/proclamations/files/2757.pdf.

- Tennessee General Assembly. Legislation – First Extraordinary Session of the 114th General Assembly. [Online] January 2025. https://wapp.capitol.tn.gov/apps/SpecSession/BillIndex.aspx?GA=114&SpecSessNum=1.

- U.S. Bureau of Labor Statistics. Comparing the Consumer Price Index with the Gross Domestic Product Price Index and Gross Domestic Product Implicit Price Deflator. Monthly Labor Review. [Online] March 2016. https://www.bls.gov/opub/mlr/2016/article/comparing-the-cpi-with-the-gdp-price-index-and-gdp-implicit-price-deflator.htm.

- U.S. Bureau of Economic Analysis. Gross Domestic Product: Chain-type Price Index [GDPCTPI], retrieved from FRED, Federal Reserve Bank of St. Louis. [Online] January 2024. https://fred.stlouisfed.org/series/GDPCTPI.

- Tennessee Department of Finance and Administration. State of Tennessee, The Budget for Fiscal Years 2011-2012 through 2023-2024. Budget Publications Archive. [Online] https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive.html.

- —. State of Tennessee, The Budget Fiscal Year 2024-2025. Fiscal Year 2024-2025 Budget Publications. [Online] February 5, 2024. https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive/fiscal-year-2024-2025-budget-publications.html.

- State of Tennessee. Tennessee 2024 Annual Comprehensive Financial Report. [Online] December 2024. https://www.tn.gov/finance/news/2024/12/19/tennessee-2024-annual-comprehensive-financial-report.html.

- —. Public Chapter No. 966 (2024). [Online] April 18, 2024. https://publications.tnsosfiles.com/acts/113/pub/pc0966.pdf.

- Tennessee Comptroller of the Treasury. Tennessee State Funding Board Packet for November 25, 2024 Meeting. [Online] November 25, 2024. https://comptroller.tn.gov/content/dam/cot/tsfb/documents/meeting-packets/2024/SFBPacket2024.11.25.pdf.

- Tennessee General Assembly. Finance, Ways, and Means Action on FY 2024-2025 Appropriations Bill HB 2973/SB 2942. House Dashboard. [Online] April 16, 2024. https://www.capitol.tn.gov/Archives/Dashboard/HR%20Scanned%20Amendments/HB2973_House%20Schedule%204.16.24.1430.pdf.

- Tennessee State Funding Board. Meeting Minutes for November 25, 2024. [Online] November 25, 2024. https://comptroller.tn.gov/content/dam/cot/tsfb/documents/minutes/2024/SFBMinutes100424102524.pdf.

- Tennessee Comptroller of the Treasury. State Funding Board Meeting Materials for November 4, 2024 Meeting. [Online] November 4, 2024. https://comptroller.tn.gov/content/dam/cot/tsfb/documents/meeting-packets/2024/SFBMeetingPacket2024.11.04.pdf.

- State of Tennessee. TN Code § 4-49-104(e)(1). [Online] 2025. https://law.justia.com/codes/tennessee/title-4/chapter-49/part-1/section-4-49-104/.

- Can, Ege, Nichols, Mark and Pavlopoulos, Vasileios. The Effects of Sports Betting on Casino Gambling and Lottery. SSRN. [Online] December 9, 2023. https://dx.doi.org/10.2139/ssrn.4659440.

- Matheson, Victor, Baumann, Robert and Marrinan, Liam. Has the Rise of Legal Sports Betting Reduced Lottery Revenues? Evidence from New York. SSRN. [Online] October 4, 2024. https://dx.doi.org/10.2139/ssrn.4974851.

- Willman, Sam. Examining the Influence of Sports Betting Legalization on State and Local Lotteries. University of Oregon. [Online] 2024. https://scholarsbank.uoregon.edu/items/2e457f23-8fd4-49bc-a6a5-442963dd5e64.

- Rotondo, Irene. ‘Concerns’ Confirmed: Sports Betting Sidelines Mass. Lottery’s Scratch Tickets. Mass Live. [Online] March 28, 2024. https://www.masslive.com/lottery/2024/03/concerns-confirmed-sports-betting-sidelines-mass-lotterys-scratch-tickets.html.

- Sher, Andy. Going Mobile? Tennessee Lottery Quietly Launches ‘Anytime Powerball’ App. The Tennessee Journal. [Online] January 21, 2025.

- Tennessee Higher Education Commission (THEC). Tennessee College Going and the Class of 2023. [Online] 2024. https://www.tn.gov/content/dam/tn/thec/bureau/research/college-going-reports/CGR%20Report_2024_FINAL.pdf.

- Tennessee Student Assistance Corporation (TSAC) and Tennessee Higher Education Commission (THEC). TELS Year-End Reports for FYs 2019-2024. [Online] 2019-2024. Available from https://www.tn.gov/thec/data-research-reports/reports-studies-pub/financial-aid-reports/tn-hope-scholarship-program.html.

- —. Tennessee Education Lottery Scholarship Program 2024 Annual Report Recipient Outcomes Through Fall 2023. [Online] 2024. https://www.tn.gov/content/dam/tn/thec/bureau/research/other-research/hope/TELS%20Report_2024.pdf.